The Paul, Weiss Antitrust Practice advises clients on a full range of global antitrust matters, including antitrust regulatory clearance, government investigations, private litigation, and counseling and compliance. The firm represents clients before antitrust and competition authorities in the United States, the European Union, the United Kingdom and other jurisdictions around the world.

The UK Expands and Enhances Its Consumer Law Regime

August 5, 2024 Download PDF

On 31 July, the UK Competition and Markets Authority (CMA) launched a consultation on how it will implement its new consumer law powers. This is one of the final steps in a major shift in UK consumer law. This shift will:

- Grant the CMA powers of direct enforcement, making it easier and quicker for the CMA to enforce consumer law.

- Expand the tools available to the CMA (and courts) to address consumer law issues, including significant fines.

- Further expand the list of codified breaches in UK consumer law.

These new powers come from the Digital Markets, Competition and Consumers Act 2024, which is expected to come into force in Autumn 2024.

The shift to a new model of UK consumer enforcement – what has changed?

Under the old model of enforcement, whilst the CMA (and some other public bodies) could investigate breaches of consumer law, the power to determine breach, prohibit the conduct and impose remedies lay with UK courts. This was often a slow and unpredictable process, so the CMA’s preferred route was to agree to voluntary undertakings with parties – although with limited bargaining power, given the ultimate need to go to court. Even then, the ability to actually enforce those undertakings required court action – and neither the courts nor the CMA could impose fines without criminal proceedings. As a result, consumer enforcement cases have to date been rare (at least in comparison with antitrust enforcement).

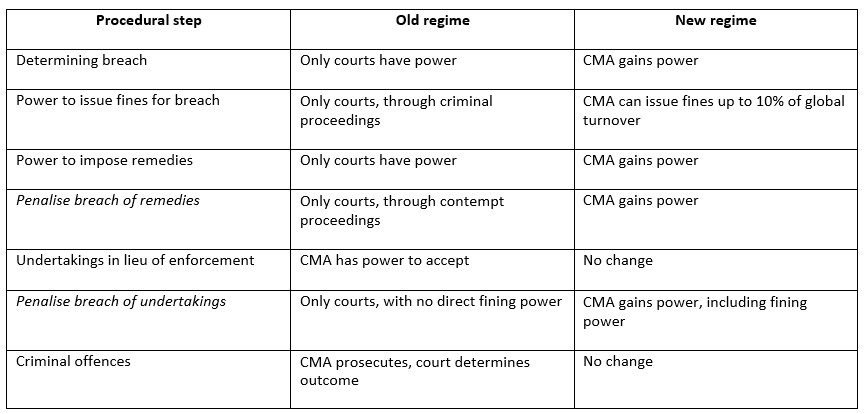

As we summarise in the table of key changes below, the CMA now gains broad powers to decide whether consumer law has been broken, issue large fines in more cases, and impose remedies and penalise breaches of remedies and undertakings.

The changes also codify what amounts to a consumer law breach in areas such as commissioned online product reviews, ‘drip pricing’ of unavoidable fees, subscription contracts and savings schemes.

How will the CMA use its new powers?

The CMA’s latest consultation sets out how it plans to implement the revised consumer law regime in practice, with draft guidance on procedure and substance. Three notable areas include:

- Draft guidance on when the CMA will accept undertakings in lieu of formal enforcement. The draft guidance suggests a stricter approach to when undertakings will be accepted. The CMA will not accept undertakings if compliance or effectiveness would be difficult to monitor, and will not accept undertakings if this would undermine deterrence.

- Draft guidance on when the CMA will use its new fining powers. The draft guidance sets out that the CMA’s objectives in imposing fines for breaches of consumer law will be to deter infringements, to reflect the seriousness and to encourage co-operation with the CMA. In particular, the CMA may impose large fines even if UK turnover is low, if “meaningful deterrence” requires it. Given the limit on fining is 10% of global turnover, this creates serious potential liability for large multinational firms operating in the UK.

- Draft guidance implying procedure closer to merger control. Now that the CMA will have powers to impose remedies and fines outside of court action, it has reformed its procedure in a way that more closely resembles the two-phase system of merger control. Whilst the decision to accept undertakings will be made by the responsible CMA officer, an ad-hoc and more independent decision group will then be convened before deciding on the imposition of fines, remedies and related matters.

What is the impact on future enforcement?

The CMA has long sought to improve the strength of its consumer law powers and voiced frustration at the limits of its current powers in recent cases. We expect that the CMA will take up new consumer law investigations given it has finally achieved this aim – as stated in the CMA’s latest Annual Plan “the introduction of a new administrative enforcement model will transform the impact of the consumer enforcement action we take – empowering us to decide when consumer law has been broken, rather than having to take each case to court, and giving us the ability to directly impose significant financial penalties.” Two existing consumer law defence strategies – to settle through undertakings or to wait and test the CMA’s resolve in court – will no longer be available in the same way. The CMA no longer needs court action to impose the remedies or fines it desires, and that a more direct route to its aims will also grant it greater leverage when negotiating undertakings.

* * *