A top-notch restructuring group, capable of handling the biggest and the most difficult restructuring from either company side or creditors’ side.

A top-notch restructuring group, capable of handling the biggest and the most difficult restructuring from either company side or creditors’ side.

- Chambers USA, Band 1 Bankruptcy/Restructuring (Nationwide and NY)

Three’s a Crowd? The Thames Water Restructuring Plan(s)

People

- Adlerstein, Jacob A.

- Basta, Paul M.

- Bilzin, Lauren

- Bolin, Brian

- Britton, Robert A.

- Clareman, William A.

- Eaton, Alice Belisle

- Ehrlich, Andrew J.

- Graham, Joe

- Hermann, Brian S.

- Hopkins, Christopher

- Kimpler, Kyle J.

- McColm, Elizabeth R.

- Mitchell, Sean A.

- Osborne, Liz

- Rosenberg, Andrew N.

- Weber, John

- Zeng, Kai

- Ziman, Ken

- Mackenzie, Patrick

- Pflueger, Lauren

- Morgan, Genevieve

- Poulson, Lydia

February 26, 2025 Download PDF

Key Takeaways:

- In one of the most high-profile and hotly-watched cases in the London restructuring market, on 18 February 2025, the English High Court approved the restructuring plan proposed by Thames Water.

- The Court gave permission to appeal the Court’s order to a group of challenging junior creditors, a subordinated creditor and Liberal Democrat MP Charlie Maynard, with the Court of Appeal due to sit from 11 to 13 March 2025. The order approving the plan has not been stayed; instead, the group has undertaken to only implement certain steps that can be reversed if the appeal is successful.

- At a separate hearing on 19 February 2025, the Court dismissed an application by the challenging junior creditors to convene creditor meetings to vote on their own, alternative plan. At the same hearing, another plan–proposed by a group of senior creditors who were supportive of the company plan and which was intended to proceed only if the Court refused to approve the company’s plan–was withdrawn.

- The situation presented a number of firsts: the first plan proposed by a regulated water company, the first time public interest arguments have been put to the Court (with the Court confirming that a non-party had standing to oppose the plan) and the first time that three restructuring plans were proposed simultaneously–one as a rival plan, the other a strategic defence.

- The question of whether there was a better or fairer plan was tested more fully than in previous cases, since a rival plan was actually proposed by the challenging junior creditors. However, in circumstances where senior creditor support is required in order for a junior plan to be implemented, any competing plan proposed by junior stakeholders without that support is likely to be a weak counterfactual. Combined with the Court’s reiteration of the (lack of) weight to be given to the views of “out-of-the-money” creditors, the case reinforces that, in practice, junior creditors are likely to have an uphill battle when challenging plans, unless the alternative plan provides for payment of senior creditors in full.

- The plan’s approval also drew out a number of themes emerging in relation to restructuring plans, including the Court’s disregard for condensed timetables and its focus on (and disapproval of) the considerable financing costs that can be incurred in restructuring plan cases. Certain untested aspects, such as the ability of junior creditors to “cram up” senior creditors–which would have been the case had the rival plan been successfully approved –will have to wait for another day.

- Timing considerations were also of central focus for the Court, with the judge reminding parties of the need to give the Court appropriate time to hear a case, deliver a reasoned decision and permit time to determine appeal applications (which it did not consider to have occurred here). From a practical perspective, if a company leaves it too late to launch a plan, the ability (and likelihood) of there being sufficient time to run an alternative plan timetable is questionable. Whether the Court will actually refuse approval of a plan where there has been a condensed timetable (and, if relevant, limited time to propose an alternative plan) remains to be seen.

Setting the Scene: Thames Water and its Woes

Thames Water is a British private utility company responsible for the water supply and wastewater treatment for nearly a quarter of the UK population (mainly in London and south-east England). In November 2024, Thames Water Utilities Holdings Limited (the “Plan Company”) proposed the restructuring plan subject to the Court’s 18 February judgment. The Plan Company is the parent company of three companies including Thames Water Utilities Limited, an entity regulated by the water industry regulator for England and Wales, Ofwat, that must comply with certain licence conditions (“TWUL” and the group being “Thames Water”).

