Paul, Weiss is an acknowledged leader among U.S. law firms representing Canadian public and private companies and their underwriters. With almost 50 years of history in Canada and an office in Toronto, our vibrant Canada practice is the largest among U.S. law firms and reflects our long-standing commitment to our clients in their Canadian–U.S. cross-border matters.

2024 Year-End U.S. Legal & Regulatory Developments

January 15, 2025 Download PDF

The following is our summary of significant 2024 U.S. legal and regulatory developments of interest to Canadian companies and their advisors. The first section below covers key developments from the fourth quarter of 2024; the second section discusses certain key developments from the first three quarters of 2024.

Recent Developments (Fourth Quarter 2024)

- Fifth Circuit Strikes Down Nasdaq Board Diversity Disclosure

Requirements

On December 11, 2024, in Alliance for Fair Board Recruitment v. SEC, the U.S. Court of Appeals for the Fifth Circuit struck down Nasdaq’s board diversity disclosure requirements, holding en banc that the Securities and Exchange Commission (the “SEC”) had exceeded its authority in approving them. The challenge was initially unsuccessful, with a Fifth Circuit panel upholding the requirements in 2023. Nasdaq has communicated to listed companies that it does not plan to appeal the ruling, although it is reported that the SEC is “reviewing the decision and will determine next steps as appropriate.”

As a result, Nasdaq-listed companies will no longer be required to comply with the vacated rules, which had mandated them to (i) disclose the voluntarily self-identified diversity characteristics of their board members and (ii) have, or explain why they do not have, at least one director who self-identified as a female, an underrepresented minority or LGBTQ+ and, beginning in 2025, at least two self-identified diverse directors.

The Fifth Circuit’s ruling may foreshadow a future circuit split on issues related to corporate board diversity and related disclosure requirements.

Looking Ahead

The Fifth Circuit’s ruling vacates the 2021 Nasdaq rule changes, eliminating the board diversity disclosure requirements. This may not have a significant impact on board diversity in practice, which had been on the rise before Nasdaq proposed the requirements. According to a Conference Board survey, in 2023, 21% of Russell 3000 directors were racially or ethnically diverse, 54% of Russell 3000 companies had three or more female directors, and male-only boards had decreased to 1.6% (down from 21% in five years). So long as board diversity remains an important priority for investors – institutional and others – as well as ISS, Glass Lewis and other stakeholders, we expect it will remain an important part of public company governance.

For the full text of our memorandum, please see:

For the Fifth Circuit’s opinion in Alliance for Fair Board Recruitment v. SEC, please see:

- New HSR Act Notification Requirements Will Impose Significantly Greater Burden on Filers; Private Equity Buyers are Likely to Have the Highest Burden

On October 10, 2024, in a highly anticipated move that was over a year in the making, the Federal Trade Commission (the “FTC”) issued changes to rules under the Hart-Scott-Rodino Antitrust Improvements Act of 1976 (the “HSR Act”) that will overhaul premerger notification filing requirements, substantially increasing the burden, time and expense required to complete HSR notifications. Parties will be required to comply with the new requirements beginning February 10, 2025. Notably, once the changes become effective, the FTC will end its “temporary” suspension of early termination after almost four years.

The new HSR rules seek incremental information to be provided in initial HSR filings about:

- The corporate and control structure of the buyer and target, to determine who has the ability to influence corporate decision-making post-closing (focusing in particular on private investment, including private equity firms and minority co-investors).

- The risk that parties who are not direct competitors may have the ability to limit products or services that their actual competitors use (a “foreclosure” issue).

- Innovation, nascent competition and future market entry, particularly in sectors that rely on technology, such as pharmaceutical, medical devices and digital markets.

- So-called “roll-up” or serial acquisition strategies where firms engage in a series of strategic acquisitions in the same or adjacent markets and which the FTC says have “been particularly prevalent in healthcare markets involving private equity buyers” and in “technology markets.”

What are the most significant new requirements?

Transaction Rationale, Overlap Descriptions and Supply Relationships

- Strategic rationale. Both parties must submit narrative strategic rationales for the transaction, with references to the transaction documents evidencing those rationales.

- Competitor relationships. Without exchanging information between the parties, they must describe principal categories of current or known planned products or services that compete (or could compete) with a current or known planned product or service of the other party. For each such product, sales figures, descriptions of all categories of customers and top 10 customers for each customer category must be provided.

- Supplier relationships. Without exchanging information between the parties, they must describe each product service or asset (including data) in the most recent year (which represented at least $10M in revenues including internal transfers) that had been (or could have been) (1) sold, licensed or supplied to or (2) incorporated as an input and purchased, licensed or otherwise obtained from the other party (or its competitors). For each such product, service or asset, the party must provide sales to/from the other party and its competitors, descriptions of all categories of customers, and top 10 customers/suppliers and descriptions for associated purchase/supply/licensing agreements.

Ownership Structure, Minority Shareholders and Limited Partners

- Acquiring persons must provide a description of the ownership structure of the acquiring entity and, for transactions where a fund or master limited partnership is the acquiring ultimate parent entity, to the extent they already exist, organizational charts sufficient to identify and show the relationship of all the entities that are affiliates or associates.

- The acquiring person must report all 5% or greater shareholders of all entities within its HSR control chain – i.e., (1) the acquiring entity, (2) any entity directly or indirectly controlled by the acquiring entity, (3) any entity that directly or indirectly controls the acquiring entity and (4) any entity within the acquiring person that has been or will be created as a result of the transaction (each a “covered entity”). If a covered entity is a limited partnership, which is common in private equity structures, filers will only identify the general partner and 5%+ limited partners with certain strategic and veto rights (including the right to serve as, nominate, appoint, veto or approve board members, or individuals with similar responsibilities).

- The acquired person must identify all 5% or greater roll-over shareholders of the target.

Interlocking Officers/Directors

Acquiring persons must provide information about officers and directors of both (1) entities within the acquiring person responsible for development, marketing or sales of overlapping products or services, or those with identified supply relationships and (2) entities the acquiring entity directly or indirectly controls, entities that directly or indirectly control the acquiring entity and new entities that have or will be created as a result of the transaction, in each case, that also serve as a director or officer of another entity with the same North American Industry Classification System (“NAICS”) code or operating in the same industry as the target.

For entities in category (1), there is a short lookback period: filers will have to report officers and directors serving within three months prior to the HSR Filing. For entities in category (2), there is no lookback requirement; however, filers must consider individuals who have not yet officially taken the relevant position, which are common among PE buyers.

Expanded Transaction-Related Documents

- Parties must submit more types of transaction-related documents (i.e., previously known as item 4 documents) than are currently required.

- Specifically, parties must submit documents prepared by or for the “supervisory deal team lead” (i.e., a single person who has primary responsibility for supervising the strategic assessment of the deal, and who would not otherwise qualify as a director or officer).

