Anti-Corruption & Foreign Corrupt Practices Act

Anti-Corruption & Foreign Corrupt Practices Act

Our team has unsurpassed experience in counseling and defending U.S. and foreign companies and individuals in matters relating to the U.S. Foreign Corrupt Practices Act and similar anti-corruption laws. We are frequently contacted when a potential corruption issue arises, and are go-to counsel for investigations and enforcement proceedings before the U.S. Department of Justice (DOJ), the Securities & Exchange Commission (SEC) and the Multilateral Development Banks, including the World Bank. In addition, we advise clients considering transactions in high-risk markets or with business partners with high anti-corruption risks. We also counsel clients who are designing compliance programs and in conducting risk assessments.

2024 Year in Review: FCPA Enforcement and Anti-Corruption Developments

- Anti-Corruption & FCPA

- Economic Sanctions & AML

- Financial Services Litigation & Investigations

- Internal Investigations

- Investigations

- Mergers & Acquisitions Litigation

- National Security & CFIUS

- Securities Litigation

- White Collar & Regulatory Defense

People

- Boehning, H. Christopher

- Brown, Walter

- Carlin, John P.

- Dagnew, Lina

- Finzi, Roberto

- Fischman, Harris

- Gonzalez, Roberto J.

- Haag, Melinda

- Hill Jr., Joshua

- Hirshman, Michele

- Karp, Brad S.

- Kessler, David K.

- Lynch, Loretta E.

- Mendelsohn, Mark F.

- Reisner, Lorin L.

- Tarlowe, Richard C.

- Wells Jr., Theodore V.

- Ioffredo, Donna

- Klein, Benjamin

- Kleiner, Samuel

- Lerer, Justin

- McGregor, Michael

- Calderone, Sarah

- Chitrao, Neil

- Disler, Matthew J.

- Fry, Samantha C.

- Klein, Robert

- Madden, Kevin P.

- Ramirez, Liliana

- Zamora, Miguel

January 29, 2025 Download PDF

Contents

Corporate Enforcement Overview

Review of Select Corporate Resolutions

Enforcement Actions Against Individuals

Policy Pronouncements Affecting Anti-Corruption Enforcement

DOJ Corporate Whistleblower Awards Pilot Program

Amendment to DOJ’s Corporate Enforcement and Voluntary Self-Disclosure Policy

Revisions to DOJ’s Evaluation of Corporate Compliance Programs

Amendments to FEPA and a Silent Year for FEPA Enforcement

Legal Developments Affecting Enforcement Tools

Snyder v. United States, 603 U.S. 1 (2024)

Foreign Jurisdictions Investigating, Prosecuting and Regulating Corruption

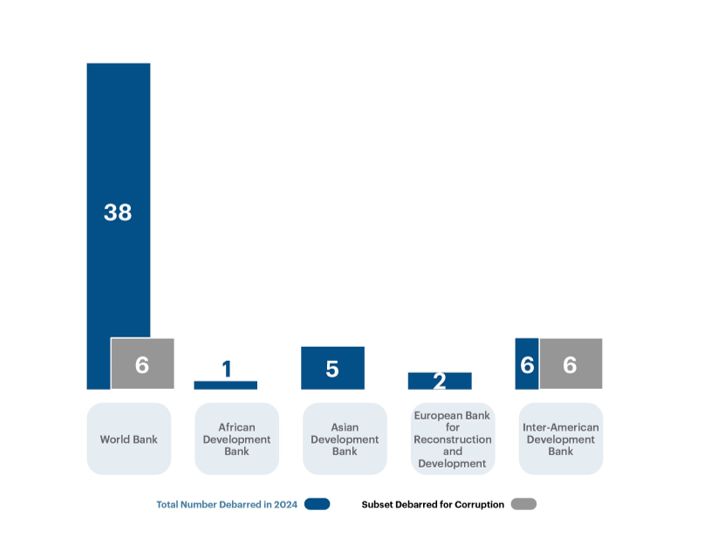

Multilateral Development Bank Sanctions

Executive Summary

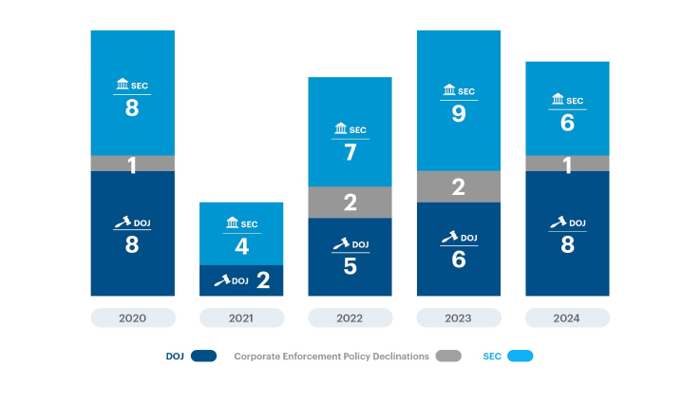

In 2024, FCPA enforcement continued apace with the DOJ reaching nine corporate criminal resolutions (including one declination with disgorgement)—the most since 2020—the SEC reaching six resolutions, and the DOJ criminally charging 19 individuals. While the number of overall enforcement actions remained roughly on par with 2023, there was a more-than-double increase in the amount of fines levied, though still about one-third of fines issued in 2020.

The DOJ also announced several important policy initiatives, building on its focus on corporate compliance and incentivizing whistleblowers to come forward. Most notably, the DOJ’s Corporate Whistleblower Awards Pilot Program offers whistleblowers a share of forfeiture obtained in certain cases where an individual reports original information about particular corporate offenses, including FCPA violations. While awards under the pilot program are discretionary and subject to a host of limitations, DOJ officials have touted the incentive in several speeches this year, and tips are already being reported in the hundreds. The DOJ also revised its Evaluation of Corporate Compliance Programs guidance to make clear that it will evaluate companies’ controls and risk mitigation relating to the use of AI and other new technologies, which will pose novel issues for compliance and legal departments over the coming years. In a similar vein, the DOJ expects that companies will devote adequate resources to leveraging data for compliance purposes. Additionally, in the first year since the enactment of the Foreign Extortion Prevention Act—which criminalizes the demand side of foreign bribery—the DOJ has not brought any public enforcement actions. Moreover, 2024 saw Congress amend the law to clarify certain definitions and narrow the scope of territorial-based jurisdiction, perhaps recognizing the sensitivities that would accompany criminal enforcement actions against foreign officials.

Finally, with the change in administration, it remains to be seen how the DOJ’s policy developments over the last few years and enforcement priorities will change. In the first Trump Administration, the DOJ and the SEC reached FCPA resolutions at approximately the same or higher rate than during the Biden Administration, and imposed a greater amount of total penalties each year. While Donald Trump once called the FCPA a “horrible law,” he said little about anti-corruption efforts during his 2024 campaign. Former Florida Attorney General Pam Bondi, the nominee for U.S. Attorney General, was a state prosecutor and appears to have made no public statements on the FCPA. Accordingly, the DOJ and the SEC’s FCPA enforcement priorities may not change a great deal as compared to recent years, though the administration’s policies on foreign bribery have yet to be articulated and its priorities and resource allocation outside of FCPA enforcement may nonetheless over time have a substantial impact.

Corporate Enforcement Overview

In 2024, the SEC resolved six and the DOJ resolved nine FCPA corporate enforcement actions, including one DOJ declination with disgorgement pursuant to the Corporate Enforcement Policy.

|

FCPA CORPORATE ENFORCEMENT ACTION RESOLUTIONS, 2020–2024[1]

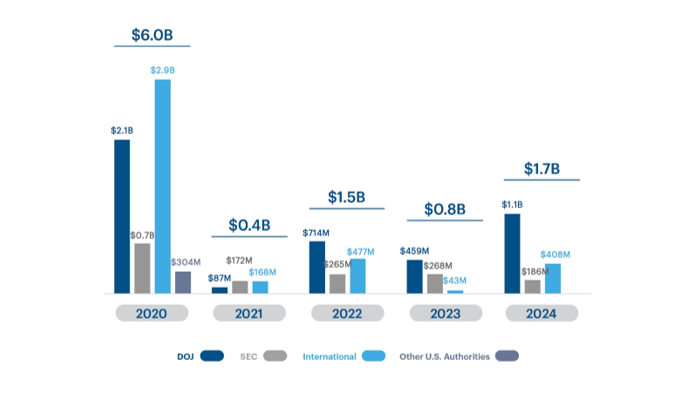

These 15 enforcement actions (against 11 unique companies) resulted in approximately $1.7 billion in fines, penalties, disgorgement and prejudgment interest, of which approximately $1.1 billion was assessed by the DOJ and approximately $186 million by the SEC.[2] The DOJ and SEC credited another $408 million in penalties assessed by foreign authorities in foreign proceedings associated with U.S. enforcement actions.