From a financing perspective, Thames Water has a “whole business securitisation” (“WBS”). As at 31 March 2024, the various drawn facilities within the WBS totalled c.£16.3 billion (with the Class A debt totalling around £14.7 billion and the Class B debt totalling £1.4 billion). This financing is supported by a range of hedging products, with an additional mark-to-market exposure of c.£1.7 billion as at 31 March 2024. The Class A debt ranks senior to the Class B debt.

In recent years, Thames Water’s financial position has deteriorated due to several factors, including significant operational and regulatory pressures. The group operates with the oldest water pipes in the most densely populated region of the UK. Considerable capital expenditure has been required to improve its infrastructure, yet the effect of the regulator’s price control reviews has been to constrain the group’s ability to increase customer costs to offset that increased spending.

While Ofwat has raised concerns about the financial resilience of Thames Water since 2022, it was not until early 2024 that the group lost the support of its current shareholders, who determined the business “uninvestable.” In April, certain members of Thames Water’s indirect holding companies defaulted on their financings (although there was no cross-default into the WBS structure). In July, the group’s ability to incur additional financial indebtedness was constrained following a trigger event under its financing documents, and its woes further spiralled later that month when Moody’s downgraded its credit rating to below investment grade. Further ratings downgrades followed and TWUL consequently found itself in breach of its operating licence. In response, Ofwat implemented certain commitments from Thames Water, including the appointment of an independent monitor and new non-executive director board appointments.

But those tumultuous times did not stop the regulatory clock from ticking. In October 2023, the group (along with all other water companies in England and Wales) submitted to Ofwat its business plan for the next five-year regulatory period (2025-2030) (known as “AMP8”). In July 2024, Ofwat released a draft price determination for Thames Water for AMP8 (the “Draft Determination”), proposing the group increase average yearly bills by 23% (rejecting Thames Water’s request to increase by 44%). In response to the Draft Determination, Thames Water revised and resubmitted its business plan, although it was facing a significant liquidity crisis and needed to take steps to ensure it had sufficient liquidity to see it through to the time at which the regulator would make its final pricing determinations (the “PR24 Final Determination”) in December 2024. In September, Thames Water announced that it had obtained senior creditors’ approval to release cash reserves and draw on its RCF, although that approval was subject to strict conditions, including that the group undergo a significant debt restructuring. The PR24 Final Determination was published on 19 December 2024, allowing the group to increase bills by 35% above inflation over AMP8, falling short of the 53% increase sought. On 14 February 2025, Thames Water formally asked Ofwat to refer its PR24 Final Determination to the Competition Markets Authority for redetermination.

Against that backdrop, in November 2024, Thames Water proposed its restructuring plan (the “Company RP”). With the plan, the group sought an “interim solution” to extend liquidity runway and provide a “stable platform” to implement a more significant restructuring later in 2025. The promotion and implementation of the “interim solution” was facilitated by a transaction support agreement (the “TSA”). Since October 2024, a number of Thames Water’s creditors (primarily its Class A creditors) had signed the TSA, effectively confirming their support for the Company RP. The TSA also required Thames Water to promote the Company RP on its agreed terms. In parallel, given the loss of shareholder support, Thames Water is seeking a new equity injection in order to fulfil its investment plans for AMP8 (the “Equity Raise Process”). The group confirmed on 11 February that it had received proposals from a number of parties, and it is undergoing a detailed assessment of each bid.

The Legal Backdrop: Restructuring Plans and the Water Special Administration Regime

A refresher on the English restructuring plan

A restructuring plan is a powerful statutory mechanism under Part 26A of the Companies Act 2006, which enables a company to propose a compromise or arrangement to its creditors (secured and unsecured) and/or shareholders. A restructuring plan must be approved by the Court and requires two Court hearings. At the first hearing, the Court considers whether it has jurisdiction in relation to the plan and (if so) whether to convene the proposed meeting(s) of stakeholders to vote on the plan. After the convening hearing, the meeting(s) will be held and at the second hearing, the Court decides whether to approve the plan.

