The Paul, Weiss Antitrust Practice advises clients on a full range of global antitrust matters, including antitrust regulatory clearance, government investigations, private litigation, and counseling and compliance. The firm represents clients before antitrust and competition authorities in the United States, the European Union, the United Kingdom and other jurisdictions around the world.

Record HSR Gun-Jumping Fine Focuses Attention on Interim Operating Covenants

People

- Bial, Joseph J

- Haigh, Katharine R.

- Kelly, Marta P.

- Sher, Scott A.

- Sobel, Yuni Yan

- Soven, Joshua H.

- St. Matthew-Daniel, Eyitayo “Tee”

- Synnott, Aidan

- Tannenbaum, Brette

- Wilson, Christopher M.

- Crandall IV, Charles E.

- Danzig, Lisa

- de Souza, Chad

- Hahn, Todd

- Knypinski, Zuzanna

- Magruder, John W.

- Laramie, Mark R.

January 15, 2025 Download PDF

- In a recent HSR enforcement action, the DOJ obtained a record $5.6 million civil penalty from companies accused of violating pre-merger “gun-jumping” prohibitions.

- The government alleged that certain interim operating covenants in the purchase agreement and certain instances of pre-merger coordination between the buyer and target allowed the buyer to obtain beneficial ownership of the target company’s business before the expiration waiting period required by the HSR Act.

- This action highlights the importance of careful drafting of interim operating covenants and of implementing and following an effective antitrust compliance process throughout a transaction’s lifecycle.

Overview of HSR Notification and Waiting Period Requirements

Under the Hart-Scott-Rodino (HSR) Act, parties must report to the Federal Trade Commission (FTC) and Antitrust Division of the Department of Justice (DOJ) proposed acquisitions of assets, voting securities or certain noncorporate interests if certain transaction and party size thresholds are met and an exemption does not apply.

Notifiable transactions are subject to a statutory waiting period, typically 30 days, which gives the antitrust agencies time to undertake a preliminary assessment the potential competitive effects of proposed transactions. The parties cannot close and the buyer cannot direct the business operations or otherwise exercise beneficial ownership of the target until the waiting period expires or is terminated. Violations of the notification and waiting period requirements of the HSR Act are subject to annually adjusted civil penalties for each day of noncompliance. The maximum daily penalty is currently $51,744.

The U.S. antitrust agencies have long had the view that when a buyer gains operational control of the target’s ordinary course business decisions before expiration of the HSR waiting period, it is gun jumping in violation of the HSR Act. Depending on the circumstances, inappropriate buyer-target pre-merger coordination could also give rise to liability under section 1 of the Sherman Act, which prohibits conspiracies in restraint of trade.

