Companies impacting national security laws, sanctions or export controls need comprehensive advice. We help clients safely navigate the full spectrum of government and compliance challenges, offering practical guidance and insights on navigating the national security landscape. We provide strategic advice, compliance counseling, transactional support, and leverage one of the industry’s deepest benches of regulatory defense and crisis management specialists.

2023 Year in Review: CFIUS, Outbound Investments and Export Controls

December 21, 2023 Download PDF

Over the past year, there have been significant developments involving U.S. regimes relating to cross-border investments and exports. We discuss the significant developments related to the Committee on Foreign Investment in the United States (“CFIUS” or the “Committee”), efforts to restrict certain outbound investments and changes to U.S. export controls.

Key Takeaways:

- CFIUS has substantially increased its scrutiny of filings, stepped up its compliance and enforcement monitoring and expanded its review of “non-notified” transactions.

- Private equity transactions are being increasingly probed for more information relating to non-U.S. limited partners notwithstanding their ownership interest.

- For the first time, President Biden issued an executive order designed to limit outbound U.S. investment in select Chinese technology sectors to safeguard U.S. technological leadership.

- Interagency initiatives to ensure compliance with export controls have resulted in significant administrative penalties and indictments, and a redesigning of voluntary self-disclosure regimes.

1. CFIUS

CFIUS Transaction Reviews

In July 2023, CFIUS released its annual report (the “Annual Report”),[1] detailing its activity in calendar year 2022. Despite the drop in U.S. and global M&A activity in 2022, CFIUS reviewed a record number of filings. The Annual Report reveals a notable decrease in transaction clearance rates, a steady increase in mitigation and a shift away from declarations to notices. We expect that 2023 has seen similar trends and that 2024 will be no exception.

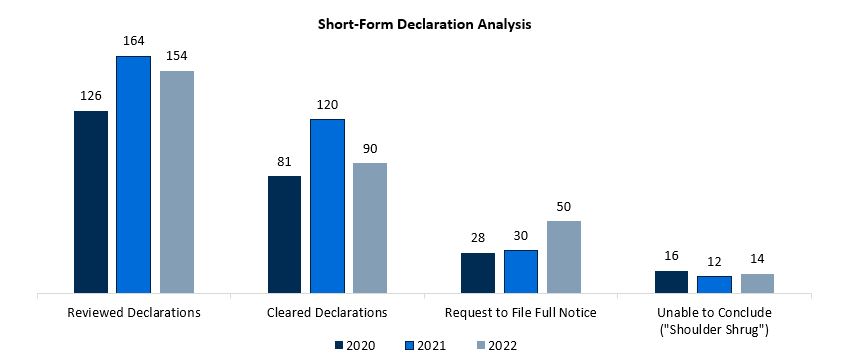

- Increased Declaration Scrutiny. Transactions subject to the Committee’s jurisdiction (“covered transactions”) are presented to CFIUS for clearance either as short-form declarations (“declarations”) or long-form notices (“notices”). The time it takes to submit a declaration is, as the name suggests, shorter, but it is accompanied by a higher-risk, higher-reward proposition. This is because declarations are less invasive. The flip side is where CFIUS concludes its review of a declaration by asking parties to file a notice anyway. In this case, the transaction timeline is now significantly extended. Such requests increased from 19% of reviewed declarations in 2021 to 32% of reviewed declarations in 2022. This increase, combined with a reduction in outright clearances of declarations in 2022, has likely resulted in a continued downward trend in declaration filings in 2023.

- With fewer declarations resulting in a favorable outcome, the risk-reward balance has likely shifted further in favor of filing a long-form notice and foregoing a declaration in many circumstances. Generally speaking, it is advisable to make declaration filings only where the acquirer or investor is well-known to CFIUS, the transaction is not complicated, the target has no U.S. government contracts and the target is not otherwise likely to be of significant interest to CFIUS from a national security perspective.