A plan will be approved by a class of stakeholders where at least 75% in value of those present in person or by proxy at the meeting vote in its favour. If one or more classes do not support the plan, the Court may still approve the plan if it is satisfied that:

(a) none of the members of the dissenting class would be any worse off under the plan than they would be in the relevant alternative (the “NWO Test”); and

(b) at least one class who would receive a payment or would have a genuine economic interest in the event of the relevant alternative (the so-called “in-the-money” class) has voted in favour of the plan.

These conditions are often described as conferring the power on the Court to “cram down” dissenting classes of creditors, or the “cross-class cram down” power.

The “relevant alternative” is whatever the Court considers to be most likely to occur in relation to the plan company if the restructuring plan is not approved. The Court has ultimate discretion whether to approve (with or without cross-class cram down) and will consider, among other things, whether it is satisfied that, in all circumstances, the plan is fair and reasonable.

Water special administration regime

In the UK, companies in certain sectors or industries are subject to individual special administration regimes (“SARs”) in the event of insolvency (rather than the typical corporate insolvency processes such as administration or liquidation). SARs are designed to assist systemically important companies navigate financial distress while ensuring continuity of essential services. Against a backdrop of UK water companies facing financial difficulties, in January 2024, the UK government refreshed the legislation relevant to the special administration of regulated water companies (“WSAR”). Only the Secretary of State or Ofwat (with the Secretary of State’s consent) may petition the Court to put a regulated water company–such as TWUL–into WSAR.

The First Showdown: The Company’s Convening Hearing

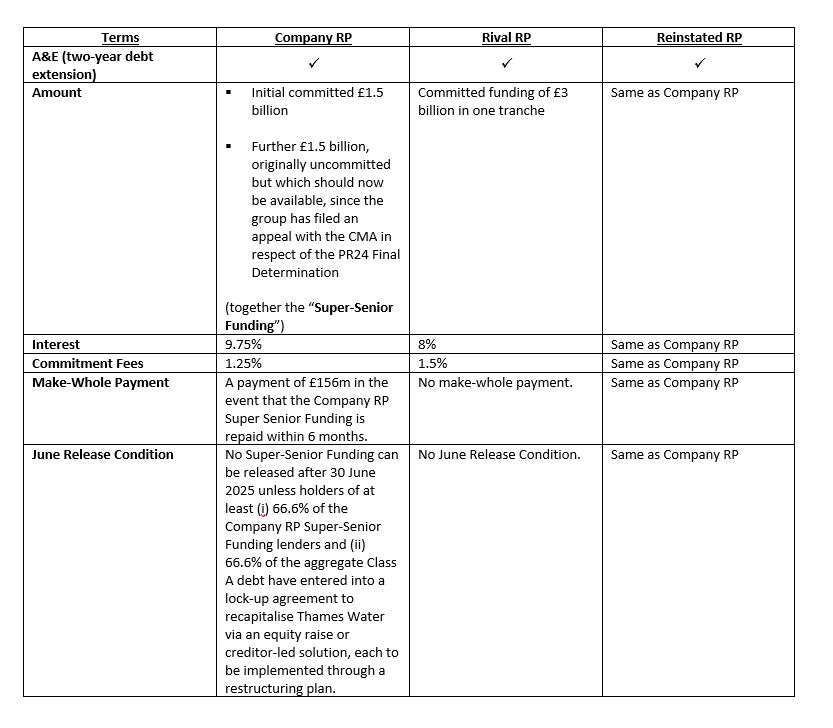

On 17 December 2024, Thames Water was granted permission to convene seven meetings of creditors to vote on its restructuring plan. As noted, the Company RP seeks to provide an “interim solution” to extend liquidity runway, following which the group will implement a more holistic recapitalisation of the business via the Equity Raise Process and a second restructuring plan known as “RP2”, expected in September 2025. See below Key Terms of the RPs for the main terms of the Company RP (which, in brief, included maturity extensions and the provision of new super-senior funding).