- While the new rules do not require parties to provide all drafts of responsive transaction-related competitive analyses, for directors, all versions of competitive analyses—even if provided only to a single director—will now have to be produced as “final” (any such document provided to the entire board is already considered “final”).

- Transaction diagrams must be provided (if they exist).

- Parties must provide full translations of all foreign-language documents produced.

Ordinary Course CEO and Board Plans and Reports—Market-Related Documents That Are Not Transaction-Specific

Parties must provide all regularly prepared plans and reports prepared within the last year provided to the CEO (e.g., annual, semi-annual or quarterly business plans) and all documents provided to the Board of Directors of the acquiring entity, or any entity that it controls or is controlled by, that analyze competition-related topics pertaining to any products or services identified in the Overlap Description.

Non-Transaction-Related Agreements

The buyer must identify whether any entity within the acquiring person has, or had within one year of filing, any contractual agreements with the target (such as licensing agreements, supply agreements, non-competition or non-solicitation agreements, purchase agreements, distribution agreements or franchise agreements), and indicate via “checkbox” which agreement types.

Additional Information

Parties must also provide certain additional information regarding foreign subsidies, defense/intelligence contracts, foreign merger control filings and prior acquisitions, as discussed in the full text of our memorandum.

Filings Based on Letters of Intent (LOI) Require More Deal Terms

To discourage “premature” filings that purportedly disadvantage the agencies’ ability to review transactions, LOI filings (which often allow the parties, in particular PE buyers, to simultaneously sign and close the transactions) will now require key material transaction terms, including parties, structure, the scope of target, purchase price, estimated closing timeline, employee retention policies, post-closing governance and other material terms.

What is the practical guidance for parties planning transactions?

We anticipate that all parties, in particular highly acquisitive PE buyers, will spend significantly longer time and greater effort in completing HSR forms. To avoid undue delay to closing timing, parties should consider proactively taking the following practical actions.

- Expand data collection and record-keeping efforts to gather, prepare and regularly update (annually—or more frequently— and periodically after each acquisition) information and documents sought by the HSR rules.

- When contemplating a potential deal, it is crucial to engage antitrust/HSR attorneys at the onset to: (1) understand the identity of the acquiring entity and the implications for HSR reporting, (2) assess antitrust risk, analyze actual or potential horizontal and vertical overlaps and draft competition and overlap narratives (this is important even for deals without apparent antitrust risk because parties could have a NAICS code “overlap” or potential customer/supplier relationship over small amounts of revenues. Such “overlap” would result in significant additional disclosures), (3) designate and educate the supervisory deal team lead early in the process and (4) review and advise on drafting transaction-related documents such as investment committee or board decks, documents to any board members, documents describing transaction rationales.

- Parties should also coordinate closely with their deal counsel and negotiate terms in deal documents that reflect the additional time it will take to prepare an HSR notification.

Parties should also keep in mind the following:

- With the heightened burden of filing on an LOI, the parties will have less flexibility to start the 30-day waiting period early and have a simultaneous “sign and close,” which has been common in PE deals.

- More “subjective” requirements in the new HSR form, such as overlap descriptions, could lead to more “bouncing” of the filings by the government and further delaying transactions.

- The new HSR rules, like the FTC’s non-compete rules, may be challenged in court.

- The incoming administration could seek to delay, modify or rescind the new rules.

For the full text of our memorandum, please see:

For the FTC’s final rule on premerger notification filing requirements, please see:

- Corporate Transparency Act Is (Once Again) Enjoined; Reporting Companies Not Required to File Beneficial Ownership Reports

Following a December 26, 2024 ruling by the U.S. Court of Appeals for the Fifth Circuit, a nationwide preliminary injunction is (once again) in effect against enforcement of the Corporate Transparency Act (the “CTA”) and the U.S. Department of the Treasury’s Financial Crimes Enforcement Network’s (“FinCEN”) beneficial ownership information reporting rule (the “BOI Reporting Rule”). As a result, reporting companies are not required to file Beneficial Ownership Information (“BOI”) reports with FinCEN. FinCEN stated in a December 27 announcement that “as of December 26, 2024, the injunction issued by the district court in Texas Top Cop Shop, Inc. v. Garland is in effect and reporting companies are not currently required to file beneficial ownership information with FinCEN.”

Background

The CTA and the BOI Reporting Rule required “reporting companies” to file BOI reports with FinCEN by specified deadlines. The BOI Reporting Rule included twenty-three categories of exempt entities.

The BOI Reporting Rule took effect on January 1, 2024 and there had been a significant deadline on January 1, 2025, which was the date when all (non-exempt) reporting companies formed before January 1, 2024 were required to file their BOI reports with FinCEN.

What this Latest Development Means for Reporting Companies

At this time, reporting companies are not required to file BOI reports—and may not be penalized for not filing BOI reports with FinCEN. Reporting companies may continue to voluntarily submit BOI reports.

We expect that the national injunction will remain in effect through at least the oral argument scheduled for March 25, 2025, but it is possible that the U.S. Department of Justice (“DOJ” or the “Department”) could seek relief from the Supreme Court.

Given the possibility that the BOI Reporting Rule could come back into effect with a short deadline to file, (non-exempt) reporting companies may decide to continue to prepare for the possibility of once again being required to submit BOI reports to FinCEN.

For the full text of our memorandum, please see:

For the full text of our memorandum on the filing requirements under the CTA, please see:

For the full text of the Fifth Circuit’s order in Texas Top Cop Shop, Inc. v. Garland, please see:

- Tenth Circuit Affirms Dismissal of Short Seller Claims for Failure to Allege Reliance and Clarifies Standard for “Manipulative” Acts Under Exchange Act

On October 15, 2024, the United States Court of Appeals for the Tenth Circuit issued an opinion in In re Overstock Securities Litigation (“Overstock”), which affirmed dismissal of class action claims by a short seller under the Securities Exchange Act of 1934, as amended (the “Exchange Act”) for failure to allege reliance, and, as a matter of first impression in the Circuit, held that a corporate transaction that artificially increases the company’s share price is not “manipulative” under the Exchange Act absent evidence that the defendants acted with intent to deceive investors.

Background

Section 10(b) of the Exchange Act broadly prohibits deception in connection with the purchase or sale of securities. SEC Rule 10b-5(b) forbids “making any untrue statement of a material fact.” To state a claim for misstatements under Rule 10b-5(b), a plaintiff must sufficiently allege, among other elements, that the plaintiff relied on the misleading statements and suffered damages because of its reliance. Additionally, Rule 10b-5(a) and (c) prohibit manipulative acts in connection with the purchase or sale of securities.

