Our lawyers provide innovative and practical counsel on a wide variety of capital raising and securities law compliance matters. We represent clients ranging from emerging private companies to established public companies. With each, we build long-term relationships, generating efficiencies and helping them realize their business goals.

SEC Adopts New Climate Disclosure Requirements

People

March 8, 2024 Download PDF

On March 6, the SEC adopted significant new climate-related disclosure requirements, marking the first U.S. federal regime of its kind. The finalization of these rules comes almost two years after the SEC proposed them, and after an intense comment process.

In a notable, though not unexpected, departure from the proposal, the final rules eliminate the controversial requirement to disclose Scope 3[1] greenhouse gas (“GHG”) emissions. The SEC also limited the requirement to disclose Scope 1 and Scope 2 GHG emissions: only large accelerated filers and accelerated filers will be required to disclose them (and eventually provide attestation reports), and only if they are material (to the filer). The SEC also modified its proposal to disclose certain climate-related financial statement metrics and related disclosures in a note to audited financial statements; the new rules will instead require disclosure in notes to the financial statements of the costs, expenses and losses associated with severe weather events and carbon offsets and renewable energy credits or certificates (if a material component of any climate target or goal).

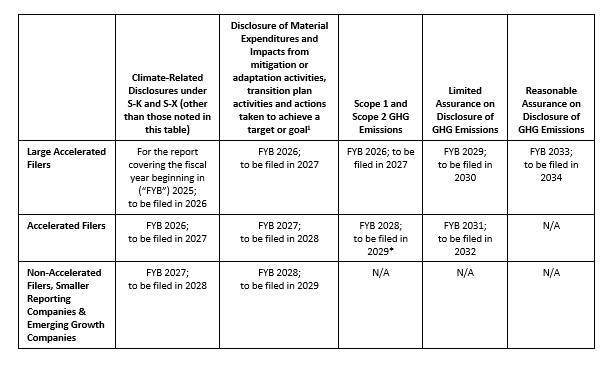

These new requirements will apply to domestic registrants as well as foreign private issuers filing on Form 20-F. However, these requirements will not apply to MJDS issuers filing on Form 40-F. The final rules have a multi-year phase-in for the disclosure requirements, based on company filing status, as noted below.

As proposed, these new requirements are modeled in part on the Task Force on Climate-Related Financial Disclosures and the Greenhouse Gas Protocol emissions reporting frameworks. The new disclosure requirements will be set forth in a new Item 1500 of Regulation S-K and Article 14 of Regulation S-X. Registrants will be required to present in their annual reports (or registration statements) and in the accompanying financial statements, detailed information regarding, among others, the following:

- material climate-related risks, their actual and potential material impacts on strategy, business model and outlook, and any mitigation or adaptation activities;

- material climate-related targets or goals and any transition plans;

- costs, expenses, charges and losses associated with severe weather events (subject to a 1% and de minimis disclosure thresholds), and relating to carbon offsets and renewable energy credits of certificates if material to targets or goals;

- company board and management oversight and governance of climate-related risks; and

- for large accelerated filers and accelerated filers, Scope 1 and Scope 2 GHG emissions data, if material, and eventually third party attestations providing assurance on the GHG emissions data.

These disclosure requirements will be phased in, depending on the registrant’s filing status:

* The Scope 1 and Scope 2 emissions may be filed in the quarterly report on Form 10-Q for the second fiscal quarter in the fiscal year following the year for which reporting is required.

Large multinational companies with significant operations and sales in the European Union and companies with significant operations in or sales to California may have separate obligations to report Scope 3 emissions and other climate change-related information to other jurisdictions; these new SEC requirements will not affect those reporting obligations.

The new rules have already been challenged in litigation and additional challenges are expected.

A more detailed summary and analysis of these disclosure requirements will follow.

* * *

[1] Scope 1 emissions are direct GHG emissions from operations that are owned or controlled by a registrant. Scope 2 emissions are indirect GHG emissions from the generation of purchased or acquired electricity, steam, heat, or cooling that is consumed by operations owned or controlled by a registrant. Scope 3 emissions are all indirect GHG emissions not otherwise included in a registrant’s Scope 2 emissions, which occur in the upstream and downstream activities of a registrant’s value chain.

[2] From new Items 1502(d)(2), 1502(e)(2) and 1504(c)(2) of Regulation S-K.