The Paul, Weiss Antitrust Practice advises clients on a full range of global antitrust matters, including antitrust regulatory clearance, government investigations, private litigation, and counseling and compliance. The firm represents clients before antitrust and competition authorities in the United States, the European Union, the United Kingdom and other jurisdictions around the world.

Breaking Down the DOJ’s Complaint to Break Up Live Nation-Ticketmaster

People

- Bial, Joseph J

- Brachman, Paul D.

- Cohen, Jay

- Dearborn, Meredith R.

- Goodman, Martha L.

- Michael, William B.

- Phillips, Jessica E.

- Rubin, Jacqueline P.

- Sher, Scott A.

- Soven, Joshua H.

- St. Matthew-Daniel, Eyitayo “Tee”

- Synnott, Aidan

- Tannenbaum, Brette

- Wilson, Christopher M.

- Crandall IV, Charles E.

- Knypinski, Zuzanna

- Sobel, Yuni Yan

- Rucker, Thomas "Tommy"

June 5, 2024 Download PDF

- The DOJ and attorneys general of 29 states and the District of Columbia have filed a complaint alleging that Live Nation has illegally monopolized and restrained trade in various markets across the live entertainment industry.

- The complaint seeks, among other things, an order requiring Live Nation to divest its Ticketmaster subsidiary, which it acquired in 2010.

- This complaint is part of what may be a trend of the DOJ requesting jury trials in civil antitrust cases when available.

- After many years of little to no monopolization enforcement activity, the federal government now has seven pending civil monopolization actions.

On May 23, 2024, the U.S. Department of Justice (DOJ), together with the attorneys general of 29 states and the District of Columbia, sued Live Nation Entertainment Inc. (Live Nation) and its wholly owned subsidiary Ticketmaster LLC (Ticketmaster), alleging unlawful monopolization, exclusive dealing and tying in violation of the Sherman Antitrust Act. According to the complaint, the company has “systematically and intentionally . . . corrupted” the competitive process, resulting in a host of harms to fans, artists and venues. These harms include fans paying more in fees that are not transparent, fans being denied access to more choices in concerts, artists having fewer opportunities to play concerts and fewer choices for concert promoters, and venues having fewer real choices for obtaining concerts and ticketing services.

Allegations Against Live Nation-Ticketmaster

The complaint alleges that Live Nation-Ticketmaster “serves as the gatekeeper for the delivery of nearly all live music in America today,” using its “power and influence to insert [itself] at the center and the edges of virtually every aspect of the live music ecosystem.” As a result, the complaint alleges that Live Nation-Ticketmaster controls around 60% of concert promotions at major U.S. concert venues and 80% or more of major concert venues’ primary ticketing. According to the complaint, the company “possesses and routinely exercises control over which artists perform on what dates at which venues” and over “how fans are able to purchase tickets to see their favorite artists in concert and what fees those fans will pay to do so.” The company allegedly gained this power through an array of anticompetitive exclusionary conduct and “conflicts of interest” arising from its status “as a promoter, ticketer, venue owner, and artist manager.”

Drawing heavily from internal Live Nation-Ticketmaster documents, the complaint alleges that the company reinforces its “multidimensional power” through what is referred to internally as its “flywheel,” with Live Nation’s concert promotion business at its core. According to the complaint, Live Nation uses its concert promotion business to “feed its other high margin businesses” – chiefly Ticketmaster’s ticketing business and Live Nation’s network of venues and sponsorship and advertising businesses. The complaint alleges that Live Nation-Ticketmaster’s flywheel “captures fees and revenue from concert fans and sponsorship, uses that revenue to lock up artists to exclusive promotion deals, and then uses its powerful cache of live content to sign venues into long-term exclusive ticketing deals, thereby starting the cycle all over again.” In turn, this creates a competitive “moat” around the company, and a potential competitor would allegedly face the daunting task of accomplishing “multi-level entry” into the various markets in order to compete effectively.

Collectively, these anticompetitive actions, according to the complaint, are effectively enhancing Live Nation-Ticketmaster’s flywheel and, in turn, “suffocat[ing] competition” and “inhibit[ing] the evolution of the live music industry that competition would and should usher in.”

