Paul, Weiss is an acknowledged leader among U.S. law firms representing Canadian public and private companies and their underwriters. With almost 50 years of history in Canada and an office in Toronto, our vibrant Canada practice is the largest among U.S. law firms and reflects our long-standing commitment to our clients in their Canadian–U.S. cross-border matters.

Client News

CGI Completes $650 Million Notes Offering

Paul, Weiss advised CGI Inc. in its offering of $650 million aggregate principal amount of 4.950% notes due 2030, led by PNC Capital Markets LLC, Scotiabank, Société Générale and TD Securities. CGI is among the largest independent information technology and business consulting services firms in the world.

» moreClient News

Medicus Pharma Completes Regulation A Offering

Paul, Weiss advised Medicus Pharma Ltd. in its Regulation A offering of units comprised of one common share and one warrant to purchase one common share.

» moreClient News

Columbia Pipelines Completes $1 Billion Offering of Senior Notes

Paul, Weiss advised the initial purchasers of Columbia Pipelines Operating Company LLC’s offering of $1 billion aggregate principal amount of notes.

» moreClient News

TransCanada PipeLines Completes $750 Million Hybrid Offering

Paul, Weiss advised the underwriters in TransCanada PipeLines Limited’s U.S. public offering of $750 million aggregate principal amount of 7.000% fixed-to-fixed rate junior subordinated notes due 2065.

» moreClient News

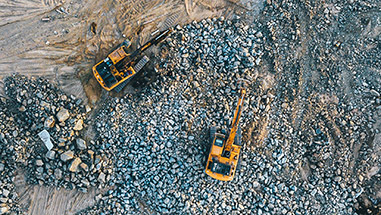

Skeena Resources Limited Completes Public Equity Offering

Paul, Weiss advised the underwriters in Skeena Resources Limited’s public offering of 5,520,000 of its common shares, of which 2,230,000 constituted “flow-through” shares for Canadian tax purposes, representing gross proceeds to Skeena Resources Limited of C$88.3 million.

» moreClient News

Ivanhoe Electric Completes Units Offering

Paul, Weiss advised BMO Capital Markets as the underwriter on Ivanhoe Electric Inc.’s $70 million public offering of units, each comprised of one share of common stock and one common stock purchase warrant.

» moreClient News

Province of Saskatchewan Completes $1 Billion U.S. Public Bond Offering

Paul, Weiss represented the Province of Saskatchewan in its public offering of $1 billion aggregate principal amount of 4.650% bonds due 2030.

» moreClient News

Canadian Natural Resources Completes $1.5 Billion Notes Offering

Paul, Weiss advised Canadian Natural Resources Limited, a senior crude oil and natural gas production company, in its private offering of $750 million aggregate principal amount of 5.000% senior unsecured notes due 2029 and $750 million aggregate principal amount of 5.400% senior unsecured notes due 2034.

» moreClient News

Dhilmar to Acquire Éléonore Mine From Newmont for $795 Million

Paul, Weiss is advising Dhilmar Ltd. in its all-cash $795 million acquisition of the Éléonore gold mine in Northern Québec, Canada, from Newmont Corporation, the world’s leading gold company.

» moreClient News

Nuvei Acquired by Advent International in $6.3 Billion Take-Private Deal

Paul, Weiss advised a special committee of independent directors of Montreal-based Nuvei Corporation in the company’s take-private acquisition by global private equity investor Advent International, alongside the company’s founder and existing shareholders Novacap and CDPQ.

» moreClient News

Methanex Corporation Completes $600 Million Senior Notes Offering

Paul, Weiss advised Methanex Corporation, the world’s largest supplier of methanol to major international markets, in its private offering of $600 million aggregate principal amount of 6.250% senior notes due 2032.

» moreClient News

Silvercorp Metals Completes $150 Million Convertible Senior Notes Offering

Paul, Weiss advised BMO Capital Markets Corp. as the representative for the initial purchasers in Silvercorp Metals Inc.’s private offering of $150 million aggregate principal amount of 4.75% convertible senior notes due 2029.

» moreClient News

Aris Mining Corporation Completes $450 Million Senior Notes Offering

Paul, Weiss advised Aris Mining Corporation, a gold producer in the Americas, in its private offering of $450 million aggregate principal amount of 8.000% senior notes due 2029.

» moreClient News

SilverCrest to Be Acquired by Coeur in $1.7 Billion Transaction

Paul, Weiss is advising SilverCrest Metals Inc. in its sale to Coeur Mining, Inc. for $1.7 billion.

» moreAwards & Recognition

Ian Hazlett to Receive The M&A Advisor’s 2024 “Emerging Leaders Award”

The M&A Advisor will recognize corporate partner Ian Hazlett as a 2024 recipient of its “Emerging Leaders Award,” which celebrates professionals under the age of 40 whose significant achievements have established them as emerging leaders in the M&A, financing and restructuring industries.

» more