Despite the DOJ and SEC’s entering into three fewer resolutions than in 2023, the total monetary penalties assessed approximately doubled in 2024, largely driven by multiple enforcement actions that resulted in penalties in excess of $200 million across DOJ, SEC and foreign settlements, including penalties totaling over $661 million against Gunvor S.A., over $361 million against RTX/Raytheon, and over $230 million against SAP.

|

FCPA CORPORATE ENFORCEMENT ACTION PENALTIES, 2020–2024[3]

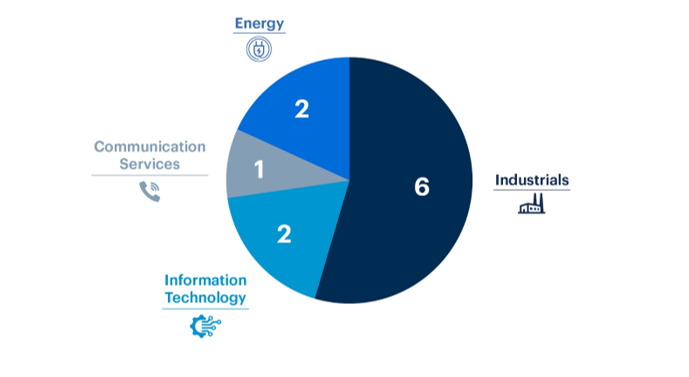

The corporate resolutions spanned several industries, with a majority of the companies belonging to the Industrials sector.[4] Industrials is a broad category that includes Aerospace & Defense and Commercial & Professional Services. The 2024 enforcement sectors reflect a reduction in the number of sectors represented in enforcement actions as compared to 2023, which included resolutions with companies in eight separate sectors, as compared to just four in 2024.

|

The map below demonstrates the range of countries that have been the locus of conduct deemed to violate the FCPA—including the location of subsidiaries implicated in the government’s allegations, of meetings concerning bribes and of the bases of operations for third-party intermediaries—based upon the allegations in the 2024 corporate resolutions. For the first time in several years, no enforcement action involved allegations of misconduct in China, which historically has been a focus of FCPA enforcement. However, three separate resolutions involved misconduct in South Africa, two of which involved parallel investigations conducted by South African authorities—indicating an increase in cooperation between the U.S. and South Africa in anti-bribery enforcement.

|

2024 FCPA CORPORATE ENFORCEMENT ACTIONS BY LOCATION

DOJ Corporate Enforcement

Enforcement Actions Overview

In 2024, the DOJ announced enforcement actions against nine companies and related entities (AAR Corp, BIT Mining Ltd., Boston Consulting Group, Gunvor S.A, McKinsey and Co. Africa (PTY), Raytheon Company, SAP SE, Telefónica Venezolana, C.A. and Trafigura Beheer B.V.).[5] We examine certain of these resolutions in the Review of Select Corporate Resolutions section below. Five companies (McKinsey, BIT Mining, Telefonica Venezolana, Raytheon and SAP) entered into deferred prosecution agreements (“DPA”); two companies (Gunvor and Trafigura Beheer) entered into guilty pleas; one company (AAR Corp.) entered into a non-prosecution agreement (“NPA”); and one company (Boston Consulting Group) received a declination with disgorgement under the DOJ Corporate Enforcement Policy.

In addition, at least four companies publicly disclosed new or ongoing FCPA-related investigations in their SEC filings or press releases in 2024 that have not yet been resolved: Calavo Growers, Inc., SQM, Saab and Methode Electronics.

Finally, at least one active FCPA investigation was closed in 2024 with no action being taken against the company in connection with the investigation. After disclosing that it had made an FCPA-related voluntary disclosure to the DOJ and SEC in its February 2023 10-K, Stanley Black & Decker disclosed in its October 29, 2024 10-Q that it had been informed that “they have each closed their inquiries with no action taken against the Company in connection with these matters.”[6]

Voluntary Disclosure Credit

The DOJ appears to have only credited one of the nine companies for making a voluntary disclosure—Boston Consulting Group. While two other companies claimed to have self-reported their conduct, the DOJ indicated that those disclosures had been preceded by media coverage and/or disclosures by others.

For SAP SE, a 2017 company press release regarding an ongoing FCPA investigation indicated that the company had “voluntarily disclosed the situation in its South Africa business to U.S. authorities.”[7] The DOJ, however, concluded that SAP SE “immediately [began] to cooperate after South African investigative reports made public allegations of the South Africa-related misconduct,” and did not mention a voluntary disclosure when addressing cooperation credit.[8]

For AAR Corp., while the DOJ recognized the company for having “self-reported to the department conduct that forms, in part, the basis for the resolution,” the DOJ concluded that “the self-report was not a ‘voluntary self-disclosure’ as defined in the Criminal Division Corporate Enforcement and Voluntary Self-Disclosure Policy” because, “[p]rior to the self-report, several English-language articles had been published in [foreign] media outlets that described potential irregularities . . . including that an AAR subsidiary had been summoned by a Nepalese agency investigating irregularities and corruption in connection with the procurement of aircraft.”[9] The DOJ also noted that an “independent source” reported the Nepal allegations to the DOJ “12 days before AAR’s self-report.”[10]

Compliance Monitors

After no monitors were imposed in 2023, the DOJ imposed one monitor in 2024 as part of its DPA with Raytheon. The monitor will be imposed for a period of three years and will oversee the company’s compliance with the DPA, which covered alleged violations of the FCPA, as well as with the International Traffic in Arms Regulations of the Arms Export Control Act.

This year also marked the conclusion after four years of Ericsson’s monitor, which was appointed in connection with its 2019 DPA to resolve FCPA violations.[11] As noted in our 2023 Year in Review, Ericsson had previously agreed to a one-year extension in connection with its guilty plea entered after breaching the terms of its 2019 DPA.[12]

Despite former Assistant Attorney General for the Criminal Division Kenneth A. Polite, Jr.’s March 2023 memorandum updating guidance for the selection of monitors in Criminal Division matters,[13] the imposition of such monitors remains a rare occurrence.

Whistleblower Activity

As explained in the Policy Pronouncements Affecting Anti-Corruption Enforcement section below, the DOJ’s Criminal Division launched a Corporate Whistleblower Awards Pilot Program in 2024 to aid in uncovering and prosecuting corporate crime. In parallel, multiple U.S. Attorney’s Offices launched similar programs. While neither the DOJ nor the U.S. Attorney’s Offices have released any formal announcements on the reporting activity to date, former DOJ Principal Associate Deputy Attorney General Marshall Miller noted in a December 2024 speech that the Criminal Division fielded over 250 tips from whistleblowers about potential misconduct in the first several months of its pilot program.[14]

SEC Corporate Enforcement

Enforcement Actions Overview

In 2024, the SEC resolved six FCPA corporate enforcement actions (AAR Corp, BIT Mining, Deere & Co., Moog Inc, RTX Corp. and SAP SE).[15] This is a slight reduction in total enforcement actions compared with 2023, when the SEC entered into nine resolutions. Total monetary penalties similarly dropped from approximately $268 million in 2023 to $186 million in 2024. After just two companies entered into resolutions with both the DOJ and SEC in 2023, four of the six companies the SEC resolved alleged FCPA violations with in 2024 entered into resolutions with both agencies.

Voluntary Disclosures

The SEC appears to have credited at least one of the six companies for making a voluntary disclosure—Moog Inc. In its Cease-and-Desist Order, the SEC explained that Moog “initially reported certain misconduct to DOJ and subsequently provided SEC staff with facts developed during its own internal investigation.”[16]

For SAP SE, the SEC noted that it “considered SAP’s self-reporting of certain conduct” without addressing the concern raised by the DOJ that press reports preceded the disclosure.[17]

For AAR Corp., the SEC—similar to the DOJ—explained that “AAR reported its misconduct after learning of press reports of potential corruption in connection with this transaction in Nepal.”[18]

Whistleblower Activity

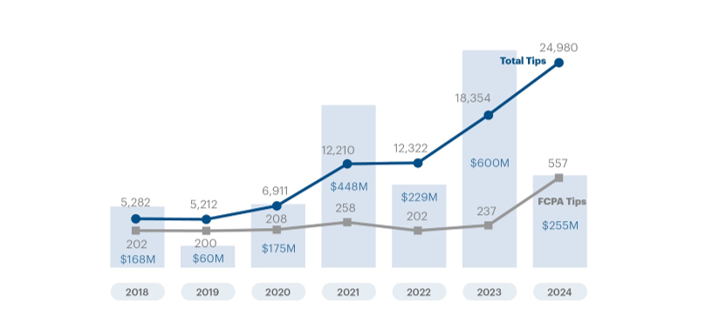

The SEC Office of the Whistleblower continued its upward trend in whistleblower reporting activity in 2024, receiving approximately 24,980 whistleblower tips—breaking 2023’s record for tips received.[19] While total whistleblower awards decreased in 2024 compared to 2023, the SEC still awarded over $255 million to whistleblowers, the third-highest annual amount in SEC history.[20] The SEC also received its highest ever number of FCPA-related whistleblower tips, 557—nearly twice the number received in any prior year.[21] That said, FCPA-related whistleblower tips have for years comprised a small fraction of the overall number of tips, with the percentage hovering at or below 3% for the past five years: 2024 (2.2%), 2023 (1.3%), 2022 (1.6%), 2021 (2.1%), and 2020 (3%). In December 2024, SEC FCPA Unit Chief Charles Cain reported that his team declines to litigate FCPA tips “all the time.”[22]

|

SEC WHISTLEBLOWER TIPS AND TOTAL WHISTLEBLOWER AWARDS, 2018–2024

The SEC also signaled its willingness to bring enforcement actions against entities and individuals that sought to prevent whistleblowers from communicating with the SEC, bringing 11 enforcement actions under Rule 21F-17, which prohibits taking “any action to impede an individual from communicating directly with the Commission staff about a possible securities law violation.”[23]

Review of Select Corporate Resolutions

SAP SE

On January 10, 2024, German publicly traded software company SAP SE (“SAP”) entered into a three-year DPA with the DOJ and agreed to pay over $220 million to resolve parallel DOJ and SEC FCPA investigations.[1] The resolution concerned alleged bribery schemes in South Africa, Malawi, Kenya, Tanzania, Ghana, Indonesia and Azerbaijan. SAP was charged with both conspiracy to violate the anti-bribery and books and records provisions of the FCPA, and conspiracy to violate the anti-bribery provision of the FCPA.