At the hearing, an ad-hoc group of Thames Water’s largest creditors, the Class A creditors (the “Class A AHG”), confirmed their support for the Company RP and an ad-hoc group of Class B creditors (the “Class B AHG”) opposed it. The Class B AHG took issue with, amongst other things, what they perceived as disproportionate control by the Class A creditors over future efforts to recapitalise Thames Water under a provision in the Company RP known as the “June Release Condition” (“JRC”).

The JRC provides that no additional super-senior-secured funding will be made available to the group unless, by 30 June 2025, a lock-up agreement in respect of the Equity Raise Process and the restructuring process (i.e. the second stage of the group’s restructuring) has been entered into by at least 66.6% of the (new) super-senior lenders and 66.6% of the Class A creditors. The Class B AHG also alleged that the JRC infringes competition law by restricting access to alternative financing options and effectively gives the Class A creditors veto rights over the recapitalisation of the group (particularly given that the Class A creditors indicated they could launch their own bid in the Equity Raise Process).

In proposing the Company RP, the group submitted that the relevant alternative to it was a WSAR of TWUL, the regulated entity, and administration of the other group companies running concurrently (a proposition that was supported by the Class A AHG) (“SAR Scenario”). In response, the Class B AHG confirmed that they would launch an alternative plan which, they argued, should be considered the relevant alternative to the Company RP.

Intervening Actions: Class B AHG Try to Put the Brakes On

The Class B AHG’s discontent with the Company RP was apparent from the convening hearing, and that was certainly not the end of it. At the beginning of 2025, the Class B AHG launched their rival restructuring plan (the “Rival RP”), which they considered to provide a more affordable interim financing transaction than had been agreed between Thames Water and the Class A AHG (and which was the subject of the Company RP) and better support the anticipated second “holistic” restructuring. The Rival RP was premised on the Court refusing to approve the Company RP. Contextually, it is important to note that by virtue of the TSA, neither Thames Water nor the Class A AHG could support or promote a plan other than the Company RP, including the Rival RP. See below Key Terms of the RPs for the main terms of the Rival RP.

Later in January, the Court dismissed an application made by a member of the Class B AHG to adduce expert evidence at the Company RP approval hearing in support of its competition law challenge. The Court held that the applicant had failed to establish that the relevant evidence was necessary for proceedings.

In Comes the A-Team: (Yet) Another Plan!

On 24 January 2025, in response to the Rival RP, a Class A creditor launched an alternative restructuring plan (the “Reinstated RP”). The plan included amendments to the terms of the Company RP and TSA to reflect agreement with the interest rate and hedging providers, but was otherwise identical to the Company RP and would fall away in the event that the Company RP was approved by the Court (hence it was ‘defensive’ in the case that the Company RP fails). The intention was for the Reinstated RP to run in parallel to the Rival RP as the Rival RP’s relevant alternative, if the Court refused to approve the Company RP. The Reinstated RP follows the position set out in the Company RP: the relevant alternative to the Reinstated RP is a SAR Scenario. See below Key Terms of the RPs for the main terms of the Reinstated RP.

The (Company) Classes Vote

At the class meetings, five classes of creditors (including the Class A class), voted in favour of the Company RP. Two classes of creditors voted against it (84.5% of its Class B creditors and 100% of its subordinated creditor class, which has a single member, the Plan Company’s parent company, Thames Water Limited (“TWL”)), meaning it was necessary for the Court to consider exercising its cross-class cram down power.

The Main Event: The Company RP is Approved

In early February, a four-and-a-half-day hearing unfolded before Mr Justice Leech (“Leech”). The Class B AHG continued to oppose the Company RP, while other opponents also took to the floor, including TWL and Charlie Maynard MP (“Maynard”), who stated in his submissions that he would assist the Court with public interest and customer interest objections.

On 18 February 2025, the Court handed down its judgment and approved the Company RP, giving Thames Water “an opportunity to finish the jigsaw.” In approving the plan, Leech found that despite submissions from the Class B AHG and their proposal of the Rival RP, the relevant alternative to the Company RP was a SAR Scenario and that the requirements to cram down the dissenting Class B creditors and TWL were satisfied.