In this case, a short seller brought a putative class action against Overstock and certain former Overstock executives, alleging that they made false and misleading statements about Overstock’s performance, risk controls and dividend strategy, and that Overstock manipulated the market by inducing an artificial “short squeeze.” During the relevant period, Overstock had significant short interest, with more than half of shares outstanding sold short. According to the complaint, Overstock’s CEO devised a plan to squeeze those short sellers in order to artificially inflate Overstock’s share price. Specifically, Overstock announced that it would issue a dividend in the form of a blockchain-based digital security token that would not be registered with the SEC. Because the token was unregistered, it could not be transferred for six months after issuance. That was problematic for short sellers who had borrowed Overstock shares to place their short positions, and were contractually obligated to transmit any dividends to the brokers that lent them the shares. The announcement of the unregistered dividend forced the short sellers to buy new Overstock shares and close their short positions before the dividend’s record date in order to avoid breaching their lending contracts. This forced buying increased the share price, enabling the CEO to sell his shares at a significant profit before departing the company. The CEO made various public statements prior to the record date of the dividend explaining that the transaction was “designed . . . carefully” to cause a short squeeze.

Implications

This decision has potential implications for securities class actions brought by short sellers and other investors with distinctive motives for transacting in a company’s stock. While securities plaintiffs typically invoke the fraud-on-the-market presumption to plead reliance, the Overstock decision suggests that short sellers may not always be entitled to that presumption. Although the Tenth Circuit made clear that it was not adopting a blanket rule barring short sellers from invoking the presumption, companies defending against securities class actions led by short sellers may succeed in rebutting the presumption at the pleadings stage if the complaint itself alleges that short sellers’ investment decisions were motivated by reasons other than the challenged public statements. And even if the complaint lacks such admissions, defendants may wish to use discovery to establish short seller plaintiffs’ distinct motivations to argue that they are inadequate representatives at the class certification stage.

Likewise, the decision underscores that courts may carefully assess the entirety of investors’ factual allegations to determine whether they constitute binding concessions that negate one of the necessary elements of a securities fraud claim. For example, a plaintiff may plead itself out of court by attributing a share price decline to a particular event that a court determines is not causally related to the alleged fraud, thereby conceding the necessary element of loss causation.

Finally, the Tenth Circuit’s decision provides further clarity on the pleading standards for a market manipulation claim under Rule 10b-5(a) and (c). Surveying market manipulation cases from sister circuits, the Tenth Circuit made clear that a claim for market manipulation is dependent on allegations of deceit. Thus, regardless of whether a transaction is designed to “artificially” inflate a company’s share price, there can be no valid claim of market manipulation if adequate information about a planned transaction is disclosed to the market, such that the market can understand the likely impact of the transaction on the share price.

For the full text of our memorandum, please see:

For the Tenth Circuit’s opinion in Overstock, please see:

- 2024 Year in Review: CFIUS, Outbound Investments and Export Controls

In the past year, the U.S. government’s efforts to counter China led to a number of noteworthy regulatory developments. The past months in particular have seen a flurry of activity, as the outgoing Biden administration has finalized initiatives related to the Committee on Foreign Investment in the United States (“CFIUS” or the “Committee”), U.S. outbound investment restrictions and export controls. In 2025, we expect President-elect Trump’s administration will continue, and likely expand upon, the Biden administration’s China-related national security initiatives, including CFIUS’s continued focus on enforcement, the use of export controls as a key tool to mitigate access to critical, defense-related technologies, and the implementation and enforcement of the imminent Outbound Investment Security Program.

2024’s Key Takeaways

- Despite a slight decline in overall filings, CFIUS remains a robust regulatory program reviewing hundreds of transactions a year, and the Committee has continued its transformation into a highly resourced and significant regulator of foreign investment into the United States. The decline in total filings may in part be due to increased familiarity with the regime and a shift in decision-making by transaction parties that are balancing the desire for regulatory certainty with timing risks. The decline also tracks with overall M&A trends year over year.

- CFIUS expanded its enforcement activities, including by disclosing a substantial uptick in its use of monetary penalties for non-compliance with mitigation agreements (including a $60 million penalty in one case) and by issuing new regulations that enhanced its enforcement capabilities.

- The U.S. government continues to prioritize export control authorities as a critical component of its efforts to counter nation-state foreign adversaries seeking to obtain access to the United States’ most sensitive technologies. In practice this has meant new, more restrictive controls on emerging technologies and increased enforcement by the U.S. government and, consequently, increased compliance and diligence considerations for companies.

- The Outbound Investment Review Program, which came into effect January 2, 2025, prohibits certain investments by U.S. persons in individuals or entities associated with China (including Hong Kong and Macau) involving critical national security technologies and products while requiring notification of others. Although similar in some regards to existing sanctions programs, the new outbound program represents a significant new step in that it restricts activities across categories of technologies rather than just with specifically identified parties or individuals. As discussed in greater detail below, we expect that the current categories, which are relatively tailored, may be expanded in the coming years.

What’s to Come in 2025 – President Trump 2.0

Current CFIUS, outbound investment, and export controls regimes reflect initiatives from the first Trump administration. Using national security authorities to address the multifaceted threat posed by China was then continued and expanded upon by the Biden administration. Accordingly, it is likely to be a rare area of continuity in the years to come.

- CFIUS.

- China: CFIUS will continue to closely scrutinize investments for national security risks from China (direct or indirect) and we assess CFIUS will continue to be a difficult environment for Chinese investment, particularly as it relates to critical technologies. Indeed, although in previous years Chinese investors successfully closed on deals in low risk businesses, the next administration may actively make the process more challenging for even low-risk deals as part of its broader initiatives to counter China economically.

- Middle East: CFIUS may decrease its scrutiny of Middle Eastern sovereign wealth funds and similarly is likely to apply less scrutiny to private equity transactions.

- Taiwan: Bolstered by statements President-elect Trump has made on Taiwan’s role in the global semiconductor supply chain, CFIUS may become a more challenging process for Taiwanese investors, at least in relation to semiconductor deals and other critical technology businesses.

- Outbound Investment Security Program. The practical implications for the outbound program with the change in administration are difficult to predict because the rules will only become effective in the final weeks of the outgoing administration. That said, we assess the new administration will likely aggressively enforce the restrictions and may even seek to expand the scope of the technologies or countries of concern that are subject to the program.

- Export Controls. We expect the enforcement efforts of DOJ and the Department of Commerce’s Disruptive Technology Strike Force and the Office of Information and Communications Technology and Services of the Department of Commerce’s Bureau of Industry and Security to continue to grow, particularly with respect to enforcement and investigation targeting China and Iran. Likewise, the incoming administration will likely continue to employ restrictive export controls on China with respect to many emerging technologies. One area to watch in particular will be how export controls on AI technologies are treated by the new administration, as maintaining U.S. leadership in the AI development race has been identified as a key priority.

For the full text of our memorandum, please see:

2024 Developments (First through Third Quarters)

- SEC Adopts and Subsequently Stays New Climate Disclosure Requirements

On March 6, 2024, the SEC adopted significant new climate-related disclosure requirements, marking the first U.S. federal regime of its kind. The finalization of these rules comes almost two years after the SEC proposed them, and after an intense comment process.