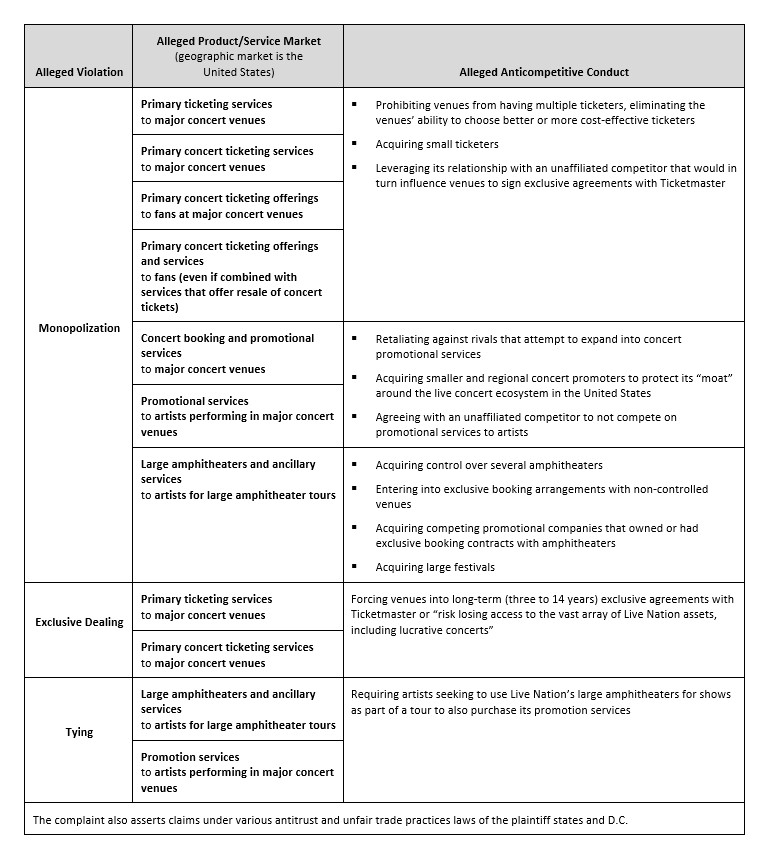

The chart at the end of this memorandum outlines the various forms of anticompetitive conduct alleged in the complaint. Notably, in partial support of two of the monopolization claims, the complaint alleges an anticompetitive relationship between Live Nation and an unaffiliated competitor active in the live entertainment space including in developing concert venues and providing artist management services. The complaint alleges that this entity’s access to significant capital via a $100 million investment from a private equity firm could have made it a real and formidable competitor to Live Nation, but Live Nation, recognizing this competitive threat, “colluded and established a partnership to allocate business lines, avoid[ed] competing with each other, and chart[ed] a mutually beneficial plan to cement Live Nation’s dominance.” The complaint further alleges that this unaffiliated entity described itself as the “pimp” and “hammer” for Live Nation, often influencing venues and artists for the benefit of Live Nation.

Remedies Sought by Government Plaintiffs[1]

To address the alleged anticompetitive harms, the DOJ and the states and the District of Columbia are seeking an order requiring Live Nation to divest Ticketmaster; terminate its ticketing agreement with an unaffiliated competitor; and enjoin Live Nation from engaging in the myriad anticompetitive practices alleged in the complaint, including enjoining Live Nation from entering into long-term exclusive contractual arrangements with major concert venues. In addition, several of the states are seeking damages for violations of state law and, as such, the complaint has a demand for a jury trial.

Key Takeaways from the Complaint

The lawsuit is consistent with several themes of antitrust enforcement in the current administration, including: increased attention to monopolization offenses, aversion to purely behavioral remedies, concern about economic power arising from the control of data, concern about serial acquisitions and concern about the role of private equity. The complaint also highlights the tremendous weight enforcers continue to place on internal documents with several quotes pulled from informal email and text communications used to support the allegations against Live Nation.

- The lawsuit is the latest in a series of monopolization cases brought by the DOJ and the Federal Trade Commission starting in the prior administration. Indeed, as AAG Kanter said in a recent interview, the government currently has “more active monopolization cases right now, both civil and criminal, than total over the last 20-plus years.”

- This complaint is part of what may be a trend of the DOJ requesting jury trials in civil antitrust cases when available. Here, various state law claims are the basis for the jury demand. In another recent case, the DOJ has demanded a jury trial because it is seeking damages for alleged overcharges paid by government agencies.

- The request for divestiture comes after the failure, according to the DOJ, of behavioral remedies for competitive concerns related to Live Nation’s acquisition of Ticketmaster. In 2010, the DOJ resolved concerns it then had that Live Nation’s acquisition of Ticketmaster would violate Section 7 of the Clayton Act with a consent decree that included a provision prohibiting the company from retaliating against venue owners for not using the company’s ticketing services. That consent decree was amended and extended in 2020 after the DOJ determined that “Live Nation repeatedly and over the course of several years engaged in conduct that . . . violated the” decree. In the new complaint, the DOJ alleges that the consent decree has “failed to restrain Live Nation and Ticketmaster from violating . . . antitrust laws in increasingly serious ways.”

- The complaint cites internal Live Nation documents to demonstrate how Live Nation-Ticketmaster’s “data supremacy over rivals” has contributed to its ability to unlawfully exercise its monopoly power and further entrench the company’s market position and ability to exclude rivals. For example, the Live Nation CEO is quoted in the complaint as having said “[n]o one has 80 million customers segmented in a database as rich as ours.”

- The complaint alleges competitive harm from Live Nation’s alleged serial acquisition strategy “to consolidate power in concert promotions.” Similarly, the complaint describes Ticketmaster initially rising “to power in part through a series of acquisitions that consolidated the company’s dominant position in primary ticketing.” For example, the complaint cites Live Nation’s own words that the company was “founded on acquisition” and since its inception “began rolling up the regional world of promoters and venues and has not stopped since.”

- The complaint alleges that Live Nation was able to neutralize a potential competitive threat in part because a private equity firm caused its portfolio company (a potential competitor for “artist promotion contracts in the United States”) to not compete with Live Nation. For example, the complaint includes a quote from the Live Nation CEO that he “fail[ed] to understand” why the private equity firm “continue[d] to invest in a business that competes” with Live Nation.

Claims for Relief

|

* * *

[1] Within a week of the complaint, the first consumer class action lawsuit was filed against Live Nation-Ticketmaster seeking damages on behalf of potentially millions of ticket buyers in the U.S.