The opposing parties were granted permission to appeal on certain grounds (see below, It’s Not Over Yet: Permission to Appeal). Despite indicating during the hearing that he would stay any order if permission to appeal were granted, Leech agreed that the order would be granted but conditioned on certain undertakings from Thames Water to only implement certain steps that could be reversed if the approval order were overturned by the Court of Appeal. Crucially, the Plan Company made it clear that no consent fees would be paid, and none of the new senior-secured funding will be lent until after the appeal has been heard.

What were the objections?

The Company Plan was challenged on a number of grounds, including:

- NWO Test: At principal issue between the Plan Company, the supportive Class A AHG and the challenging Class B AHG was what constituted the most likely relevant alternative to the Company RP. The Plan Company and the Class A AHG submitted that it was the SAR Scenario, while the Class B AHG considered it to be an alternative restructuring (namely, their Rival RP). The Class B creditors argued that they would be better off in either scenario than under the Company’s RP, meaning that the first condition to cross-class cram down–the No Worse Off Test–would not be satisfied.

- Fair distribution of value: The dissenting creditors argued that the Court should not exercise its discretion to approve the Company RP as it gives rise to an unfair distribution of the restructuring surplus, which mainly benefits the Class A creditors.

- Better or fairer plan? According to the dissenting creditors, a “better and fairer” plan (i.e. the Rival RP) was available for the parties to consider which (according to them) provided for a better or fairer allocation of value.

- Interim restructuring an issue? The Class B AHG argued that the Company RP did not seek to solve the financial difficulties of the group and instead, it only acted as a “stopgap” to a further restructuring, the terms of which were yet to be identified.

- Information rights: TWL argued that the Company RP was unfair due to the disparity between the information to which the Class A creditors were entitled under the plan and the information to which other creditors were granted.

- TWL disenfranchised? TWL also argued that the Company RP disenfranchised its proper participation in RP2 by preventing them from being able to vote on it.

- A blot (or blots) on the plan? The Class B AHG and TWL argued that there were “blots,” which meant the Company RP should not succeed.

- Public interest: Maynard argued that the Company RP “aggravates” rather than addresses Thames Water’s financial position, meaning it was not in the public interest or the interests of customers of Thames Water to approve it.

What did the Court decide?

The NWO Test: Leech concluded that the NWO Test was satisfied. In reaching that conclusion, he reflected on the valuation evidence submitted by the Plan Company and the Class B AHG, ultimately preferring the Plan Company’s evidence.

The judge rejected the Class B’s AHG argument that in the event of the Company RP not being approved, their Rival RP would be the most likely outcome. In line with the Plan Company’s evidence, the Court accepted that, if not approved, the directors of TWUL would most likely write to Ofwat and the Secretary of State requesting that they apply for a WSAR (and that such an application will be made and granted). Ahead of the hearing, Ofwat confirmed their position in a letter shared with the Court: Ofwat would likely make a WSAR order if requested to do so. The Court agreed with the Plan Company and Class A AHG that, in a non-approval scenario, it would be reasonable for the directors to conclude that there would be insufficient time to implement an alternative restructuring and, even if the Rival RP proceeded, it was unlikely that that plan would be approved (given, among other things, the potential for, under the Rival RP, the unprecedented use of a “cram up” of the (senior) Class A creditors by the Class B creditors, the lack of liquidity runway and the non-binding nature of the funding package proposed by the Class B AHG). Leech was also not convinced that, in the event the Company RP was not approved, the Class A AHG would support the Rival RP or release the group from the TSA (in order that it might support the Rival RP).