The SEC’s Stay

On April 4, 2024, the SEC issued an order staying the new rules pending the outcome of litigation in the U.S. Court of Appeals for the Eighth Circuit. The rules are the subject of numerous legal challenges, initially leading to a stay issued by the U.S. Court of Appeals for the Fifth Circuit, but all of which have now been consolidated into one litigation in the Eighth Circuit. In its order, the SEC noted that “the Commission is not departing from its view that the [climate-related disclosure requirements] are consistent with applicable law and within the Commission’s long-standing authority to require the disclosure of information important to investors in making investment and voting decisions” and that it would continue to vigorously defend the new rules in court. However, the SEC decided to voluntarily stay the rules to facilitate the orderly resolution of these challenges and to avoid companies being subject to the rules during the pendency of the litigation. It is currently unclear how the stay might affect the compliance deadlines for the new requirements.

Summary of Disclosure Requirements

In a notable, though not unexpected, departure from the proposal, the final rules eliminate the controversial requirement to disclose Scope 3 greenhouse gas (“GHG”) emissions. The SEC also limited the requirement to disclose Scope 1 and Scope 2 GHG emissions: only large accelerated filers and accelerated filers will be required to disclose them (and eventually provide attestation reports), and only if they are material (to the filer). The SEC also modified its proposal to disclose certain climate-related financial statement metrics and related disclosures in a note to audited financial statements; the new rules will instead require disclosure in notes to the financial statements of the costs, expenses and losses associated with severe weather events and carbon offsets and renewable energy credits or certificates (if a material component of any climate target or goal).

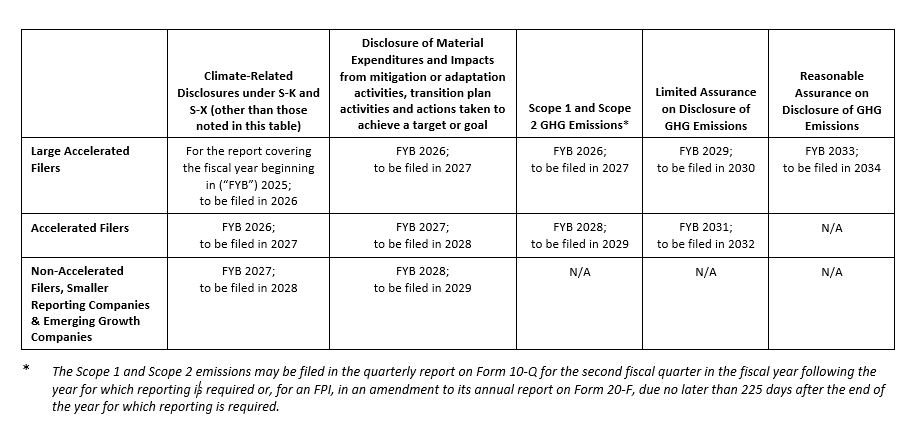

These new requirements would apply to domestic registrants as well as foreign private issuers (“FPIs”) filing on Form 20-F. However, these requirements would not apply to multijurisdictional disclosure system issuers filing on Form 40-F. The final rules have a multi-year phase-in for the disclosure requirements, based on company filing status, as noted below.

As proposed, these new requirements are modeled in part on the Task Force on Climate-Related Financial Disclosures and the Greenhouse Gas Protocol emissions reporting frameworks. The new disclosure requirements will be set forth in a new Item 1500 of Regulation S-K and Article 14 of Regulation S-X. Registrants would be required to present in their annual reports (or registration statements) and in the accompanying financial statements, detailed information regarding, among others, the following:

- material climate-related risks, their actual and potential material impacts on strategy, business model and outlook, and any mitigation or adaptation activities;

- material climate-related targets or goals and any transition plans;

- costs, expenses, charges and losses associated with severe weather events (subject to a 1% and de minimis disclosure thresholds), and relating to carbon offsets and renewable energy credits of certificates if material to targets or goals;

- company board and management oversight and governance of climate-related risks; and

- for large accelerated filers and accelerated filers, Scope 1 and Scope 2 GHG emissions data, if material, and eventually third party attestations providing assurance on the GHG emissions data.

These disclosure requirements would be phased in, depending on the registrant’s filing status:

|

Large multinational companies with significant operations and sales in the European Union and companies with significant operations in or sales to California may have separate obligations to report Scope 3 emissions and other climate change-related information to other jurisdictions; these new SEC requirements will not affect those reporting obligations.

For the full text of our memorandum on the new rules, please see:

For the SEC’s final rules, please see:

For the full text of our memorandum on the SEC’s order issuing a stay of the new rules, please see:

For the SEC’s order issuing a stay of the new rules, please see:

- Delaware General Assembly Approves 2024 Amendments to General Corporation Law

On June 20, 2024, the Delaware General Assembly passed legislation to amend provisions of the Delaware General Corporation Law (“DGCL”). The amendments took effect on August 1, 2024 and apply retroactively, but do not apply to or affect any completed or pending civil actions on or before the amendments’ effective date. The amendments abrogate various recent Court of Chancery decisions that many practitioners had considered inconsistent with market practice. In particular, key changes effected by the amendments include: (i) expressly permitting stockholders agreements relating to corporate governance, such as consent rights over corporate actions; (ii) authorizing boards to approve agreements, instruments and other documents that require board approval under the DGCL, such as merger agreements, in final or “substantially final” form; (iii) clarifying that customary disclosure schedules delivered in connection with merger agreements are not part of the “agreement” that must be approved by the board and adopted by stockholders, and that the merger agreement need not include any provision relating to the survivor’s charter in certain circumstances; and (iv) expressly permitting merger agreements to include “Con-Ed” provisions addressing “penalties and consequences” for non-performance, including reverse termination fees representing stockholders’ lost transaction premium, as opposed to the target entity’s expectation or reliance damages.

Authorization of Stockholders Agreements

In West Palm Beach Firefighters’ Pension Fund v. Moelis & Co. (“Moelis”), the Delaware Court of Chancery held that certain consent and other provisions in a stockholders agreement were facially invalid under the DGCL because they substantially restricted the ability of the board to manage the business and affairs of the corporation. The amendments enact a new subsection (18) of DGCL Section 122 (relating to a corporation’s specific powers and permitted actions) that expressly authorizes corporations to contract with stockholders or beneficial owners of its stock on governance matters for such minimum consideration approved by the board, thus abrogating that portion of Moelis. In particular, new Section 122(18) expressly permits corporations to agree to take (or not to take) actions identified in a stockholders agreement, including to provide stockholders or directors with veto or consent rights over such actions, so long as they do not override any requirements for corporate action enumerated in the DGCL or the corporation’s charter. For example, Section 242(b)(1) of the DGCL generally requires approval by the board and the stockholders (in that order) for a corporation to amend its charter. So while a stockholders agreement cannot eliminate that requirement, it may, pursuant to Section 122(18), contain a covenant prohibiting the corporation from amending the charter without first obtaining a particular stockholder’s consent. Importantly, Section 122(18) addresses only the statutory validity of such provisions; it does not affect a board’s or controlling stockholder’s fiduciary duties in entering into, performing or exercising its rights under such agreements in any particular case, nor does it abrogate other principles articulated in existing case law.