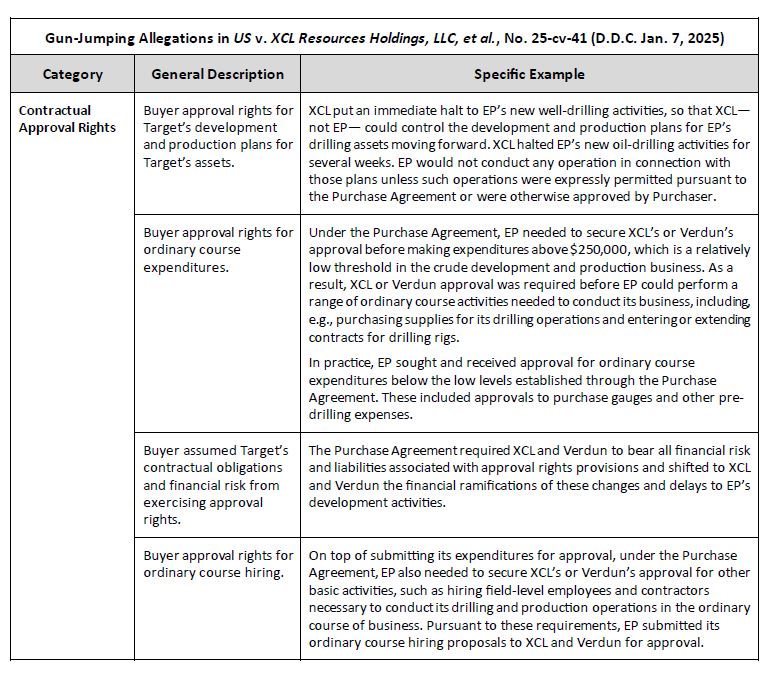

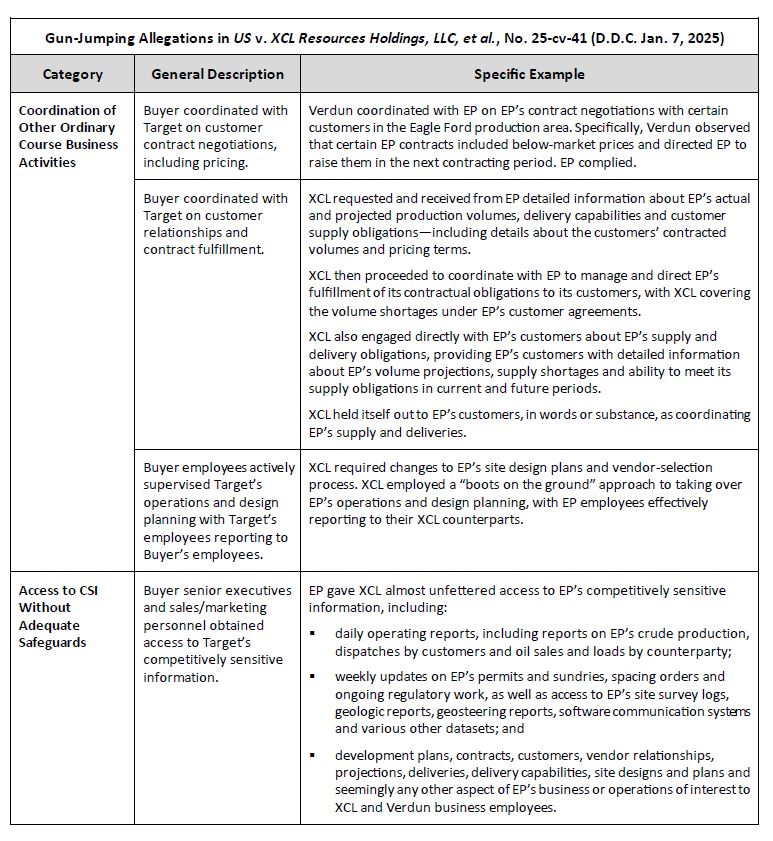

Allegations of Gun Jumping Against Defendants

Last week, the DOJ filed a complaint against the buyers (Verdun Oil and its sister company XCL Resources) and target company EP Energy (an alleged XCL competitor) in a now-consummated upstream oil transaction. The complaint alleges that from the moment the parties signed the purchase agreement until it was amended 94 days after signing, the buyers obtained beneficial ownership of EP Energy by acquiring control of certain of its ordinary course business decisions, assuming or rejecting its contractual obligations, obtaining its competitively sensitive information and partaking in its financial gains and losses—all in violation of the HSR Act’s gun-jumping prohibition.

Notably, according to the complaint, certain buyer consent terms in the purchase agreement inappropriately gave the buyers control over the target’s ordinary course business decisions. The purchase agreement contained a provision in the interim operating covenants requiring EP Energy to obtain consent for any expenditures over $250,000. However, according to the complaint, a number of expenditures associated with EP Energy’s ordinary course business decisions—such as purchases of supplies and entering into drilling rig contracts—required outlays of more than $250,000. Therefore, according to the DOJ, the $250,000 threshold gave the buyers the right to control ordinary course business decisions, and they allegedly did so.

In addition to consent rights over certain expenditures, the complaint alleges that the buyers also inappropriately acted to stop EP Energy’s well-drilling activities, control EP Energy’s drilling assets during the interim period, actively manage EP Energy employees and approve routine activities such as hiring field-level employees and contractors. The parties also allegedly coordinated regarding EP Energy’s contract negotiations with customers and upcoming pricing decisions, and shared competitively sensitive information about EP Energy’s business without using appropriate “clean team” safeguards.

The table below lists the gun-jumping conduct alleged in the DOJ’s complaint.

Significance

This action highlights the importance of careful drafting of interim operating covenants to avoid granting rights to the buyer the exercise of which would constitute gun jumping. It also serves as a reminder that parties should implement and follow an effective antitrust compliance process throughout a transaction’s lifecycle to avoid potential violations of the HSR Act and other antitrust laws governing coordination between independent business entities. Indeed, the complaint serves as a useful antitrust compliance document insofar as it sets out examples of conduct the antitrust agencies see as violating the HSR Act.

This enforcement action demonstrates that parties to a purchase agreement may be subject to substantial civil penalties for gun jumping under the HSR Act, including when post-signing, pre-HSR clearance conduct includes:

- Buyer obtaining or exercising control or consent rights over ordinary course business decisions;

- Buyer assuming target’s contractual obligations and/or the associated financial upside/risk; or

- Buyer obtaining target’s competitively sensitive information without using appropriate “clean team” safeguards.

Special attention should be paid to proposed interim operating covenants that may go beyond preserving the target’s business and value of the transaction and permit the buyer to influence target’s ordinary course business decisions. When negotiating consent rights in interim operating covenants, parties should carefully consider the target’s operations and industry and establish a threshold that is high enough to capture all ordinary course expenditures. Otherwise, they risk running afoul of the HSR Act. Terms that may be appropriate for one industry, may not be inappropriate for another.

|

|

* * *