The Class B AHG also took issue with recoveries in the SAR Scenario (in anticipation, as ended up being the case, that the Court would find that to be the relevant alternative, and not the Rival RP). Their approach was two-fold:

- first, in their own expert valuation evidence, the Class B AHG submitted that the Plan Company significantly undervalued the Thames Water group, and if a proper approach to valuation had been adopted, the Class B creditors would be better off in the SAR Scenario than under the Company RP;

- second, the Class B AHG submitted that the Class A creditors were able to “divert value” away from the Class B creditors, which they would otherwise have received in any of the relevant alternatives. The Class B AHG alleged that without various control terms in favour of the Class A creditors (such as the JRC), the group would have more time to entertain equity bids and achieve a high valuation for Thames Water. In particular, the JRC was said to severely limit the Equity Raise Process by giving the Class A creditors early veto rights in respect of any future restructuring.

The Court disagreed with those arguments, concluding that the Class B creditors and TWL would be no worse off under the Company RP than in the SAR Scenario. Leech accepted the Plan Company’s valuation evidence and rejected the Class B AHG evidence. The difference between the evidence was stark: the projected enterprise value of Thames Water in September 2025 was stated to be £16.7 billion (whereas the Class B AHG evidence stated it to be £23.3 billion). The Court agreed with the Plan Company that TWL and Class B AHG would be “out-of-the-money” in the relevant alternative, with the Class B AHG failing to demonstrate, with its own valuation evidence, that the Class B creditors should be considered to be “in-the-money” in that alternative.

On diversion of value, the Court found that the JRC (in particular) should be construed in its context, and the Class A creditors had, irrespective of whether the Company RP was approved or not, a significant element of control, given their existing consent and enforcement rights under the finance documents. The Court rejected the suggestion that the JRC and related conditions amounted to “bid-rigging” in the Equity Raise Process, and that their inclusion would have a “chilling effect” on that process, instead finding that it was in the interests of the Class A AHG to promote as many competitive bids as possible to maximise the prospects that they will achieve a full recovery.

Discretion: fairness

Having concluded that both conditions to cross-class cram down were satisfied, the Court had to reflect on whether it should use its discretion to approve the Company RP. As part of that, Leech was invited to consider a number of potential fairness issues.

- Fair distribution of value: In the Adler restructuring plan, the Court of Appeal held that where a plan with cross-class cram down is proposed, the Court should undertake a horizontal comparison, comparing the position of the class in question with the position of other classes if the restructuring goes ahead.[1] In this case, the Court rejected the Class B AHG’s argument that the Court should undertake a horizontal comparison where the challenge is brought by an out-of-the-money creditor. Listing a number of precedents, the Court also continued a prior line of authority, being that if the junior creditors are out-of-the-money in the relevant alternative (as here), the restructuring plan is not unfair and little weight should be attached to their views.[2] The Court also agreed with the Plan Company and the Class A AHG that there was no issue of horizontal fairness in this case, because it was an interim restructuring plan which did not generate a restructuring surplus (and even if it could be treated as if it did, all creditors were treated equally because they were invited to participate pari passu in the new money).

- Better or fairer plan? In Adler, the Court of Appeal confirmed that, when considering whether there has been a fair distribution of the benefits of the restructuring, the Court should ask whether a better or fairer plan might have been available.[3] The Class B AHG argued that even if SAR is the relevant alternative, the Rival RP should and could have been proposed to the creditors on the basis that it provides for a better or fairer distribution of value as between the Class A and the Class B creditors. However, the Court decided that, due to a combination of the debt structure and the maturity dates of various instruments, it would have proved difficult for the Plan Company to put in place an interim plan other than as envisaged by the Company RP.

- Information rights: TWL argued that the Company RP was unfair due to disparity between the information to which the Class A creditors were entitled under the plan and the information to which other creditors were entitled (for example, documentation under the Company RP included a covenant requiring Thames Water to “engage” with the Class A creditors in respect of RP2, but not other creditors). Leech concluded that these provisions gave him concern but not sufficient to refuse approval of the plan.