The DPA with the DOJ, which focuses only on conduct involving South Africa and Indonesia, states that SAP provided foreign government officials with cash payments, political contributions, and wire and other transfers, along with luxury goods, in an effort to obtain improper business advantages for SAP in connection with government contracts. The payments were reportedly made to government officials at various government agencies, departments and instrumentalities, including the City of Johannesburg, the City of Tshwane, the Department of Water and Sanitation, a South African state-owned and state-controlled energy company, the Indonesian Ministry of Maritime Affairs and Fisheries, and an Indonesian state-owned and state-controlled Telecommunications and Information Accessibility Agency. In total, SAP agreed to pay a criminal penalty of $118.8 million and administrative forfeiture of $103,396,765, and the DOJ credited SAP $109,141 off the criminal penalty for compensation that SAP withheld from qualifying employees.[2]

The parallel SEC order covered conduct not only in South Africa and Indonesia, but also in Malawi, Kenya, Tanzania, Ghana and Azerbaijan. The SEC’s order found that SAP inaccurately recorded bribes as legitimate business expenses in its books and records and failed to implement sufficient payment approval controls to ensure that services were actually rendered, or expenses were actually incurred, before issuing payments to third parties.[3] Like the DPA, the SEC’s order credited SAP’s “significant cooperation” and “self-reporting of certain conduct.”[4]

Gunvor S.A.

On March 1, 2024, the DOJ announced that Swiss commodities trading firm Gunvor S.A. (“Gunvor”) pleaded guilty to one count of conspiracy to violate the FCPA in connection with a scheme to bribe Ecuadorian government officials related to the purchase and sale of oil products between 2012 and 2020.[5] Gunvor was ordered to pay over $661 million, including a $374,560,071 criminal penalty and $287,138,444 in forfeiture; however, the sentence provided for up to one-quarter[6] credit off the criminal penalty for amounts paid to either Ecuadorean[7] and Swiss[8] authorities within one year, for a total credit of up to half off the criminal penalty.[9] After receiving the maximum credit off the criminal penalty, the total amount Gunvor was required to pay was reduced to approximately $474.5 million. Additionally, Gunvor agreed to review, test and update its compliance program and internal controls, as well as related policies and procedures, and to provide follow-up reviews and reports to the DOJ for at least three years.[10]

In its plea agreement, Gunvor acknowledged that its Singaporean subsidiary paid more than $97 million to intermediaries, a portion of which was intended to be used and was ultimately used to bribe at least five Ecuadorian officials.[11] The payments were reportedly routed through U.S. banks using shell companies based in Panama and the British Virgin Islands, and which were controlled by two Gunvor consultants.[12] To effectuate and conceal the bribery scheme, the two Gunvor consultants entered into service agreements to facilitate the payment of bribes, created fake invoices for nonexistent consulting services, and set up email accounts with pseudonyms to transfer funds to the offshore shell companies.[13] As a result of this scheme, Gunvor earned more than $384 million in profits from state oil-based contracts.[14]

Boston Consulting Group

On August 27, 2024, the DOJ issued a letter to U.S. management consulting company Boston Consulting Group, Inc. (“BCG”), announcing a declination with disgorgement of over $14 million to resolve an investigation of FCPA misconduct.[15] According to the letter, prosecutors identified evidence that BCG, through its Lisbon, Portugal office, paid $4.3 million in commissions to an agent who BCG employees knew had close ties to the Angolan government to help BCG win government contracts. In turn, the agent reportedly paid a portion of these funds to Angolan officials in connection with BCG obtaining contracts. Moreover, BCG employees allegedly attempted to conceal the scheme by backdating contracts and falsifying the agent’s work product. In the letter, the DOJ credited BCG’s “timely and voluntary self-disclosure,” “full and proactive cooperation,” “timely and appropriate remediation, including termination of the personnel involved,” “significant improvements to its compliance program and internal controls” and the “absence of aggravating circumstances,” as the reasons why the government declined prosecution. BCG also agreed to disgorge $14,424,000, the amount of profit it received from the increased revenues of $22.5 million derived from the Angolan government contracts at issue.[16]

Deere & Company

On September 10, 2024, the SEC issued a cease-and-desist order under which U.S. manufacturing company Deere & Company (“John Deere”) agreed to pay nearly $10 million to resolve an investigation into misconduct by its Thai subsidiary.[17] In December 2017, John Deere acquired Wirtgen Group, a German private manufacturer of road equipment. According to the SEC, from at least late 2017 through 2020, Wirtgen employees bribed Thai government officials, through cash payments, massage parlor visits and international travel, to win multiple government contracts.

The SEC alleged that “Deere failed to timely integrate [Wirtgen] into its existing compliance and controls environment,” which led to a “failure to devise and maintain a sufficient system of internal accounting controls with respect to employee expense reimbursements, third party payments, and gifts, travel and entertainment,” and caused the scheme to go unchecked for several years. John Deere’s penalty included disgorgement of $4,343,401 and prejudgment interest of $1,086,954, and a civil monetary penalty in the amount of $4,500,000 for a total of $9,930,355.

The SEC credited John Deere for “providing translations of certain relevant documents, making current and former employees available to the Commission staff, including witnesses located overseas, and timely providing the details of facts developed during its internal investigation.”[18] The SEC also cited remedial measures by John Deere, including terminating employees responsible for the misconduct and initiating improvements to its internal audit and compliance programs.

Raytheon Company

On October 16, 2024, the SEC and the DOJ announced that Raytheon Company (“Raytheon”), a subsidiary of defense contractor RTX based in Arlington, Virginia, agreed to pay over $391 million to resolve allegations that Raytheon conspired to violate the anti-bribery provision and violated the anti-bribery and accounting provisions of the FCPA in order to obtain contracts with the Qatari military.[19] To resolve the DOJ investigation, Raytheon agreed to pay $267 million, including a $230,400,000 criminal penalty and $36,696,068 forfeiture, and entered into a three-year DPA imposing an independent compliance monitor, compliance program enhancements, remediation of the root causes of prior misconduct, reporting of the monitor’s findings to the DOJ, implementation of the monitor’s recommendations within 150 days of receiving the recommendations, and at least annual meetings with the DOJ and the monitor.[20] To resolve the SEC investigation, Raytheon agreed to pay $49,186,298 in disgorgement and prejudgment interest, as well as a $75,000,000 civil penalty. The DOJ’s DPA allows for an offset of the forfeiture in the amount of approximately $7,400,000 of the disgorgement Raytheon paid to the SEC,[21] and the SEC resolution allows for a civil penalty offset of $22,500,000 based on the resolution with the DOJ.[22]

The DOJ alleged that from approximately 2012 to 2016, Raytheon, through certain employees and agents, conspired and agreed with others to offer and make improper payments to a high-ranking Qatari foreign official in exchange for assisting Raytheon in obtaining and retaining two contracts from The Qatar Emiri Air Force (“QEAF”) and Qatar Armed Forces (“QAF”).[23] Raytheon allegedly used false subcontracts with a supplier to make the payments.[24] As a result, Raytheon allegedly profited by approximately $36,700,000, an amount that could have been as high as $72,000,000 if the second contract had not been canceled.[25]

The DOJ provided Raytheon with cooperation credit, citing Raytheon’s provision of information obtained through its internal investigation, facilitation of interviews with employees, presentations to the government, disclosure of evidence and key documents, and engagement of experts to conduct financial analyses.[26] The DOJ also credited Raytheon for timely remedial measures, including Raytheon’s efforts to lower the company’s risk tolerance, implement enhanced controls over sales intermediary payments, hire experts to oversee its anti-corruption compliance program and third-party management, implement data analytics to improve third-party monitoring, and develop its communications strategy to enhance ethics and compliance training and communications.[27] At the same time, the DOJ stated that, prior to 2022, “Raytheon was at times slow to respond to the government’s requests and failed to provide relevant information in its possession,” and noted three prior civil/regulatory enforcement actions with federal authorities dating back to 2006, none of which involved FCPA misconduct.[28]

