We advise our domestic and international clients on a broad spectrum of legal needs, including: estate and tax planning; business succession issues; litigated Surrogate's Court cases; trust and estate administration; lifetime transfers of wealth; and private foundations. We handle many of our clients' tax issues, including controversies with the Internal Revenue Service and other taxing authorities.

The Corporate Transparency Act from an Estate-Planning Perspective (October 2024 Update)

October 8, 2024 Download PDF

On November 27, 2023, we published a client memorandum (our Initial CTA Memo) addressing some of the key aspects of the Corporate Transparency Act (or CTA) as they relate to individuals with entities in their estate planning and wealth management structures. The CTA establishes uniform beneficial ownership information reporting requirements for certain types of entities created in or registered to do business in the United States effective as of January 1, 2024 (or Reporting Companies). Under the CTA, Reporting Companies are required to identify (i) the beneficial owners of the Reporting Companies and (ii) (for entities created on or after January 1, 2024) individuals who have filed applications to create the Reporting Company or registered it to do business to the Financial Crimes Enforcement Network (or FinCEN).

We summarize below key reporting deadlines and developments relating to the CTA that have taken place since our Initial CTA Memo was published.

What are Reporting Companies under the CTA?

A Reporting Company is any domestic or foreign entity that is a corporation, limited liability company or “similar entity” that is created by the filing of a document with a secretary of state or similar office. Depending on the laws of the state of formation, limited partnerships, limited liability partnerships, business or statutory trusts, and even general partnerships (if required to file with the Secretary of State or equivalent office) are likely to be considered Reporting Companies for purposes of the CTA. Foreign companies that register to do business in the United States generally are included in the definition of a Reporting Company.

Who is a beneficial owner of a Reporting Company?

A beneficial owner of a Reporting Company includes any individual who directly or indirectly (i) exercises substantial control over the Reporting Company or (ii) owns or controls at least 25% of the ownership interests in the Reporting Company.

Exercising substantial control is defined as a non-exhaustive list of illustrative powers, including serving as a senior officer of the company and having substantial influence over important decisions such as compensation schemes, business lines and major transactions such as mergers.

Ownership interest is defined broadly and includes direct and indirect interests.

When does information need to be reported to FinCEN?

FinCEN began accepting applications on January 1, 2024.

Entities in existence prior to January 1, 2024, must report to FinCEN no later than January 1, 2025. Entities formed in 2024 must file within 90 days after receiving notice of their creation or registration. Entities formed on or after January 1, 2025, must file within 30 days after receiving notice of their creation or registration.

Companies have 30 days to report changes or corrections to previously submitted information. Similarly, whenever there is a change to the beneficial ownership of the Reporting Company, a report with the updated entity information must be submitted to FinCEN within 30 days. Although the time to file for entities formed during calendar year 2024 is 90 days, any subsequent corrections and changes must be filed within 30 days.

What information must a Reporting Company, Beneficial Owners and Company Applicants file with FinCEN?

Reporting Companies must submit information including:

- the name of the entity (including any trade name or doing business as name);

- if the company’s principal place of business is located in the United States, the address of the company’s principal place of business, or, if the company’s principal place of business is not located in the United States, the address from which the company conducts business in the United States;

- the jurisdiction of formation;

- the company’s unique identification number; and

- reports on the beneficial owners and (for companies created on or after January 1, 2024) company applicants.

As described below, the Reporting Company will need to report similar information on each beneficial owner and company applicant.

Individual beneficial owners and company applicants will be required to report the following information:

- full legal name;

- date of birth;

- except as noted below, the individual’s current residential street address;

- unique identifying number from a valid identification document, such as a passport or driver’s license, and its issuing jurisdiction; and

- an image of the document with the unique identifying number.

With respect to company applicants, if the company applicant is an individual who engages in the business of corporate formation, he or she must report the current street address of the company applicant’s business, rather than his or her residential street address.

FinCEN has created a process to obtain a unique FinCEN identifying number for an individual or a Reporting Company which can be used in lieu of filing the above information each time an entity is formed. To obtain a FinCEN ID, the individual is required to submit an application containing the information listed above. It is often advisable for individual beneficial owners to obtain a FinCEN ID from FinCEN at https://fincenid.fincen.gov.

Where are beneficial ownership reports filed?

FinCEN reports are filed directly at https://boiefiling.fincen.gov/.

There are a number of third-party vendors who assist with filing reports. However, be aware that FinCEN has published an alert on its website with a warning that there have been fraudulent attempts to solicit information and entities who may be subject to reporting requirements under the Corporate Transparency Act and therefore, caution should be exercised before engaging any third-party vendor to assist with CTA filings.

Where can I find additional information on CTA reporting obligations?

For additional resources regarding CTA filing obligations, refer to:

- the Initial CTA Memo; and

- the FinCEN FAQ Website.

What developments have occurred since the Initial CTA Memo?

Reporting Companies owned or controlled by a trust with a corporate trustee

FinCEN has issued guidance to clarify how beneficial owners are reported if a Reporting Company is owned or controlled by a corporate trustee.

If a Reporting Company’s ownership interests are owned or controlled by a trust with a corporate trustee, the Reporting Company should determine whether any of the corporate trustee’s individual beneficial owners indirectly own or control at least 25 percent of the ownership interests of the Reporting Company through their ownership interests in the corporate trustee.