- TWL disenfranchised? The complexity of having to decide an “interim” solution in the shadow of a more significant holistic restructuring process was apparent throughout the hearings. On a number of occasions whilst hearing arguments, the judge commented on the difficulty of separating the effect of the Company RP and RP2. Continuing that theme, TWL argued that the Company RP disenfranchised its proper participation in RP2 by including a provision in one of the restructuring documents effected by the Company RP that sought to “dilute and qualify” its existing voting rights (provided only that the Plan Company could demonstrate that a future plan does not “materially adversely affect” TWL). In his judgment, Leech concluded that the relevant provisions of the plan would not prevent TWL from voting in RP2 (if it were otherwise entitled to do so).

Discretion: a blot (or blots) on the plan?

The Court was also required to consider whether there were any “blots” on the plan that should lead it to refuse to approve.

- Competition law: Not only did Leech hear three days of evidence regarding complex valuation and fairness issues, he also heard a half day of submissions on competition law, which formed part of the Class B AHG’s challenge. While the Class B AHG were prevented from bringing expert evidence on the issue (see Intervening Actions: Class B AHG Try to Put the Brakes On), they submitted a number of arguments, including that that the JRC was an “unlawful collusive agreement” and that it prevented, restricted or distorted competition because it fixed “purchase or selling prices” or “other trading conditions”. They also submitted that the effect of the JRC was that the Plan Company no longer had any control over the equity bidding process. Leech concluded that the Class B AHG failed to prove any of these allegations on the balance of probabilities and the competition law objection failed on the facts. The judge also rejected the competition law objections as a matter of law.

- Third-party releases: The Company RP included wide releases for the group’s directors and advisors involved in negotiating the plan. The Class B AHG, TWL and Maynard objected to the inclusion of such wide-ranging releases in the Company RP, an interim restructuring plan (with Maynard arguing in particular that any breaches by the directors were “valuable assets” that should not be released prematurely in case Thames Water were to enter a WSAR). The Court found that such releases were not a blot on the Company RP; indeed, it is well-established that the Court may approve the entry into a deed of release where it is necessary to give effect to the restructuring plan.[4] The releases in question were limited to conduct in relation to the interim transaction and not RP2 (although, Leech did note that it may be difficult to draw the line between the two, but that would be a factual issue whatever the wording of the release). In any event, the directors and advisers were not granted releases in advance for their conduct in relation to the Equity Raise Process or subsequent RP2.

Public interest

This was the first restructuring plan case opposed on a public interest basis, raising interesting and novel issues.

- Standing: The Plan Company and Class A AHG argued that Maynard did not have standing to appear before the Court in relation to the plan and as a result, the Court should not take into account his submissions. Leech rejected those arguments in short order. The Court considered that the customers of Thames Water and the members of the public who are the recipients of the Thames Water’s services are “plainly affected” by the approval of the Company RP, even those neither Maynard nor those customers or members of the public were party to the plan proceedings.

- Arguments in respect of public interest: Through the hearing, there were many interjections from a ‘public interest lens’ or ‘customer lens’. The judge seemed well persuaded by many of the arguments proposed by Maynard, but ultimately did not find them sufficiently persuasive to refuse approval of the plan.

The Court acknowledged the public interest in ensuring the uninterrupted provision of vital public services. The Company RP was seen as a means to achieve financial stability for Thames Water, which was in the best interest of the public and the creditors. In his arguments, Maynard suggested that the Court should give the “most weight” to the interests of customers and the general public when considering the allocation of value in the Company RP. He argued that this was the logical conclusion when under a WSAR, the relevant alternative, Thames Water’s customers and the general public would be prioritised above creditors. Leech did not directly address this reasoning in his judgment, but did conclude that it will not be Thames Water or its customers that will bear the finance costs of the Company RP; instead, he was satisfied that it would be the Class A creditors who would end up absorbing the costs. He also gave consideration to the fact that Ofwat and the Secretary of State have not opposed the Company RP, and noted that there is public interest in facilitating the rescue of Thames Water as a struggling company via the Company RP before the UK government is forced to fund WSAR.