|

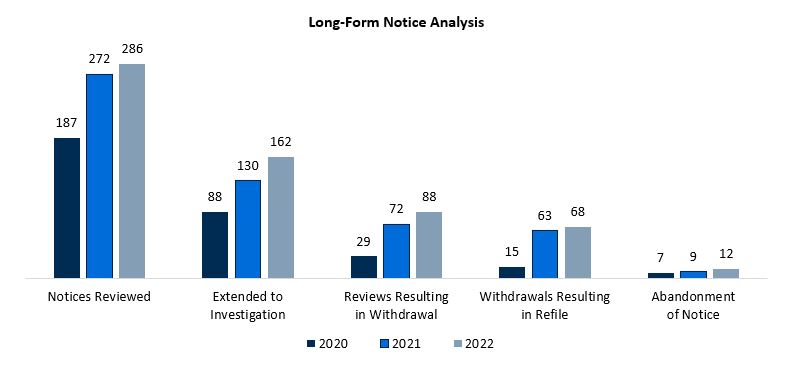

- Lengthy Notice Reviews. Notice filings have likewise seen trends in 2022. In 2022, 57% of notices were extended to the Committee’s second 45-day investigation stage, up from 48% in 2021. In addition, 31% of notices reviewed in 2022 were withdrawn versus 26% in 2021. Finally, the percentage of notices reviewed that resulted in mitigation imposed by CFIUS rose nearly 5% from 2021.

Taken together, these trends speak to the importance of parties conducting thorough diligence with respect to CFIUS risks and engaging openly and proactively with the Committee during the review process. Thorough filings, early discussions with the Committee and willingness to engage in mitigation discussions, if needed, can help expedite the Committee’s review process and lead to more favorable and timely outcomes.

|

CFIUS Monitoring and Enforcement

- Increased Compliance Monitoring. In the Annual Report, the Committee said it was monitoring compliance in 214 mitigation agreements in 2022 (up from 187 agreements in 2021) and that it had deployed investigators to 44 locations to verify compliance (up from 29 locations in 2021). This provides further evidence that the Committee has substantially expanded its resources and emphasis on compliance and is consistent with Treasury Department Assistant Secretary for Investment Security Paul Rosen’s stated emphasis on compliance monitoring. In fall 2023, Rosen noted that CFIUS is “renewing our focus on compliance and ensuring we have the necessary resources to do so. This means parties can expect more compliance checks, questions, and site-visits. We are also leaning on third-party monitors and auditors and are actively engaged with them.”[2]

- Review of Non-Notified Transactions Increases. In 2022, the Committee made inquiries in more than 80 non-notified transactions and required notice filings for 19 of them.[3] The Committee has emphasized its increased focus on identifying and bringing in non-notified transactions, particularly those that may have been subject to mandatory filing. In fall 2023, Assistant Secretary Rosen described this as “one of CFIUS’s most important functions” and said that the Committee had “added resources to reinvigorate the attention we give to failures to file.” As such, we expect that CFIUS will continue to exercise its broad authority to call up closed, non-notified transactions for review. The risks of having a non-notified transaction brought in can be substantial, resulting in mitigation or divestment and, for transactions where there was a failure to make a mandatory filing, penalties that are at the full value of the transaction.

- CFIUS Signals More Enforcement Actions and Regulations. Building on the enforcement guidelines that CFIUS issued in October 2022, Assistant Secretary Rosen announced that in 2023 the Committee had issued two civil monetary penalties, the same number that the Committee had previously issued in its entire history, and noted that there were more penalties “pending at various stages.” In support of these efforts, a new Chief Counselor for Enforcement position is being created at Treasury’s Office of Investment Security. Looking ahead, Rosen signaled that CFIUS would be looking to begin rulemakings in 2024 that would “update the Committee’s penalty and enforcement authorities” and “sharpen and enhance the Committee’s tools in the non-notified space.”[4]

- DOJ Announces New Focus on Corporate National Security Matters. In parallel to CFIUS’s emphasis on monitoring and enforcement, senior Department of Justice (“DOJ”) leadership have emphasized that DOJ is focused on corporate national security crime.[5] In her October 2023 remarks, Deputy Attorney General Lisa Monaco noted that DOJ was focused on applying its “corporate enforcement principles across the entire Department” and noted that its emphasis on breaches of compliance commitments by companies in criminal resolutions would be extended “beyond the criminal context to other enforcement resolutions,” including “CFIUS mitigation agreements or orders.”[6]

CFIUS’s Scrutiny of Private Equity

Since the enactment of FIRRMA, CFIUS has directed considerable attention to private equity structures, particularly with respect to investments by sovereign wealth funds. CFIUS’s increasing scrutiny of these investments was indicated by, among other things, its issuance of FAQ guidance[7] that addressed its interests in understanding holdings by limited partners, even in U.S.-controlled funds.