Approval of Agreements

The amendments address the Court of Chancery’s decision in Sjunde Ap-Fonden v. Activision Blizzard, Inc. (“Activision”) in which the court considered (but did not conclusively decide) whether Section 251(b) of the DGCL requires boards to approve the final execution version of a merger agreement. The Activision court held that at a minimum the board must approve an “essentially complete” version of the merger agreement, which the court held the board in that case failed to do, as the approved version was missing disclosure schedules, the surviving company’s charter, the consideration amount and the amount of dividends that the company could pay in the period between sign and close. In response to this holding, the amendments enact a new Section 147 of the DGCL, which provides that whenever the DGCL requires board approval of any “agreement, instrument or document,” such document may be approved in “final form or in substantially final form.” According to the legislative synopsis, a document is substantially final when all its material terms are either set out in the document or known to the board through other materials presented to it. For example, new Section 147 will permit a board to approve a merger agreement or a charter that does not specify a particular material term (such as the merger consideration or reverse stock split ratio in a charter amendment) if the board was otherwise aware of that term when it gave its approval (such as through a presentation identifying the final amount of consideration or split ratio). However, new Section 147 only addresses board approval of agreements, instruments and other documents; it does not authorize submitting such documents in substantially final form to stockholders. Nor does it affect fiduciary duties or equitable remedies in connection with the board’s approval or taking of other actions in respect of the agreement, instrument or document so approved.

The amendments also enact a new Section 268 of the DGCL that addresses the Activision court’s concerns that the board did not approve a final form of the surviving company’s charter amendments or disclosure schedules related to a merger. Specifically, new Section 268 provides that disclosure letters, disclosure schedules or similar documents will not be deemed to be part of a merger agreement that must be approved by the board unless otherwise provided in the agreement. In addition, if a merger agreement (other than for a “holding company” merger under Section 251(g)) provides that all of the stock of a constituent will be converted into or exchanged for cash, property or securities (other than shares of the surviving corporation), then (i) the merger agreement required to be approved by the board need not include any provision relating to the survivor’s charter to be considered in final or substantially final form, (ii) the board or any person acting at its direction may approve any amendment to the survivor’s charter and (iii) no alteration or change to the survivor’s charter will constitute an amendment to the merger agreement. According to the legislative synopsis, “[a]mong other things, this amendment will provide flexibility to a buyer in a typical ‘reverse triangular merger’ to adopt the terms of the [survivor’s charter] that, following the effectiveness of the merger, will be wholly owned and controlled by the buyer.” The synopsis also notes, however, that a target may still insist that the merger agreement provide for the survivor’s charter in a particular form or that it contain specified provisions, such as those relating to indemnification and advancement of the corporation’s directors and officers.

Authorization of Lost Premium Damages Provisions

The amendments modify Section 261 of the DGCL to clarify that a merger agreement may specify “penalties or consequences” for noncompliance prior to the effective time of the merger, including a “reverse termination fee” requiring a would-be acquiror in a failed transaction to pay the target an amount based on the stockholders’ loss of the transaction premium. The amendments also expressly authorize, if specified in the merger agreement, the target itself to retain such stockholders’ lost premium payments without any obligation to distribute them to the stockholders. Merger agreements commonly include such provisions, but the Court of Chancery recently suggested in Crispo v. Musk that they may be inconsistent with Delaware law. This amendment would reinstate the validity of such “Con-Ed” provisions in Delaware.

Conclusion

The amendments reflect the Delaware legislature’s willingness and ability to address dislocations between the state’s jurisprudence and market practice quickly and efficiently. As already mentioned, while the amendments make facially valid certain actions that the courts had found to violate the DGCL, directors, officers and stockholders remain bound by longstanding fiduciary duties, and also equitable principles developed by Delaware case law and policed by the Delaware courts on an as-applied basis.

For the full text of our memorandum, please see:

For the full text of the amendments, please see:

- SEC Approves Amendment to NYSE Shareholder Approval Requirements

On December 26, 2023, the SEC approved an amendment to the shareholder approval requirements of the New York Stock Exchange (the “NYSE”) in the case of certain issuances to a substantial security holder. Under amended Section 312.03(b)(i) of the NYSE Listed Company Manual, listed companies will no longer be required to get shareholder approval for issuances to substantial security holders in excess of 1% which are below the “Minimum Price” where such substantial security holders are not “Active Related Parties” – i.e., controlling stockholders or members of a control group or have an affiliated person serving as an officer or director of the listed company. For purposes of Section 312.03(b)(i) of the NYSE Listed Company Manual, “control” has the same meaning as defined in Rule 12b-2 of Regulation 12B under the Exchange Act, and “group” means a group as determined in accordance with Section 13(d)(3) or Section 13(g)(3) of the Exchange Act. The “Minimum Price” is defined in Section 312.04(h) of the NYSE Listed Company Manual as the lower of (i) the official closing price on the NYSE as reported to the Consolidated Tape (the “Official Closing Price”) immediately preceding the signing of the binding agreement; or (ii) the average Official Closing Price for the five trading days immediately preceding the signing of the binding agreement.

Issuances to substantial security holders (regardless of whether they are Active Related Parties or not) remain subject to other NYSE shareholder approval requirements, including Section 312.03(c) of the NYSE Listed Company Manual, which requires shareholder approval for issuances in excess of 20% of the outstanding at a price below the Minimum Price, and Section 312.03(b)(ii), which requires shareholder approval for issuances to substantial security holders (regardless of their control status or affiliated directors or officers), where such securities are issued as consideration in a transaction or series of related transactions in which such substantial security holder (or a director or officer) has a 5% or greater interest (or such persons collectively have a 10% or greater interest), directly or indirectly, in the company or assets to be acquired or in the consideration to be paid in the transaction or series of related transactions and the present or potential issuance of common stock, or securities convertible into common stock, could result in an issuance that exceeds either 5% of the number of shares of common stock or 5% of the voting power outstanding before the issuance.

In proposing this amendment, the NYSE noted that issuances to substantial security holders that are not Active Related Parties do not pose the same potential conflicts of interest as issuances to those shareholders who participate in the listed company’s governance or management and have the ability to influence decision making. This amendment will more closely align the NYSE’s shareholder approval requirements with those of Nasdaq and ease listed companies’ ability to raise capital from existing shareholders.