In a cease-and-desist order, the SEC alleged that Raytheon violated the FCPA’s anti-bribery, internal accounting controls, and books and records provisions.[29] The SEC alleged that, between 2011 and 2017, Raytheon used sham subcontracts with a supplier to pay bribes of approximately $2 million to Qatari foreign officials to obtain military defense contracts.[30] The SEC further alleged that, between the early 2000s and 2020, Raytheon paid more than $30 million to a Qatari agent, who was related to the Qatari Emir, had no prior background in military defense contracting, and about whom numerous Raytheon employees had raised concerns of corruption risks.[31]

Similar to the DOJ, while the SEC cited Raytheon’s overall cooperation and remediation efforts, it also flagged a “period of uncooperativeness” by the company.[32]

BIT Mining

On November 18, 2024, U.S. crypto asset mining company BIT Mining Ltd., agreed to pay $10 million to resolve parallel DOJ and SEC FCPA investigations concerning the company’s participation in a corrupt scheme to pay bribes to Japanese government officials.[33] Regulators alleged a bribery scheme designed to establish an integrated resort casino in Japan. Specifically, the DOJ and the SEC alleged that BIT Mining engaged in a bribery scheme to influence “numerous foreign government officials, including members of Japan’s parliament” by hiring third-party consultants to target government officials and pay them bribes on behalf of the company.[34] On the same day, the DOJ unsealed an indictment charging BIT Mining’s former CEO, Zhengming Pan, with FCPA violations for “directing company consultants to pay the bribes and to conceal the illicit payments through sham consulting contracts.”[35]

The DOJ resolution included a three-year DPA requiring BIT Mining to, among other things, pay a criminal penalty, continue cooperating with the DOJ’s investigation and report to the DOJ annually on its compliance reporting. Notably, the DPA explains that, due to an inability to pay the assessed $54 million criminal penalty, the DOJ reduced the resolution amount to $10 million and agreed to credit up to $4 million to be paid to the SEC to resolve a parallel investigation.[36] The BIT Mining resolution appears to be the only 2024 corporate enforcement action involving an “inability to pay” assessment, the contours of which are set forth in a 2019 DOJ memorandum to Criminal Division personnel entitled “Evaluating a Business Organization’s Inability to Pay a Criminal Fine or Criminal Monetary Penalty.”[37]

While the DOJ credited BIT Mining for its cooperation with its investigation, including voluntarily producing relevant records and information, along with sharing facts learned during its internal investigation, the DOJ described the cooperation as “reactive and limited in degree and impact.”[38]

McKinsey & Company Inc.

On December 5, 2024, the DOJ announced that McKinsey and Company Africa (Pty) Ltd. (“McKinsey Africa”), a South African subsidiary of international consulting firm McKinsey & Company Inc. (“McKinsey”), agreed to enter into a three-year DPA and pay over $122 million to resolve charges that it conspired to violate the FCPA’s anti-bribery provisions.[39]

According to the DPA, between at least 2012 and 2016, McKinsey Africa, acting through a senior partner at McKinsey, conspired to pay bribes to high-ranking South African officials at two state-owned enterprises—Transnet SOC Ltd. and Eskom Holdings SOC Ltd. —in order to obtain information that McKinsey Africa used to win consulting contracts with the two state-owned entities.[40] As a result of the consulting contracts, McKinsey Africa and McKinsey earned approximately $85 million in profits.[41]

The DPA requires McKinsey Africa to pay a criminal penalty of $122,850,000, and both McKinsey Africa and McKinsey agreed to report the status of the companies’ anti-corruption compliance efforts for three years to the DOJ.[42] The DOJ agreed to provide credit up to $61,425,000—exactly half of the criminal penalty—for amounts paid by McKinsey to South African authorities for the same misconduct.[43] In early December 2024, South Africa’s National Prosecuting Authority (NPA) announced a coordinated resolution of approximately $61 million to resolve bribery charges by South African prosecutors.[44] As a result, the company received the maximum credit off the criminal penalty, reducing the total amount of the criminal penalty to $61.4 million.

The DOJ credited McKinsey Africa for its cooperation, which included witness interviews, presentations and document productions to the DOJ, reports in real-time of newly discovered information and documents,[45] and engagement with the DOJ in response to a deconfliction request.[46] The DOJ also credited McKinsey Africa and McKinsey for timely remedial measures, including taking appropriate employment measures with respect to the McKinsey partner involved in the bribery scheme, conducting additional anti-corruption training for employees, enhancing due diligence processes for third-party partners, and voluntarily repaying revenue received from “potentially tainted contracts.”[47] McKinsey Africa and McKinsey agreed to cooperate with the DOJ in future investigations as well as to enhance their anti-corruption compliance program, and to report to the government with respect to remediation and implementation of the enhanced compliance program.[48]

This enforcement resolution was the DOJ FCPA Unit’s third coordinated resolution with South African regulators in two years, reflecting an increase in cooperation with the country’s prosecutors.[49]

AAR Corp.

On December 19, 2024, U.S. publicly traded aviation company AAR Corp. (“AAR”) agreed to pay approximately $74.2 million to resolve parallel DOJ and SEC investigations into FCPA misconduct in South Africa and Nepal. According to regulators, from approximately 2015 to 2020, AAR conspired to pay bribes to government officials to obtain and retain business with Nepalese and South African state-owned airlines in violation of the FCPA.[50] The resolutions included an 18-month NPA with the DOJ, which provided for payment of a $26,363,029 criminal penalty and $18,568,713 in forfeiture, the latter of which would be credited against the $29,236,624 disgorgement and prejudgment interest to be paid in connection with the SEC resolution.[51] In connection with the allegations made against AAR, on July 15 and August 1, 2024, Julian Aires and Deepak Sharma, respectively, pleaded guilty to a conspiracy to violate the FCPA for their roles in the South Africa and Nepal schemes, respectively.[52]

In Nepal, the DOJ alleged that from approximately 2015 to 2018, an AAR agent conspired and agreed to offer and pay bribes to Nepalese government officials, including an individual serving as a high-level official at state-owned Nepal Airlines Corporation (“NAC”), to secure advantages for AAR in obtaining and retaining business from NAC.[53] The NPA specifically references a bid to sell two Airbus A330-200 aircraft to NAC, from which AAR obtained profits of approximately $6 million.[54] With respect to the NAC transaction, the bribes at issue were allegedly made through various intermediary companies.[55]

In South Africa, the DOJ alleged that from approximately 2016 to 2020, AAR agents conspired and agreed to offer and pay bribes to South African government officials, including three officials at state-owned South African Airways Technical (“SAAT”), to secure advantages for AAR in obtaining and retaining business from SAAT.[56] The NPA references an award for a five-year aircraft component support contract and payments made in connection with the contract from which AAR obtained profits of approximately $17,900,000.[57] The DOJ alleged that AAR was awarded the contract after paying the bribes at issue through a third-party agent.[58]

The NPA indicates that AAR self-reported to the DOJ, but that the DOJ concluded that the self-report did not constitute a “voluntary self-disclosure” because, prior to the self-report, news articles in Nepal and South Africa described potential irregularities in the relevant contracts, and an independent source reported the Nepal-related conduct to the DOJ.[59] The DOJ did credit AAR for cooperation, citing the company’s substantial support of the DOJ’s investigation and acceptance of responsibility for its criminal conduct. The DOJ also acknowledged the company’s extensive and timely remedial measures.[60] AAR agreed to continue to cooperate with the DOJ in any ongoing investigation of the company and of any associated individuals with respect to violations of the FCPA.[61]

In its cease-and-desist order, the SEC accused AAR of violating the FCPA’s anti-bribery, recordkeeping and internal accounting controls provisions.[62] The SEC alleged that AAR “failed to devise and maintain internal accounting controls related to vendor management and accounts payable sufficient to provide reasonable assurances that AAR personnel were adhering to AAR’s Global Anti-Corruption Policy and its procedures regarding the retention of and payments to third-party agents.”[63] Additionally, the SEC alleged that AAR’s “books and records inaccurately characterized commission payments and success fees to the third-party agent and joint venture partner in connection with the Nepal and South Africa transactions. AAR failed to properly record the true nature of these payments and falsely recorded the payments as legitimate expenses or contra revenue.”[64] Similar to the DOJ, the SEC credited AAR for its cooperation and remediation efforts.[65]

Enforcement Actions Against Individuals

In a series of speeches and panel discussions in early December 2024, DOJ officials explained that, while FCPA trials remain tricky endeavors due to overseas evidence collections, massive investigative records, and other challenges, the DOJ tried to convictions four foreign bribery cases involving individual defendants in 2024—a record number for the FCPA Unit.[66] The DOJ reported achieving an additional 12 convictions through guilty pleas. We summarize these four cases below.