- CFIUS Closely Scrutinizes Non-U.S. Limited Partners. In May, the Committee confirmed in its FAQs, that it will continue to request information on direct and indirect foreign ownership in investment funds and related vehicles to the degree it believes necessary, including the identity of limited partners (“LPs”) and the rights they hold regardless of confidentiality commitments made to such investors. Historically, sponsors, especially those based in the U.S. or in jurisdictions friendly to the U.S., were not required to identify their non-U.S. or non-U.S.-controlled LPs unless they held a large stake or held unusual rights (either individually or as part of a group). In the current environment, sponsors should assume that CFIUS may undertake a detailed review of their non-U.S. or non-U.S.-controlled investors and the rights they hold.

- CFIUS Clarifies View of Springing Rights. In May, the Committee also clarified, that in the case of a transaction where an equity investment is made by a non-U.S. or non-U.S.-controlled person but its acquisition of consent or governance rights are delayed, CFIUS will consider the initial equity investment to trigger a mandatory filing deadline where the target produces, designs, tests, manufactures, fabricates or develops one or more critical technologies.[8] This is a significant shift from the prior practice of many parties, particularly financial sponsors, that sought to bring in sizeable foreign co-investors who were willing to condition their acquisition of consent or governance rights on a post-closing review by CFIUS. Parties that fall into the category of a mandatory filing should be aware that they can no longer close the equity investment only to make a subsequent filing covering the consent or governance rights of the non-U.S. investor.

2. Outbound Investment

- The President’s Outbound Investments Executive Order Aims to Control U.S. Investment in Certain Chinese Technology Sectors. In August 2023, the President issued an executive order directing the Treasury Department to restrict or monitor outbound U.S. investment in Chinese semiconductor and microelectronic, quantum information technology and artificial intelligence sectors.[9] Importantly, under the order, Treasury will view China to include Chinese-controlled territories outside the mainland. The full extent of the limitations are uncertain while the Treasury rulemaking[10] process plays out, but what is clear is that if the rule finalizes “as is,” investments in a range of transactions are likely to be prohibited while others will have to be notified to the U.S. government. The program has been called “reverse CFIUS,” but in reality it is much closer to a sanctions program, in that it imposes various investment limitations rather than creating a new interagency review process to approve or deny transactions.

- Although the Treasury Department has described the initiative’s goals as establishing a “high fence” around a “small yard” of cutting-edge technologies, parties will likely have to engage in robust diligence to ensure that they are in compliance, much as they currently do with respect to various sanctions regimes. In other words, compliance is likely to require diligence that goes beyond the scope of just understanding whether the particular covered technologies are involved in a given transaction.

3. Export Controls Summary and Other National Security Developments

A number of actions over the course of 2023 demonstrated the increased attention that the U.S. government pays to compliance with U.S. export control law. We summarize several of the most important:

- In March, DOJ and the Department of Commerce (“Commerce”) announced a joint initiative to address new national security and cyber security threats arising from new technological capabilities.[11] Companies contemplating developing or investing in technologies related to national security, particularly those with any connection to “autocratic regimes,” should anticipate heightened scrutiny.

- In May, Commerce’s Bureau of Industry and Security (“BIS”) imposed the largest standalone administrative penalty

($300 million) against Seagate Technology LLC (an Irish incorporated and U.S.-based data storage company) for its sales of hard drive disks to Huawei Technologies Co. in violation of the Export Administrative Regulations.[12] Relatedly, Commerce announced a significant overhaul of the BIS voluntary self-disclosure program, which now incorporates incentives for reporting potential violations and BIS’s intention to consider the failure to file such voluntary self-disclosures as an aggravating factor in its enforcement actions. - In June, DOJ announced five criminal cases brought under the recently created Disruptive Technology Strike Force, an interagency initiative with Commerce aimed at preventing national security threats from autocratic jurisdictions with growing technological capabilities.[13]

- In October, BIS announced that it will tighten restrictions on exports of advanced computing chips and semiconductor manufacturing equipment to China.[14] These measures augment the outbound investment restrictions detailed in the President’s executive order in August highlighted above. We do not anticipate this economic pressure by BIS to subside, which has signaled its intention to compound restrictions and close loopholes in this sector.

- In November, Treasury’s Financial Crimes Enforcement Network (“FinCEN”) and BIS issued a notice emphasizing the importance for financial institutions to monitor for possible export control violations.[15] This comes on the heels of increased efforts by persons or entities to evade U.S. sanctions and export controls. FinCEN and BIS expect financial institutions “with customers in export/import industries, including the maritime industry” to employ “appropriate risk-mitigation measures” as required under the Bank Secrecy Act.