For the full text of our memorandum, please see:

For the full text of the amendment, please see:

- SDNY Court Deals Blow to SEC Cyber Enforcement, Dismisses Most Charges Against SolarWinds and Its CISO

On July 18, 2024, Judge Paul A. Engelmayer of the U.S. District Court for the Southern District of New York (“SDNY”) granted in large part a motion by SolarWinds Corporation (“SolarWinds”) and Timothy Brown, SolarWinds’ Chief Information Security Office (“CISO”), to dismiss a civil suit filed against them by the Securities and Exchange Commission. The motion to dismiss was supported by four groups that submitted amicus briefs, including a brief submitted by Paul, Weiss on behalf of former government officials.

According to the SEC’s lawsuit, in January 2019, threat actors secured access to SolarWinds’ corporate VPN and proceeded to exploit that connection to access SolarWinds’ network. The threat actors subsequently inserted malicious code into SolarWinds’ software. The threat actors leveraged this malicious code to conduct a series of cyberattacks, later referred to as SUNBURST, which impacted the operations of many of SolarWinds’ customers, including federal and state government agencies. After learning of the SUNBURST attack, Brown and other executives at SolarWinds prepared Form 8-K filings disclosing the event. On October 30, 2023, the SEC brought securities fraud claims against SolarWinds and Brown based on alleged material omissions and misstatements in disclosures that were made in public statements and in SEC filings both before and after the SUNBURST attack.

When filed, the case marked a number of firsts for the SEC: the first time it had brought intentional fraud charges in a cybersecurity disclosure case, the first time it had brought an accounting control claim based on an issuer’s alleged cybersecurity failings, and the first time it had brought a cybersecurity enforcement claim against an individual. The SEC based its claims on alleged material misrepresentations and omissions by SolarWinds and Brown, both before and after the company disclosed a large-scale cyberattack, known as SUNBURST, in December 2020. Specifically, the SEC alleged that SolarWinds and Brown had misleadingly touted the company’s cybersecurity practices before the incident, including in a security statement published on the company’s website, in a cybersecurity risk disclosure made in SolarWinds’ SEC filings, and in press releases, podcasts and blog posts. The SEC also alleged that the company’s Form 8-K disclosures following the SUNBURST incident minimized the scope and severity of the attack. Additional claims were premised on SolarWinds’ purported failure to maintain effective internal accounting and disclosure controls and procedures for identifying and disclosing cybersecurity risks.

The only set of claims sustained by the court were the claims against SolarWinds and Brown for securities fraud based on the security statement on the company’s website, which claims the court held were viably pled as materially false and misleading in numerous respects. The court dismissed the claims of securities fraud and of false filings based on other statements and filings, as well as all of the claims based on SolarWinds’ post-SUNBURST disclosures. The court also dismissed the SEC’s claims relating to SolarWinds’ internal accounting and disclosure controls and procedures.

Key Takeaways

- Specific false or misleading statements on a company’s public website about the state of a company’s cybersecurity, even if the statements are directed to customers rather than investors, can be the basis for securities fraud liability: The court declined to dismiss the SEC’s claims related to a security statement published on a SolarWinds website, explaining that the statement was accessible to investors and therefore part of the “total mix of information” that SolarWinds furnished to the investing public. According to the amended complaint, Brown approved and disseminated the security statement despite being privy to internal information that contradicted the statement’s representations about the company’s access controls and password practices. The court determined that the alleged misrepresentations, as pled, were materially misleading and that the allegations sufficiently pleaded Brown’s knowledge of, or at least recklessness as to, the misstatements on SolarWinds’ website. Additionally, the court concluded that Brown’s scienter was properly imputed to SolarWinds. Although it remains to be seen whether the evidence will support the allegations, the fact that these claims based on a public security statement were the only claims to survive the motion to dismiss, serves as an important reminder that all public statements about a company’s cybersecurity practices, not only those in SEC filings, can have legal consequences and should therefore be carefully reviewed for accuracy.

- “Internal accounting controls” do not extend to cybersecurity controls: The court held that Section 13(b)(2)(B) of the Exchange Act, which requires an issuer to devise and maintain “internal accounting controls,” is limited to controls related to accounting and does not extend to cybersecurity controls, such as password and VPN protocols. As the court explained, the Exchange Act “does not govern every internal system a public company uses to guard against unauthorized access to its assets, but only those qualifying as ‘internal accounting’ controls.” “Cybersecurity controls,” stated the court, “are undeniably vitally important, and their failures can have systemically damaging consequences. But these controls cannot fairly be said to be in place to ‘prevent and detect errors and irregularities that arise in the accounting systems of the company.’”

If the decision stands, it could limit the SEC’s ability to pursue Exchange Act claims related to internal controls that do not relate specifically to the company’s financial statements. And the SEC could therefore lose an important tool for public company cybersecurity enforcement. Just last month, the SEC announced that R.R. Donnelley & Sons Co. had agreed to pay $2.1 million to settle charges that the company failed to maintain “cybersecurity-related internal accounting controls” and to design effective disclosure controls to report relevant cybersecurity information to management. The SolarWinds decision may make it more difficult for the SEC to settle internal accounting controls claims based on allegedly deficient cybersecurity controls.

- Cybersecurity risk disclosures and disclosure controls can provide important defenses to securities fraud claims: The court reiterated that risk disclosures do not need to be stated with maximum specificity and detail under the securities laws, and found that SolarWinds had adequately identified in its disclosures the nature and types of cyber risks that it faced and associated consequences. Moreover, the court seemed to attach significance to SolarWinds’ ability to promptly assess whether disclosures of material information to the investing public were needed, and to file a Form 8-K disclosing the cyberattack within a matter of days. In the court’s view, “[p]erspective and context are critical” when evaluating whether SolarWinds’ Form 8-K was sufficiently pled as materially misleading; considering the “short turn-around” in which SolarWinds was able to file its Form 8-K disclosing the SUNBURST attack, it contained “appropriate gravity and detail.”

For the full text of our memorandum, please see:

For the district court’s opinion in SEC v. SolarWinds Corp. & Timothy Brown, please see:

- DOJ Launches New Whistleblower Program Focused on Corporate Misconduct

On August 1, 2024, DOJ’s Criminal Division launched a new Corporate Whistleblower Awards Pilot Program (the “Whistleblower Pilot Program” or the “Pilot Program”). The launch of the Whistleblower Pilot Program follows DOJ’s announcement of the program in March 2024. The Pilot Program will be managed by the Criminal Division’s Money Laundering and Asset Recovery Section. DOJ plans to “regularly assess the design and implementation of the Pilot Program and, at the end of this 3-year pilot period, the Department will determine whether the program will be extended in duration or modified in any respect.”

Under the Pilot Program, eligible whistleblowers who provide DOJ’s Criminal Division with original and truthful information about certain types of corporate misconduct are eligible to receive a portion of a criminal or civil forfeiture exceeding $1 million. The Pilot Program covers certain crimes involving financial institutions, domestic or foreign corruption by companies and health care fraud schemes involving private insurance plans.