Trials

Javier Aguilar

On February 23, 2024, following an eight-week trial in the Eastern District of New York, a jury convicted Javier Aguilar of conspiracy to violate the FCPA, violating the FCPA and conspiracy to commit money laundering.[67] While his sentencing has yet to be scheduled, Aguilar faces a maximum sentence of 40 years’ imprisonment.[68]

Aguilar was a trader in the Houston office of Vitol Inc. (“Vitol”), an energy trading firm.[69] The charges against him concerned a scheme to pay over $1 million in bribes to officials of Petroecuador, the Ecuadorean state-owned oil and gas company, and PEMEX Procurement International, a subsidiary of Mexican state-owned oil and gas company PEMEX, in order to obtain lucrative contracts for Vitol.[70] Aguilar and his co-conspirators were alleged to have concealed the payments using fake contracts, sham invoices and shell entities, and communicated using alias email accounts.[71]

In addition to the charges against Aguilar, seven co-conspirators pleaded guilty for their roles in the scheme and agreed to forfeit over $63 million.[72] Vitol also admitted to bribing officials in Ecuador, Mexico and Brazil, entered into a DPA, and agreed to pay a combined $135 million in penalties as part of a coordinated resolution with the DOJ, the Commodity Futures Trading Commission (“CFTC”) and Brazilian authorities.[73] Additional details about the Vitol enforcement action can be found in our 2020 FCPA Year-in-Review.[74]

After his conviction in the EDNY case, which concerned the payment of bribes to Ecuadorian officials and laundering of bribe money for both the Ecuadorian and Mexican bribery schemes, on August 21, 2024, Aguilar pleaded guilty to additional FCPA conspiracy and Travel Act charges filed in the Southern District of Texas (“SDTX”) relating to the Mexican bribery scheme.[75] He also consented to transferring the SDTX case to the EDNY for consolidation and sentencing in both cases.[76]

Carlos Ramon Polit Faggioni

While not technically an FCPA prosecution, on April 23, 2024, following a three-week trial in the Southern District of Florida, a jury convicted Carlos Ramon Polit Faggioni (“Polit”), the former Comptroller General of Ecuador, of one count of conspiracy to commit money laundering, three counts of concealment of money laundering, and two counts of engaging in transactions in criminally derived property.[77] On October 1, 2024, Polit was sentenced to a decade in prison and ordered to forfeit $16.5 million in illicit proceeds.[78]

The charges related to a scheme in which Polit solicited and received over $10 million in bribes from a Brazilian construction company, Odebrecht S.A. (“Odebrecht”), in exchange for fine exemptions for the company’s Ecuadorian projects.[79] Polit and his co-conspirators were alleged to have concealed the bribery proceeds using Florida companies registered under names of their friends and associates, often without their knowledge, and to have used the funds to purchase and renovate property in Florida.[80] Additionally, Polit was alleged to have received a bribe from an Ecuadorian businessman in exchange for assistance in obtaining contracts with an Ecuadorian state-owned insurance company.[81]

Following his father’s conviction, in November 2024, Polit’s son, John Christopher Polit, pleaded guilty to similar crimes. Prosecutors accused John Polit of laundering the bribe proceeds paid for the benefit of his father through the U.S. financial system and into various real estate and business investments in South Florida.[82] According to prosecutors, between approximately 2010 and 2018, John Polit engaged in a transaction-layering scheme using Panamanian accounts of intermediary companies along with Florida companies registered in the names of certain associates, causing the bribe proceeds to “disappear.”[83] John Polit’s sentencing is scheduled for January 30, 2025.[84]

In December 2016, Odebrecht pleaded guilty to conspiracy to violate the FCPA in connection with a broader bribery scheme involving officials in 12 countries and nearly $800 million in bribes.[85] At the time, Odebrecht and Brazilian petrochemical company Braskem S.A. agreed to pay a combined penalty of at least $3.5 billion to resolve bribery charges with authorities in the U.S., Brazil and Switzerland.[86] Additional details about the Odebrecht enforcement action can be found in our 2016 FCPA Year in Review.[87]

Manuel Chang

While also not technically an FCPA prosecution, on August 8, 2024, following a four-week trial in the Eastern District of New York, a jury convicted Manuel Chang, the former Finance Minister of Mozambique, of conspiracy to commit wire fraud and conspiracy to commit money laundering in what has been referred to as the tuna bonds scandal.[88] On January 17, 2025, he was sentenced to 102 months’ imprisonment and ordered to pay $7 million in forfeiture.[89]

The charges related to a $2 billion fraud, bribery and money laundering scheme through which Chang was alleged to have received over $7 million in bribe payments in exchange for signing guarantees on behalf of the Republic of Mozambique to secure over $2 billion in loans for three maritime projects, including shipyards, ships to combat piracy and a tuna fishing fleet.[90] Prosecutors alleged that over $200 million of the loan proceeds were diverted to pay bribes and kickbacks to Chang and other officials.[91] Chang was first arrested in December 2018 in South Africa, pursuant to a provisional arrest warrant issued at the request of the U.S., and extradited to the EDNY in July 2023.[115]

In October 2021, Credit Suisse AG entered into a DPA and Credit Suisse Securities (Europe) Limited (“CSSEL”) pleaded guilty to conspiracy to commit wire fraud in connection with their role in financing these loan projects.[116] As a part of the resolution, Credit Suisse AG and CSSEL paid approximately $475 million in penalties, fines and disgorgement as part of coordinated resolutions with authorities in the U.S. and the U.K.[117]

Three CSSEL bankers also pleaded guilty in connection with the alleged wrongdoing: Andrew Pearse, a former managing director of CSSEL, who pleaded guilty to conspiracy to commit wire fraud in July 2019; Surjan Singh, a former managing director of CSSEL, who pleaded guilty to conspiracy to commit money laundering in September 2019; and Detelina Subeva, a former vice president of CSSEL, who pleaded guilty to conspiracy to commit money laundering in May 2019.[118] Meanwhile, in December 2019, Jean Boustani a salesman for an Abu Dhabi-based shipbuilder, was acquitted by a jury in the EDNY of three counts of conspiracy to commit fraud and money laundering in connection with the same alleged scheme.[119]

Glenn Oztemel

On September 26, 2024, following a four-week trial in the District of Connecticut, a jury convicted former oil and gas trader Glenn Oztemel of conspiracy to violate the FCPA, conspiracy to commit money laundering, three counts of violating the FCPA and two counts of money laundering.[120] His sentencing is not yet scheduled, but he faces a lengthy prison sentence.

Oztemel was a senior oil and gas trader, first at Arcadia Fuels Ltd. (“Arcadia”) and then at Freepoint Commodities LLC (“Freepoint”).[121] The charges against him related to a scheme to bribe officials of Petróleo Brasileiro S.A. (“Petrobras”), the Brazilian state-owned oil and gas company, to obtain and retain fuel oil contracts for Oztemel’s employers.[122] Prosecutors accused Oztemel and his co-conspirators of causing Arcadia and Freepoint to make corrupt payments disguised as consulting fees and commissions to a third-party intermediary and agent, knowing that some of those funds would be paid to Brazilian government officials.[123] The conspirators used code words, fake names, personal email accounts, encrypted messaging applications and disposable phones to conceal their communications.[124]

In December 2023, Freepoint admitted to bribing officials in Brazil, entered into a DPA, and agreed to pay over $98 million in criminal penalties and forfeiture.[125] In February 2019, Texas-based Petrobras trader Rodrigo Berkowitz pleaded guilty to a money laundering conspiracy charge, and in June 2024, Oztemel’s brother, Gary Oztemel, pleaded guilty to money laundering.[126] Another co-conspirator, Eduardo Innecco, who prosecutors alleged was the third-party agent for the corrupt payments, was arrested in France in May 2023; his extradition to the U.S. remains pending.[127]

New Charges Filed in 2024

In 2024, the DOJ brought criminal FCPA charges against 19 individuals.[128] That total marks an increase compared to recent years and a return to earlier levels of enforcement. The past year additionally saw a modest uptick in SEC enforcement against individuals after a three-year long drought, with cases brought against four individuals for FCPA violations. Though this figure remains a tiny fraction of the SEC’s overall individual enforcement activity, it may signal a return to individual enforcement under the FCPA after several years in which no FCPA cases were brought by the Commission.[129]

|

FCPA AND ANTI-CORRUPTION ENFORCEMENT ACTIONS AGAINST INDIVIDUALS, 2020–2024

Individual Enforcement Actions Tied to Corporate Enforcement Actions

As in past years, a significant portion of the enforcement actions against individuals were connected to corporate enforcement actions. For example, the DOJ charged two individuals connected to AAR (see supra at 18).[130] On June 11, 2024, the DOJ charged Julian Aires, a third-party agent of AAR, with conspiracy to violate the FCPA for his role in allegedly bribing South African officials to obtain an aircraft support contract with a subsidiary of South Africa’s state-owned airline.[131] Then, on June 24, the DOJ charged Deepak Sharma, an executive at an AAR subsidiary, for conspiring to violate the FCPA by bribing Nepali officials in order to win a bid to sell aircraft to Nepal’s state-owned airline.[132] Aires entered a guilty plea on July 15, 2024,[133] and Sharma pleaded guilty on August 1, 2024.[134] Sharma further agreed to pay $184,597 in disgorgement and prejudgment interest to resolve a parallel SEC proceeding.[135]