4. What’s to Come in 2024

2023 proved to be a significant year with respect to the U.S. government’s efforts to address national security risks that arise in connection with business transactions, particularly as those risks relate to the country’s main geopolitical competitors—China and Russia. CFIUS continued its transition from a once relatively obscure interagency committee focused on a narrow range of industrial transactions to a broad-based regulatory and enforcement agency whose jurisdiction affects a wide array of investment transactions. CFIUS’s efforts on regulating inbound investment were bolstered by a new program to address certain U.S. outbound investments, and agencies stepped up their enforcement of a variety of existing authorities, particularly those tied to export control. What’s more, the United States’ strategic partners have begun to coordinate their foreign direct investment regimes to give maximum effect.

Given the increased scrutiny of foreign investment, companies should take steps to conduct appropriate due diligence on foreign investors. Assistant Secretary Rosen has described this as an effort to “Know Your Investor.”[16] Given the heightened focus on monitoring and enforcement, companies should carefully consider how they plan to implement the mitigation commitments they make and then take steps to adequately resource those commitments.

2024 promises to be another active year in this space. CFIUS has already previewed the issuance of new regulations and guidance on a range of topics. Congress may act as well. Likewise, ever since the passage of FIRRMA there have been various calls in Congress to further expand CFIUS’s authority (for example, with respect to agriculture- and food-related transactions and a broader array of real estate transactions), and some of these efforts may finally come to fruition. The trend of state governments moving to enact their own CFIUS-like laws to fill perceived gaps in CFIUS’s jurisdiction (particularly with respect to foreign investment in agricultural land) is likely to continue and may further motivate Congress to act. In addition, we can expect that actual Treasury Department regulations governing outbound investment in China (as discussed above) will enter into effect sometime in 2024. What remains to be seen is the impact of this rule on the foreign investment community.

* * *

[1] U.S. Dep’t of Treasury, Committee on Foreign Investment in the United States: Annual Report to Congress, (Jul. 31, 2023), available here.

[2] U.S. Dep’t of Treasury, Remarks by Assistant Secretary for Investment Security Paul Rosen at the Second Annual CFIUS Conference, (Sept. 14, 2023), available here.

[3] Id.

[4] Id.

[5] Paul, Weiss, DOJ Previews New Guidance on Voluntary Self-Disclosures in Mergers and Acquisitions While Signaling Continued Focus on Corporate National Security Crimes, (Sept. 27, 2023), available here.

[6] U.S. Dep’t of Justice, Deputy Attorney General Lisa O. Monaco Announces New Safe Harbor Policy for Voluntary Self-Disclosures Made in Connection with Mergers and Acquisitions, (Oct. 4, 2023), available here.

[7] U.S. Dep’t of Treasury, CFIUS Frequently Asked Questions, (accessed Dec. 16, 2023), available here.

[8] Id.

[9] Paul, Weiss, President Biden Issues Executive Order Creating Unprecedented Outbound Investment Review Prohibitions Targeting China, (Aug. 10, 2023), available here.

[10] Provisions Pertaining to U.S. Investments in Certain National Security Technologies and Products in Countries of Concern, 88 Fed. Reg. 54961 (proposed Aug. 14, 2023) (to be codified at 31 C.F.R. chapter undefined), available here.

[11] Paul, Weiss, Deputy Attorney General Announces Creation of Disruptive Technology Strike Force, (Mar. 3, 2023), available here.

[12] Paul, Weiss, BIS Imposes $300 Million Penalty Against Seagate for Export Control Violations and Makes Controversial Changes to Voluntary Self-Disclosure Program, (May 1, 2023), available here.

[13] Paul, Weiss, First Cases From DOJ’s Disruptive Technology Strike Force Cover Export Evasion and Trade Secret Theft, (Jun. 5, 2023), available here.

[14] Paul, Weiss, Department of Commerce Tightens Restrictions on the Export of Advanced Computing Chips and Semiconductor Manufacturing Equipment to China, (Oct. 20, 2023), available here.

[15] Paul, Weiss, FinCEN and BIS Issue Joint Notice Emphasizing That Financial Institutions Should Monitor for Possible Export Control Violations, (Nov. 12, 2023), available here.

[16] Paul M. Rosen, Know Your Investor, Before CFIUS Does, Barron’s (Nov. 14, 2023), available here; see also Paul, Weiss, John Carlin to Discuss the U.S. Approach to Economic National Security Regulation and Enforcement at Future in Review Conference with Top Treasury Official, (Dec. 4, 2023), available here; see also Future in Review, Defending Economic Interests, with Paul Rosen (Treasury), Marc Raimondi (Silverado) & John Carlin, (Dec. 7, 2023), available here.