DOJ has in recent years offered increased incentives to companies that self-report corporate misconduct. Under a 2022 revision to DOJ’s voluntary disclosure policy, absent aggravating factors, “the Department will not seek a guilty plea when a company has voluntarily self-disclosed, cooperated, and remediated misconduct.” This policy provides considerable benefits to eligible companies that file a Voluntary Self-Disclosure (“VSD”), including a potential declination.

However, DOJ has made clear that it is also seeking to incentivize individuals to come forward with original information about corporate misconduct. Under the Individual VSD Program announced in April 2024, certain individuals who were involved in corporate misconduct are eligible to receive a Non-Prosecution Agreement (“NPA”) if they report information to DOJ and cooperate in the investigation. Now, under the Whistleblower Pilot Program, eligible individuals are financially incentivized to report corporate misconduct to DOJ’s Criminal Division. While the Individual VSD program applied only to individuals involved in the misconduct, the Whistleblower Pilot Program more broadly offers an incentive to eligible individuals to report corporate misconduct to DOJ.

The Deputy Attorney General noted that there is “a synergy to these disclosure programs: together, they create a multiplier effect that encourages both companies and individuals to tell us what they know — and to tell us as soon as they know it.” In order for the individual to receive an NPA or whistleblower reward, they must generally report original information that DOJ did not have before. As the Deputy Attorney General noted, “to be eligible for the most significant benefits under these disclosure programs — both our corporate voluntary self-disclosure programs and the whistleblower initiative we’re announcing today — you have to tell us something we didn’t already know. With very few exceptions, you need to be first in the door.”

Amendment to Corporate VSD Policy

Alongside the Whistleblower Pilot Program, DOJ announced that it was amending its VSD policy for corporations. “Under that amendment, where a company receives an internal report from a whistleblower, if the company comes forward and reports the misconduct to the Department within 120 days and before the Department reaches out to the company, the company will be eligible for the greatest benefit under our policy—a presumption of a declination—so long as they fully cooperate and remediate.” This amendment is designed to incentivize companies to file VSDs where they receive a report from a whistleblower—and they can still receive the “greatest benefits” under the policy if they file the VSD within 120 days and before DOJ has reached out to the company about the issue. This is designed to create an incentive for companies to come forward with whistleblower allegations, rather than deal with them exclusively internally.

Confidentiality and Retaliation

Similar to other whistleblower programs, the Pilot Program affords whistleblowers confidentiality protections. Under the program, DOJ will “not publicly disclose any information, including information . . . that could reasonably be expected to reveal the identity of a whistleblower, except as required by law or Department policy as determined by the Department, in its sole discretion, unless and until required to be disclosed to a defendant in connection with a judicial or administrative proceeding.”

While the program does not afford explicit anti-retaliation protections to whistleblowers, DOJ notes that any retaliation would be assessed in terms of whether the company or any individual “cooperated with the Department or obstructed an investigation” and DOJ could “institute appropriate enforcement actions in response to retaliation.”

Compliance Considerations

With the adoption of the Whistleblower Pilot Program and the corresponding update to the corporate VSD Policy, it is clear that DOJ is continuing to aggressively incentivize individuals and companies to provide the Department with information about certain corporate misconduct. As a result, there are a number of steps that companies may wish to consider to respond to the increased risk of a whistleblower report to DOJ:

- First, companies may wish to review their internal investigation protocols and related statistics, including the average run time for their investigations. They may wish to consider policy or process changes to ensure that going forward, potentially reportable matters are timely triaged and investigated. For example, companies may wish to consider making adjustments to their intake process, such as their risk ranking or prioritization criteria, and/or establish target guidelines for completing certain investigatory phases within the 120-day window.

- Second, companies may wish to review their whistleblower and anti-retaliation policies and ensure that their reporting channels are both easily accessible and sufficiently advertised. Companies may also wish to consider developing or revising their guidelines for responding to and communicating with whistleblowers—in accordance with anti-retaliation protections—to address the risk that colleagues may be operating as external whistleblowers.

- Third, companies may wish to consider developing a framework for determining when it will report matters to DOJ and who will be involved in those decisions, and at what stage they will consult external counsel.

For the full text of our memorandum, please see:

For DOJ’s program guidance on the Whistleblower Pilot Program, please see:

- Delaware Supreme Court Affirms Two-Condition MFW Roadmap to Obtain Business Judgment Review of Controller Transactions

In an en banc, unanimous opinion in In re Match Group, Inc. Derivative Litigation (“Match”), the Delaware Supreme Court declined to provide a less burdensome path to business judgment review for self-interested controlling stockholder transactions that are not full “squeeze-out” mergers. Instead, the court’s opinion, by Chief Justice Collins J. Seitz, Jr., confirms that, in all transactions where the controller stands on both sides and receives a non-ratable benefit (including in non-squeeze-outs), entire fairness is the presumptive standard of review and defendants must demonstrate that they satisfied both prongs of the framework set forth in Kahn v. M & F Worldwide Corp. (“MFW”) to obtain business judgment review of the transaction—satisfying only one of the two protective measures will shift the burden of proving entire fairness to the plaintiff, but will not alter the standard of review. In addition, the opinion confirms that in the MFW setting, to replicate arm’s-length bargaining, all committee members, not just a majority of the committee, must be independent of the controller. Match therefore affirms that MFW remains the only path under Delaware law to invoke business judgment review in self-interested controller transactions and clarifies the need to ensure the independence of each special committee member in order to rely on MFW’s protections.

Background

In its seminal 2014 MFW opinion, the Delaware Supreme Court held, in the context of a controller squeeze-out transaction where minority holders sell their shares and are not stockholders of the surviving entity, that the transaction will be subject to business judgment review if it is conditioned from the start on both (i) approval by a special committee of independent directors that is fully empowered and meets its duty of care and (ii) the fully informed, uncoerced vote of a majority of the minority stockholders. After MFW was decided, the Court of Chancery also applied the MFW framework in a series of non-squeeze-out cases where the controller received a non-ratable benefit, which raised the question whether it was necessary to do so in those circumstances in order to obtain business judgment review of those transactions.

Match also arose in the context of a controller, non-squeeze-out transaction, specifically the 2020 separation of Match from its controlling stockholder, IAC/InterActiveCorp (“IAC”). IAC had conditioned the transaction from the start upon approval by an independent special committee and a vote of a majority of the minority stockholders. The Match board formed a three-member separation committee and empowered the committee to, among other things, approve or disapprove any proposed separation transaction. The transaction was ultimately approved by both the separation committee and a majority of the minority stockholders.

The plaintiffs, minority stockholders of Match, brought direct and derivative claims alleging, among other things, that the transaction was a controller transaction subject to entire fairness review, and that the business judgment rule did not apply under MFW because the separation committee was not fully independent. Initially, the Court of Chancery dismissed the complaint upon finding that the transaction fully complied with the MFW requirements. Importantly, the Court of Chancery determined that the independent committee prong of the MFW framework was satisfied even though the complaint adequately alleged that one of the three directors on the separation committee lacked independence from IAC, reasoning that the allegedly non-independent director did not dominate or infect the proper functioning of the committee, which was comprised of a majority of independent directors.