Individual enforcement actions also followed the corporate resolution for Stericycle, Inc., an international waste management company based in Illinois. In 2022, Stericycle agreed to pay more than $84 million and submit to a two-year monitorship to resolve parallel investigations by the DOJ, the SEC and Brazilian authorities into bribes offered and paid to Mexican, Brazilian and Argentinian officials.[136] In 2024, the DOJ brought charges against two Stericycle executives, Mauricio Gomez Baez, the Senior Vice President of Stericycle LATAM and Abraham Cigarroa Cervantes, the Finance Director for Stericycle LATAM, for their roles in this conspiracy. According to the charging documents, Gomez, Cigarroa and colleagues made hundreds of payments to officials in Mexico, Brazil and Argentina for business advantages, calculated bribes as a percentage of the payments on underlying contracts, tracked the payments on spreadsheets, and used code words to refer to the payments.[137] In February, Gomez was charged with conspiracy to violate the antibribery provisions of the FCPA.[138] He pleaded guilty later that month, and in July was sentenced to a term of seven months’ imprisonment, three years of supervised release and a fine of $250,000.[139] On March 19, the DOJ unsealed a two-count indictment against Cigarroa, charging him with conspiracies to violate the bribery and books-and-records provisions of the FCPA; the indictment further noted that Cigarroa, who had financial reporting responsibilities and was a member of Stericycle’s FCPA Compliance Management Steering Committee, had certified falsely that he was unaware of legal violations.[140]

Other Individual Enforcement Actions

The DOJ also brought charges against individuals in the absence to date of parallel corporate enforcement actions. On August 8, 2024, for instance, Roger Alejandro Pinate Martinez and Jorge Miguel Vasquez, executives at the voting machine company Smartmatic, were charged with conspiracy to violate the FCPA and a substantive FCPA violation in connection with alleged bribes to Juan Andres Donato Bautista, the former Chairman of the Philippines Commission on Elections (COMELEC).[141] Pinate, Vasquez, Bautista and Elie Moreno (a third Smartmatic executive) also were charged with conspiracy to commit money laundering and international laundering of monetary instruments.[142] According to the indictment, Pinate and Vasquez sought to bribe Bautista in order to obtain contracts and receive payments from COMELEC in connection with the 2016 Philippine elections.[143] To do so, the executives over-invoiced the cost per voting machine for the elections, added the excess payment to slush funds, and ultimately transferred bribe payments to Bautista through a series of sham agreements.[144]

As another example, on October 23, 2024, the DOJ unsealed a one-count indictment against Raul Gorrin Belisario, charging him with conspiracy to commit money laundering, in which the predicate crime was an FCPA violation and bribery of a public official or the misappropriation, theft or embezzlement of public funds by or for the benefit of a public official.[145] Gorrin previously was indicted in 2018 and remains a fugitive on charges that he bribed Venezuelan officials for contracts to conduct foreign currency exchange transactions at favorable rates.[146] The 2024 indictment similarly alleged that Gorrin and co-conspirators agreed to bribe officials of Venezuela’s state-owned energy company, Petróleos de Venezuela S.A. (PDVSA), in order to obtain favorable foreign exchange loan contracts that took advantage of the Venezuelan bolivar’s artificially high value,[147] and that, as a result, PDVSA paid $600 million to a company controlled by Gorrin in exchange for a loan worth approximately $50 million.[148] According to the indictment, the conspirators then used banks and shell companies to transfer parts of the proceeds from the loan contract to themselves and PDVSA officials.[149] Luis Fernando Vuteff, an Argentinian national and financial asset manager,[150] pleaded guilty on May 14, 2024 to a single count of conspiracy to commit money laundering, based on his assistance in laundering proceeds from the same loan contracts, and was sentenced on December 17, 2024 to 30 months in prison and a forfeiture.[151]

Guilty Pleas

The DOJ also obtained 12 guilty pleas in FCPA cases this year.[152] As discussed above, this total included two individuals connected to AAR (Deepak Sharma and Julian Aires), one Stericycle executive (Mauricio Gomez Baez), and a guilty plea by Javier Aguilar in the Southern District of Texas following conviction on separate charges in the Eastern District of New York.

Several individuals connected to other trials in 2024 agreed to guilty pleas, including the brother of Glenn Oztemel (Gary Oztemel), the son of Carlos Polit (John Polit) and an associate of Raul Gorrin Belisario (Luis Fernando Vuteff).

The remaining plea agreements marked conclusions of lengthy proceedings. On May 21, 2024, Swiss-Portuguese banker Paulo Jorge Da Costa Casqueiro Murta pleaded guilty to conspiracy to violate the FCPA. [153] The plea agreement ends a years-long effort by the DOJ to prosecute Murta for offenses related to a bribery scheme involving PDVSA, the Venezuelan state oil company, in which Murta was extradited to the U.S. and the district court twice dismissed Murta’s indictment and the U.S. Court of Appeals for the Fifth Circuit twice reversed the dismissal.[154] Similarly drawn-out proceedings concluded in a guilty plea in the prosecution of Alain Riedo, a Swiss former executive at Maxwell Technologies who was initially indicted in 2013 for various FCPA offenses in connection with efforts to bribe Chinese government officials.[155] Riedo voluntarily appeared in the U.S. and pleaded guilty to a single books-and-records violation on March 7, 2024.[156]

Upcoming FCPA Trials

Several FCPA proceedings against individuals are scheduled to come to trial in 2025. These matters include, for example, the pending trial of Gordon Coburn and Steven Schwartz, former executives at Cognizant Technology Solutions Corporation, which is scheduled to begin in March 2025.[157] The indictment in the case, issued in 2019, alleged that Coburn (formerly the president of Cognizant) and Schwartz (formerly the chief legal officer) authorized an illegal bribe payment of approximately $2 million to officials in India in order to obtain a planning permit for a new office campus in Tamil Nadu, India.[158] Coburn and Schwartz were charged with conspiracy to violate the FCPA and various violations of the anti-bribery, books-and-records and internal accounting controls provisions of the FCPA.[159] Separately, an April 2025 trial is currently scheduled for Carl Alan Zaglin,

Aldo Nestor Marchena and Francisco Roberto Cosenza Centeno, who were indicted in 2023 on charges related to an alleged scheme to bribe Honduran government officials, including Consenza, to obtain contracts for sales of uniforms and other goods to the Honduran National Police.[160] Another individual indicted in 2023, Amadou Kane Diallo, is also set for trial in September on wire fraud, money laundering and FCPA offenses; the FCPA charge relates to alleged efforts to corruptly influence Senegalese officials for a grant of land in Senegal.[161]

Policy Pronouncements Affecting Anti-Corruption Enforcement

In 2024, the DOJ announced several policy initiatives and revised guidance intended to complement its enforcement objectives. Like last year, the DOJ’s focus on anti-corruption reflects the outgoing White House’s whole-of government approach to fighting corruption, which it has deemed “a grave and enduring threat to U.S. national interests and those of our partners.”[162] In an October 2024 fact sheet, the White House highlighted, among other efforts, over $3.5 billion recovered in DOJ FCPA resolutions during the administration; a new Treasury Department filing system for certain companies to report their beneficial owners; visa restrictions for those who facilitate and enable significant corruption and their immediate family members; incorporating corruption risk into the Department of Defense’s security cooperation planning; and institutionalizing anti-corruption efforts in the activities of several agencies and interagency work.[163] Some of these priorities may carry over into the new administration, though there is not clear indication which areas will be expanded or rolled back. As discussed below, the DOJ’s 2024 initiatives continued to emphasize corporate compliance and incentives for reporting potential misconduct. As has been the trend for the past few years, the DOJ is taking the lead on developing public-facing FCPA enforcement policies, while the SEC has remained comparatively quiet.

DOJ Corporate Whistleblower Awards Pilot Program

On March 7, 2024, former U.S. Deputy Attorney General Lisa Monaco announced a new pilot program to provide financial incentives to whistleblowers who report tips about corporate misconduct to the DOJ Criminal Division.[164] The program aligns with similar whistleblower incentives offered by the SEC, CFTC, IRS and FinCEN, and is intended to “fill gaps” in reporting incentives offered by federal law enforcement agencies. DAG Monaco explained, “The premise is simple: if an individual helps DOJ discover significant corporate or financial misconduct — otherwise unknown to us — then the individual could qualify to receive a portion of the resulting forfeiture.”[165] The program is intended to encourage individuals to report misconduct and “drive companies to invest further in their own compliance and reporting systems.”[166] The DOJ is most interested in information about “[c]riminal abuses of the U.S. financial system,” “[f]oreign corruption cases outside the jurisdiction of the SEC,” and “[d]omestic corruption cases.”[167]

On August 1, 2024, the Criminal Division released a 14-page guidance document formally launching the pilot program.[168] Individuals may be eligible for awards if they report “original information in writing pursuant to the conditions and procedures set forth [in the guidance] and that information leads to criminal or civil forfeiture exceeding $1,000,000 in net proceeds forfeited.”[169] The information must pertain to certain corporate offenses, including violations by financial institutions, violations related to corruption and bribery (foreign and domestic) and violations related to federal health care offenses or fraud in the health care industry.[170] The submission must be voluntary and truthful and the individual must cooperate with an ensuing DOJ investigation, such as by providing testimony and evidence to a grand jury or at any court proceeding.[171] Individuals will be required, if asked, to work in a “proactive manner” with federal law enforcement.