Privacy of information reported to FinCEN

FinCEN has published rules that will govern access to and protection of beneficial ownership data. Beneficial ownership information will be stored in a secure, non-public database using rigorous information security methods and controls.

Challenges to the CTA

Although there have been challenges to the CTA, as of the date of this publication, the current filing requirements as outlined above are still in place.

On March 1, 2024, in the case of National Small Business United v. Yellen, No. 5:22-cv-01448 (N.D. Ala.), a federal district court in Alabama concluded that the Corporate Transparency Act exceeded the Constitution’s limits on Congress’s power and enjoined the Department of the Treasury and FinCEN from enforcing the Corporate Transparency Act against the plaintiffs. This ruling only applies to the plaintiffs in that case. FinCEN will continue to implement the Corporate Transparency Act and has appealed the judgment.

The U.S. Court of Appeals for the Eleventh Circuit, in the case of Nat’l Small Bus. United v. Dep’t of Treasury, 11th Cir., No. 24-10736, is set to hear arguments about the CTA.

On September 20, 2024, in the case of Firestone v. Yellen, D. Or., No. 3:24-cv-01034 (D. Or. Jun 26, 2024), a federal district court in Oregon denied the plaintiff’s motion for preliminary injunctive relief in their case challenging the constitutionality of the CTA. The judge ruled that the plaintiffs were not likely to succeed on the merits of their lawsuit that the CTA violated privacy rights and exceeded Congress’s power to regulate interstate commerce.

Another case, Small Business Association of Michigan et al. v. Yellen et al., No. 1:24-cv-00314 (W.D. Mich. Mar 26, 2024), is currently pending in a federal district court in Michigan. Plaintiffs are also challenging the constitutionality of the CTA. There has not yet been a final ruling on this case.

What are the penalties if a Reporting Company does not comply with the CTA?

Willful violations of the CTA’s reporting requirements may be subject to civil and criminal penalties. That is, (i) willful failure to file a complete or updated report with FinCEN or (ii) willfully providing (or attempting to provide) a report containing false or fraudulent information is subject to a civil penalty of a fine of up to $500 per day, adjusted annually for inflation ($591 as of January 25, 2024) and criminal penalties of imprisonment for up to two years and a fine of up to $10,000.

New York LLC Transparency Act

A New York law going into effect on January 1, 2026 imposes separate beneficial ownership disclosure requirements for certain LLCs, in addition to the requirements under federal law. Every LLC formed or authorized to do business in New York state that meets the definition of a Reporting Company under the CTA must file a beneficial ownership disclosure with the New York Department of State.

There are several distinctions between the New York law and the CTA. Of particular note, the New York law is applicable only to LLCs, but LLCs that would be exempt from reporting under the CTA must still file an attestation of exemption with the Department of State. Further, all LLCs that are required to file an initial beneficial ownership report also must file an annual statement confirming or updating their information, rather than filing an updated report within 30 days of any change (as required under the CTA).

Beginning after January 1, 2026, New York beneficial ownership disclosures and attestation schedules will have to be filed by newly formed and authorized LLCs within 30 days of initial filing or application for authority. All LLCs formed or authorized on or prior to the January 1, 2026 effective date will have to file within one year of the effective date of the legislation.

What should I do to prepare for the CTA?

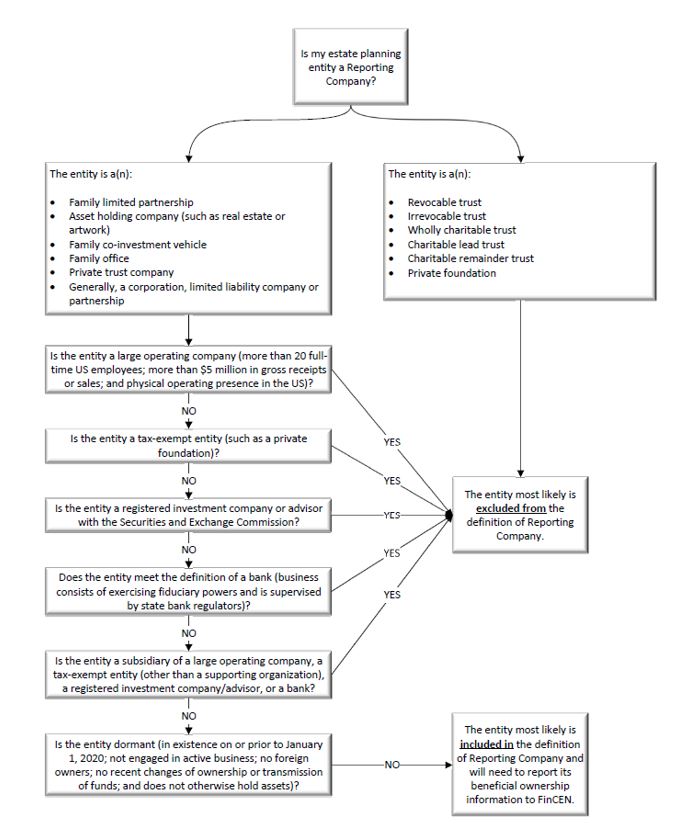

The first step for many individuals is to identify whether there are Reporting Companies in their estate-planning structures. The following chart provides a quick reference guide as to whether an entity likely will need to report its beneficial ownership information to FinCEN.

|

Paul, Weiss is carefully monitoring developments relating to the CTA.

Although the reporting requirements are still evolving, Reporting Companies with the obligation to file by January 1, 2025 are urged to file their reports at this time.

* * *