For the full text of our memorandum, please see:

For the Delaware Supreme Court’s opinion in In re Match Group, Inc. Derivative Litigation, please see:

- Delaware Court of Chancery Applies Entire Fairness to Controlled Company’s Move to Nevada

In Palkon, et al. v. Maffei, et al. (“Maffei”) (an opinion by Vice Chancellor J. Travis Laster), the Delaware Court of Chancery denied a motion to dismiss claims that the directors and controlling stockholder of TripAdvisor and its parent entity breached their fiduciary duties of loyalty when they decided to convert the two entities—both Delaware corporations—into Nevada corporations. The court held that the conversions are subject to review for entire fairness because the entities’ controlling stockholder is alleged to receive a non-ratable benefit (i.e., reduced litigation exposure) not shared by the common stockholders. Nevertheless, the court explained that, even if the plaintiffs prevailed on the merits, it would not enjoin the conversions because any resulting harms could be compensated by monetary damages based on any decline in the valuation of the company after announcement of the conversion. Although Maffei applies traditional controlling stockholder doctrine to the potential benefit of changing the entity’s state of incorporation, the decision demonstrates that the Court of Chancery is unlikely to award the extreme remedy of enjoining the conversion if there is any potential that monetary damages could compensate the harm.

For the full text of our memorandum, please see:

For the Delaware Court of Chancery’s opinion in Palkon, et al. v. Maffei, et al., please see:

- Delaware Court of Chancery Holds That Director Was Not Permitted to Share Confidential and Privileged Information with Affiliated Stockholder

In Icahn Partners LP v. deSouza (an opinion by Vice Chancellor Paul A. Fioravanti Jr.), the Delaware Court of Chancery held that a director elected to the board after a proxy contest run by a 1.4% stockholder of the corporation was not entitled to share confidential or privileged information about the corporation received in his capacity as a director. In connection with his election to the board, the director signed a questionnaire in which he agreed to comply with the corporation’s code of conduct, including a requirement that directors not share privileged or confidential company information. The director nevertheless gave such information to the stockholder who nominated him, and the stockholder used the information in a lawsuit against the corporation. The corporation then moved to strike the information from the complaint. The court granted the motion, holding that the director breached his duties in sharing the information. The court held that directors may share privileged or confidential information in two scenarios: (i) where the director is designated pursuant to a contract or the stockholder’s voting power and (ii) where the director serves in a controlling or fiduciary capacity with the stockholder. This latter category includes what the court called “one brain” situations (i.e., where the director is the controller of the corporation or a fiduciary to the controller and is of “one mind” in the sense that it cannot be expected that he or she not use the information known in his or her capacity as a director in his or her decision-making as a stockholder or stockholder fiduciary). Here, the stockholder did not have a contractual right (or the voting power) to appoint the director, and the director did not owe a fiduciary duty to the stockholder (he was an employee of the stockholder with no fiduciary duties to it). Therefore, it was a breach of his duty to share the confidential and privileged information with the stockholder and the court granted the motion to strike.

For the full text of our memorandum, please see:

For the Delaware Court of Chancery’s opinion in Icahn Partners LP v. deSouza, please see:

- Federal Jury Finds Defendant Liable in SEC “Shadow Trading” Case

On Friday, April 5, 2024, a jury in the Northern District of California found that the SEC had established that Defendant Matthew Panuwat, a former senior director of business development at biopharmaceutical firm Medivation Inc. (“Medivation”), was liable under a civil misappropriation theory of insider trading for violations of Section 10(b) of the Exchange Act and SEC Rule 10b-5. Panuwat bought $117,000 in call options in the stock of biopharmaceutical firm Incyte Corporation (“Incyte”) seven minutes after receiving an email from Medivation’s CEO that Medivation was “on track to sign [a] deal” for Pfizer Inc. (“Pfizer”) to acquire Medivation. When the merger was announced four days later, Incyte’s stock price increased, and Panuwat began selling shares, realizing over $100,000 in profits. This insider trading theory is known as “shadow trading”—possessing insider information about a company and trading in the shares of a similarly situated competitor.

The trial lasted eight days. The SEC called as witnesses an investment banker who worked on the Medivation-Pfizer deal, who testified as to Panuwat’s involvement in the confidential bidding process, and the SEC’s deputy chief economist, who testified that market observers would have expected a “spillover effect” on Incyte’s stock after the Medivation-Pfizer deal was announced. This “spillover effect” was to be expected, she testified, because analyst reporting had linked Medivation and Incyte before the deal was announced and noted they were similarly situated and because, when a company makes a big announcement that causes an increase in its stock price, it is typical to see a similar bump in stock price across the industry. In pursuing the lawsuit, the SEC has relied on, among other things, Medivation’s insider trading policy, which prohibited trading in a non-exhaustive list of other public companies’ securities, to help establish that Panuwat had breached a duty of trust and confidence he owed to Medivation.

Panuwat called his former Medivation colleague, who testified that Medivation and Incyte were not competitors and that he did not see a correlation between their stocks, before Panuwat took the stand to explain that he had been monitoring Incyte stock for over a month before buying call options, after reading an analyst report recommending purchasing Incyte call options. Panuwat’s lawyers argued that he could not have had an intent to defraud because he did not think that trading in Incyte stock could be considered insider trading. On cross-examination, the SEC probed why Panuwat now had a detailed explanation for his purchase, but had not provided this explanation in his earlier deposition testimony, and repeatedly questioned Panuwat whether his purchase of Incyte call options moments after receiving an email about the Medivation-Pfizer deal was “just a coincidence.”

On September 9, 2024, the court imposed a civil fine of three times Panuwat’s trading gain but declined to bar Panuwat from serving as an officer or director of any public company. Panuwat has yet to appeal the judgment to the Ninth Circuit, which may consider whether “shadow trading” is able to support a Section 10(b) and Rule 10b-5 claim as a matter of law and if there was sufficient evidence to support the jury verdict.

The SEC released a statement from Division of Enforcement Director Gurbir Grewal that the case was “nothing novel” and was instead “insider trading, pure and simple.” But as we have previously observed, this case marks what appears to be the first time the SEC has brought a lawsuit alleging that information about one company could be considered material to investors in another company because of the companies’ substantial similarities or connections. The verdict is thus likely to embolden the SEC’s enforcement of suspected “shadow trading” where it believes there is sufficient evidence of correlation between the stock performance of two companies and that information material to one company would be considered material to investors in the other. The SEC’s action also underscores the importance of the specific terms of a company’s insider trading policy to the question of whether an employee has breached a relevant duty by engaging in shadow trading. Companies may wish to review the scope of their insider trading policy and ensure that those subject to the policy are aware of its scope.

For the full text of our memorandum, please see:

* * *