Whistleblower awards are “entirely discretionary” and the amount awarded will be in the “sole discretion” of the DOJ.[172] The obligations and limitations of the program suggest only rare cases will result in a payout: rewards will be available where the DOJ successfully recovers funds, after all victims are compensated and in cases where there is not an existing financial disclosure incentive.[173] Nonetheless, an award could be substantial, given the many eight-, nine- and ten- figure penalties imposed in FCPA and other criminal cases in recent years. The DOJ intends to evaluate the program regularly and, at the end of the three-year pilot period, determine whether to maintain or modify it.[174]

In addition to the DOJ Criminal Division’s whistleblower program, multiple U.S. Attorneys’ offices have launched their own programs. In January 2024, the U.S. Attorney’s Office for the Southern District of New York announced a Whistleblower Pilot Program, which will afford an NPA to individuals who disclose information about certain non-violent offenses, subject to similar limitations as in the DOJ pilot program.[175] The SDNY program reaches a broader range of criminal activity than the Criminal Division’s program, including fraud or corporate control failures affecting market integrity, intellectual property violations, obstruction of justice and perjury and money laundering.[176] In deciding whether to enter into an NPA, SDNY prosecutors may consider several discretionary factors, including the extent to which the disclosed conduct was previously known, the individual’s culpability and prior criminal history and the individual’s ability to assist the investigation.[177] Unlike the Criminal Division program, SDNY does not exclude individuals who were involved in the offense, if they fully and truthfully disclose all conduct of which they are aware.[178] Several other U.S. Attorneys’ offices have announced similar programs, including in the Northern District of California, Eastern District of New York, District of New Jersey, Southern District of Florida, Eastern District of Virginia, District of Columbia, Southern District of Texas and Northern District of Illinois.

Amendment to DOJ’s Corporate Enforcement and Voluntary Self-Disclosure Policy

In conjunction with the whistleblower pilot program, the DOJ made a “temporary amendment” to its Corporate Enforcement and Voluntary Self-Disclosure Policy to incentivize self-reporting of corporate misconduct further.[179] The amendment provides that, even if an individual whistleblower reports misconduct within a company and to the DOJ, a company will still qualify for a presumption of a declination, provided that the company: “(1) self-reports the conduct to the Department within 120 days after receiving the whistleblower’s internal report and (2) meets the other requirements for voluntary self-disclosure and presumption of a declination under the policy.”[180] Thus, the amendment preserves a significant legal benefit for companies that timely self-report misconduct and cooperate, regardless of whether an individual separately comes forward to the DOJ. Former Principal Deputy Assistant Attorney General (PDAAG) Nicole M. Argentieri noted that not requiring companies to be the first to report is a “departure from our usual approach.”[181]

Revisions to DOJ’s Evaluation of Corporate Compliance Programs

On September 23, 2024, the DOJ announced the latest set of revisions to its guidance titled Evaluation of Corporate Compliance Programs (“ECCP”). PDAAG Argentieri explained that the ECCP is DOJ’s “roadmap” to evaluate corporate compliance in making prosecution decisions and that a “critical component of our corporate resolutions involves an assessment of the corporation’s compliance program, at both the time of the misconduct and the time of resolution.”[182] The DOJ has continually revised the ECCP since its publication in 2017 to account for evolving compliance risk areas.

Most notably, the 2024 revisions to the ECCP address how companies use artificial intelligence and the compliance risks of new technologies. [183] The ECCP’s criteria align with the DOJ’s expectations for traditional aspects of compliance programs. For example, legal, compliance, and business functions are expected to take a proactive approach to incorporating AI into controls and risk mitigation measures, such as employee training and discipline.[184] Periodic risk assessment and self-evaluation are also key, as the DOJ will consider how a company “assess[es] the potential impact of new technologies, such as [AI], on its ability to comply with criminal laws,” and how the company guards against intentional and reckless misuse of technology.[185] Companies will be expected to implement proper controls and monitoring to ensure new technology’s “trustworthiness, reliability and use in compliance with applicable law and the company’s code of conduct.”[186] Although the ECCP does not illustrate concrete steps that companies can take, legal and compliance leaders should brainstorm circumstances where new mitigation measures are needed. As an example, PDAAG Argentieri highlighted that companies could be vulnerable to AI-enabled criminal schemes, such as “false approvals and documentation generated by AI.”[187]

The revised ECCP also notes that the DOJ will compare the resources and technologies devoted to “gathering and leveraging data” for business purposes with those used for compliance activities.[188] The DOJ will consider “proportionate resource allocation” to determine whether there is “an imbalance between the technology and resources used by the company to identify and capture market opportunities and the technology and resources used to detect and mitigate risks.”[189] Compliance programs should, as appropriate, use data “to create efficiencies in compliance operations and measure the effectiveness of components of compliance programs,” and manage the quality of its data sources.[190] Other parts of the ECCP anticipate that companies will collect data to enhance their compliance programs, for example, to measure the effectiveness of employee training and supervise third-party relationships.[191]

Finally, the ECCP complements DOJ’s whistleblower incentive policies by asking whether companies have an anti-retaliation policy and train employees on the policy and applicable anti-retaliation and whistleblower laws.[192] Prosecutors will also look to whether companies provide effective internal reporting systems and whether practices incentivize or disincentivize reporting.[193]

Amendments to FEPA and a Silent Year for FEPA Enforcement

As we reported last year, in 2023, Congress enacted the Foreign Extortion Prevention Act (“FEPA”), which established criminal liability for foreign officials who solicit, receive, or agree to bribe payments in exchange for an improper business advantage.[194] As we detailed earlier this year,[195] in July 2024, Congress amended FEPA to “harmonize” inconsistencies with the FCPA and make “technical corrections.”[196] The amendments eliminate “unofficial activity” from the definition of “foreign official,” removing liability for a foreign official who acts in “an unofficial capacity.”[197] Under the amended FEPA, territorial-based jurisdiction exists only where the foreign official or their agent “is in the territory of the United States,” clarifying that it is not enough for the recipient of a solicitation to be located in the U.S. if the foreign official is abroad. Finally, the amendments extend FEPA’s coverage to a foreign official’s “act or decision” in an “official capacity,” whereas the original FEPA encompassed influence on an “official act” or “official duty.” A “decision” likely covers a broader range of behavior than an “act” or “duty.”

Exercising jurisdiction over foreign officials carries diplomatic and practical challenges, and federal prosecutors have not announced any FEPA charges or resolutions since the statute’s passage in 2023.[198] In an addendum to its FCPA Resource Guide, the DOJ indicated that, in consultation with the State Department, it will begin its annual mandatory reporting to Congress on FEPA enforcement in July 2025.[199] It remains to be seen how the DOJ will navigate sensitivities around charging foreign officials, but PDAAG Argentieri has previewed that prosecutors plan to “vigorously enforce” FEPA.[200]

Legal Developments Affecting Enforcement Tools

Snyder v. United States, 603 U.S. 1 (2024)

On June 26, 2024, the Supreme Court continued its trend of limiting the scope of conduct subject to federal corruption laws with its holding in Snyder v. United States that 18 U.S.C. § 666, a criminal statute governing certain categories of payments made to U.S. state and local officials, “does not make it a crime for those officials to accept gratuities for their past acts.”[201] Following its passage and subsequent amendments, 18 U.S.C. § 666 resembles the bribery provision for federal officials (18 U.S.C. § 201(b)) and makes it a crime for most state and local officials to “corruptly” solicit, accept, or agree to accept “anything of value” “intending to be influenced or rewarded in connection with” any official business or transaction worth $5,000 or more.[202]

In Snyder, the Supreme Court reversed the conviction of James Snyder, the former mayor of Portage, Indiana. In 2013, during Snyder’s tenure as mayor, Portage awarded Great Lakes Peterbilt, a local truck company, two contracts, and further purchased five trucks worth roughly $1.1 million from the company.[203] In 2014, Snyder received $13,000 from Great Lakes Peterbilt. While Snyder insisted this payment was compensation for his consulting services, a federal jury convicted him of accepting an illegal gratuity in violation of 18 U.S.C. § 666(a)(1)(B).[204] Snyder appealed his conviction, arguing that 18 U.S.C. § 666 does not criminalize gratuities.[205] The U.S. Court of Appeals for the Seventh Circuit affirmed based on its precedent interpreting the statute to cover both bribes and gratuities.[206]

Following appeal of the Seventh Circuit decision, the Supreme Court reversed. The Supreme Court observed that “the question in this case is whether 18 U.S.C. § 666(a)(1)(B) makes it a federal crime for state and local officials to accept gratuities for their past official acts.”[207] The Court held that it did not: “Six reasons, taken together, lead us to conclude that § 666 is a bribery statute and not a gratuities statute—text, statutory history, statutory structure, statutory punishments, federalism and fair notice.”[208] The Court further explained that “differing approaches by the state and local governments reflect policy judgments about when gifts expressing appreciation to public officials for their past acts cross the line from the innocuous to the problematic” and that “[t]hose carefully calibrated policy decisions would be gutted” if the Court were to accept the government’s interpretation of 18 U.S.C. § 666 to federally criminalize gratuities for past acts.[209] The Court further observed that the government did “not identify any remotely clear lines separating” an innocuous or benign gratuity “from a criminal gratuity,” leaving “state and local officials entirely at sea to guess about what gifts they are allowed to accept under federal law, with the threat of up to 10 years in federal prison if they happen to guess wrong.”[210]

While the impact of the Snyder decision on statutes beyond 18 U.S.C. § 666 remains to be seen, the FCPA concerns the provision of payments and anything else of value for corruptly “inducing” and “influencing”—but not rewarding—official action. Where transfers of value to government officials are offered or provided after the performance of the official “act[s] or decision[s]” at issue, defense counsel may try to argue that such conduct should be treated as a gratuity beyond the FCPA’s scope. FEPA similarly does not use the term “rewarding,” and it is possible that after-the-fact transfers of value could also create challenges for prosecutors.