It’s Not Over Yet: Permission to Appeal

Shortly after the judgment approving the plan was handed down, Leech gave permission to the Class B AHG, TWL and Maynard to appeal the order, each on a number of grounds. The Class B AHG were granted permission to appeal on the following grounds:

1. the judge erred in law and fact by finding that Thames Water’s valuation evidence established that the Class B creditors were out-of-the-money;

2. the judge erred in law and fact and should have found that the Company RP was unfair as it provided Class A creditors with beneficial rights that were not provided to the Class B Creditors; and

3. the judge erred in law and fact and should have found that certain releases granted under the Company RP were unnecessary for what was an interim deal.

The Class B AHG requested permission to appeal on two additional grounds–that the Company RP breached competition law and procedural unfairness–but these were denied.

The Last Dance: The Rival RP Convening Hearing

On 19 February, a day after the Company RP was approved and permission to appeal was granted, Leech dismissed an application from the Class B AHG to convene meetings in connection with their Rival RP, noting that those meetings would be a waste of “money, time and spirit.”

Initially minded to allow the convening hearing to take place, the judge refused permission to convene the meetings on the basis that there was no reasonable probability that the meetings would serve any reasonable purpose[5], given that:

1. the Class B AHG had not asked for permission to appeal Leech’s finding that the Rival RP would not be implementable before the liquidity runway expires;

2. the Class B AHG faced an “insuperable obstacle” of knowing what proposal to put to the creditors at the meetings until after the Court of Appeal has made its final decision; and

3. the Class B AHG have no standing to invite the Court to convene meetings to vote on its Rival RP unless and until the Court of Appeal overruled Leech’s preference for the group’s valuation evidence because as it stood, if the Plan Company’s valuation is correct, the Class B creditors have no genuine economic interest in Thames Water and so should not be able to bring the Rival RP.

In response to the Court’s dismissal, the Class A AHG clarified that the Reinstated RP would no longer be pursued.

Coming Up For Air: What Comes Next?

The Rival RP and the Reinstated RP are no longer in action, but for Thames Water, the story continues. The Court of Appeal is expected to hear the matter on an expedited basis from 11 to 13 March 2025, with the intention being to ensure that a decision is made before Thames Water’s liquidity runway expires on 24 March 2025. Whether the Court of Appeal is happy about that is quite another thing. At a directions hearing on 21 February 2025, the Court expressed clear frustration with the condensed timetable, as well as concern with the costs associated with the transaction.

Looking to the future of contested restructuring plans, this case once again shows that it is difficult to challenge the relevant alternative to a plan[6], particularly where a liquidity cliff edge approaches. The judgment adds to a long line of cases where the “economic owners” of a company in distress are considered to have the largest say on the terms of its restructuring, while, more novelly, it demonstrates that where there is public interest, the Court must balance the “public policy” in facilitating the rescue of a struggling company against the public interest of the benefits of an administration.

Thames Water and its restructuring plan will be well-remembered. Conclusions from the Court of Appeal are likely to bring further clarity on the use and implementation of restructuring plans, while the process of the (potentially) three plans will serve as instructive indicators for the restructuring community on how (or how not) to approach future plans (although the unique circumstances of Thames Water’s distress, together with its distinct regulatory framework, cannot be understated).

With the Court of Appeal hearing imminent, we will provide further updates as the case develops.

* * *

Key Terms of the RPs

|

* * *

[1] Re AGPS Bondco plc [2024] Bus LR 745

[2] For example, Re Virgin Active [2022] 1 All ER (Comm) 1023

[3] Re AGPS Bondco plc [2024] Bus LR 745

[4] Re Noble Group Limited [2018] EWHC 3092 (Ch) applied.

[5] As per the decision in Re Savoy Hotel Ltd [1981] Ch. 351 which held plan meetings cannot be convened without the plan company’s consent and that there must be a reasonable probability that the meetings would serve a reasonable purpose if convened. The Court also made reference to Validus Holdings Ltd v IPC Holdings Ltd and Max Capital Group Ltd [2009] Bda LR 30, where a Bermudan Court applied the principles in Savoy.

[6] See, for example, Project Lietzenburger Strasse HoldCo S.a.r.l. [2024] EWHC 468 (Ch); Project Lietzenburger Strasse HoldCo S.a.rl. [2024] EWHC 563 (Ch)