Foreign Jurisdictions Investigating, Prosecuting and Regulating Corruption

In 2024, foreign authorities continued to make both strides in enforcement related to combating corruption. Investigations and prosecutions of corruption in foreign jurisdictions, including for individual liability, continued with mixed results. One jurisdiction saw settlement agreements allowing the re-entry of entities into public procurement processes while others prosecuted and confirmed sentences of former presidents following the uncovering of a multinational corruption scheme. Yet others passed new foreign bribery legislation and judicial and administrative reforms.

Further, foreign authorities including Canada, Ecuador, Moldova, Netherlands, Nigeria, Democratic Republic of the Congo,

The Gambia, Rwanda, and the U.K. have demonstrated further support for a new International Anti-Corruption Court (“IACC”) meant to hold corrupt leaders and officials accountable, particularly in countries where domestic legal systems are either unwilling or unable to prosecute such crimes effectively.[211] The IACC is envisioned as operating independently, with the authority to prosecute individuals for grand corruption which involves significant sums of money and impacts governance.[212] The court would also have the power to recover stolen assets and return them to affected countries.

Africa

In Kenya, in January 2024, two separate rulings by the country’s judiciary went against the administration of President

William Ruto of Kenya amid contentious disputes with the judiciary, despite the president’s attempts to exert influence and following mutual accusations and public confrontations.[213] On January 26, 2024, one court ordered the government to halt the collection of payments for a new housing levy. Shortly thereafter, another court ruled that President Ruto could not fulfill his promise to the United Nations to send 1,000 police officers to Haiti. Meanwhile, President Ruto has launched a series of attacks on the judiciary, accusing unnamed judges of corruption and criticizing those who challenge government projects in court.

In South Africa, on July 2024, Tshifhiwa Matodzi, the former chairperson of VBS Mutual Bank, was sentenced to 15 years in prison for orchestrating a $130 million banking scandal.[214] The scandal, which caused the collapse of VBS Mutual Bank in 2018, involved extensive looting that impacted entities from impoverished rural villages to government circles. Matodzi pleaded guilty to 33 counts, including corruption, theft, fraud, money laundering and racketeering. Although his combined sentence totals 495 years, the court ordered the sentences to run concurrently, resulting in a 15-year prison term. VBS Mutual Bank, once a modest institution serving rural communities, was transformed into a slush fund for corrupt politicians, local government leaders and their business associates through an elaborate pyramid scheme. The bank’s owners bribed local officials in some of South Africa’s poorest municipalities to divert their budgets into VBS’s accounts in exchange for cash and gifts. Matodzi, with the help of a team of accountants, lawyers and fraudulent shell companies, masterminded the scheme. While numerous arrests have been made in connection with the case, only Matodzi and former VBS chief financial officer Phillip Truter have been convicted and sentenced.

On August 27, 2024, the Special Investigative Unit (“SIU”), South Africa’s anti-graft unit, revealed in a report to a parliamentary committee that ongoing investigations into alleged corruption within several major state-owned companies amount to over $7 billion.[215] The SIU’s probes involve six key state-owned enterprises: Transnet (ports and rail), Denel (arms), Eskom (power utility), the National Lotteries Commission, South African Airways and PRASA (passenger rail). At Transnet alone, around 60 suspicious contracts and numerous cases of conflict of interest, totaling nearly $4 billion, are under scrutiny. At Eskom, more than 270 contracts worth approximately $2.2 billion are under investigation, and law firm Dentons is under investigation in relation to review of government contracts.[216] Current President Cyril Ramaphosa has vowed to eradicate corruption within his party and government and hold those responsible accountable, though experts remain skeptical about the recovery of the lost funds.

Asia

In China, an ongoing anti-corruption crackdown remains a high priority for the Communist Party going into 2025. President Xi Jinping warned as recently as the start of the new year that any easing of China’s anti-corruption crusade would pose “catastrophic” risks to the country.[217] Speaking with the Central Commission for Discipline Inspection, the country’s anti-corruption agency, on January 6, 2025, Xi noted the success of the program but maintained that “[c]orruption is the biggest threat facing the [Communist] Party.” Reports indicate an increased focus in the anti-corruption drive in 2025 on the country’s finance and energy sectors, along with state-owned enterprises; other areas of interest include firefighting, tobacco, medicine, universities, sports, development zones, engineering construction and bidding.[218] The Communist Party is also considering a new draft law on cross-border corruption.

In particular, China’s National Supervisory Commission has focused anti-corruption efforts on the healthcare industry, which according to reports included 52,000 medical corruption cases filed nationwide, with 40,000 people punished and 2,634 referred for prosecution, in 2024 alone.[219] Among those have been 350 senior health officials, hospital directors, leading academics, and pharmaceutical executives.

Meanwhile, the State Administration for Market Regulation, the country’s primary antitrust regulator, rolled out and solicited public comment on official anticorruption guidance to the healthcare industry in October 2024.[220] The guidance covers compliance management requirements for companies, considerations for the identification and prevention of various bribery risks and mitigation and reporting of risks to regulators.

In Singapore, in October 2024, former cabinet minister Subramaniam Iswaran was sentenced to a year in prison for accepting illegal gifts while in office, the first time in nearly 50 years that a Singaporean minister has been jailed.[221] The former transport minister admitted to his charges in a court hearing, having faced 35 counts, including corruption, for receiving gifts worth more than $300,000, including flights, hotel stays and tickets to events, from Ong Beng Seng, a Malaysian property tycoon who owns Formula 1 race rights and also had been arrested but not charged. Despite the prosecution’s recommendation of a maximum seven-month sentence, the judge sentenced him to a year’s imprisonment, emphasizing that public officials must avoid any perception of being influenced by improper financial benefits.

In South Korea, on December 3, 2024, President Yoon Suk Yeol declared martial law and has since faced widespread protest and impeachment.[222] Investigations and detentions of high-level officials have followed, including Yoon’s former defense minister, Kim Yong Hyun, who was arrested for his role in the martial law decree and the national police chief and head of Seoul’s metropolitan police. Yoon’s declaration was seen as an overreach of his powers, and on December 14, 2024, the National Assembly impeached Yoon, leading to the suspension of presidential powers.[223] Meanwhile, South Korea’s anti-corruption agency dispatched investigators to detain Yoon under a court warrant after he repeatedly evaded questioning and obstructed searches of his office, which hindered an investigation into his actions.[224] The Constitutional Court has been deliberating whether to uphold the impeachment and formally remove Yoon from office; at least six of the nine justices must vote in favor to end Yoon’s presidency.

In Vietnam, on December 3, 2024, property tycoon Truong My Lan lost her appeal of her death sentence for orchestrating the world’s largest bank fraud.[225] Her sentence will be commuted if she can repay 75% of the embezzled amount, which would be

$9 billion. In April, a trial court found that Truong My Lan had secretly controlled Saigon Commercial Bank, the fifth largest lender in Vietnam, and siphoned off $44 billion over more than a decade through a network of shell companies. Of this amount, $27 billion was misappropriated and $12 billion was embezzled. My Lan’s lawyers are working to liquidate her assets, which include luxury properties and shares in various businesses, to raise the $9 billion needed. However, the process is complicated by the fact that her assets have been frozen by authorities.

Europe

Across Europe as a whole, in June 2024, the Council of the European Union confirmed its stance on a new directive for combating corruption.[226] Previously, in May 2023, the European Commission introduced an anti-corruption package, which included a proposed directive aimed at combating corruption. This proposal, grounded in Articles 83 and 82 of the Treaty on the Functioning of the European Union, outlines criminal offenses and sanctions related to corruption, recognizing it as a serious crime with cross-border implications. The directive aims to modernize the EU’s legislative framework by incorporating binding international standards and addressing both public and private-sector corruption.