Our White Collar & Regulatory Defense group has unparalleled experience and expertise, and is among the most respected and successful in the United States. We regularly represent Fortune 500 companies and their executives and boards in connection with investigations by federal and state enforcement authorities, and in courtrooms nationwide. We excel at developing creative and successful strategies and defenses for responding to or preventing government investigations and enforcement proceedings.

False Claims Act Liability in the Age of COVID-19

May 19, 2020 Download PDF

For additional guidance in navigating this crisis, visit our Coronavirus (COVID-19) Resource Center.

To download a compendium of our recent advisories and alerts related to the outbreak, click here.

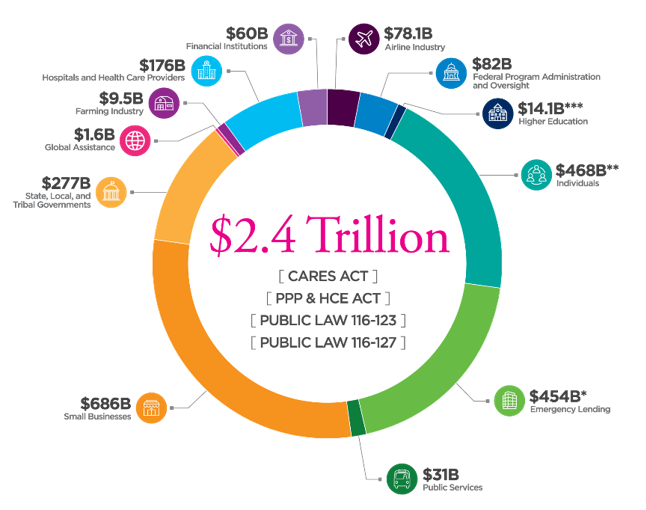

Congress has passed a number of measures to provide financial relief to individuals and businesses impacted by COVID-19, including, most notably, the Coronavirus Aid, Relief, and Economic Security (“CARES”) Act.[1] The CARES Act provides approximately $2 trillion in relief, including $349 billion for SBA Paycheck Protection Program (“PPP”) loans; $46 billion for Treasury direct lending to airline industry and national security companies; and $454 billion for Treasury support to lending facilities established by the Federal Reserve. On April 24, 2020, Congress appropriated another $310 billion for the PPP. On May 15, 2020, the House of Representatives passed the Health and Economic Recovery Omnibus Emergency Solutions (“HEROES”) Act, which would make a significant amount of additional COVID-19 aid available.

|

| Source: Pandemic Response Accountability Committee |

This unprecedented level of federal aid has triggered bipartisan calls for close scrutiny of the procurement and disbursement of relief funds, and there are mounting efforts by a range of agencies to root out potential fraud and abuse. The PPP, in particular, has become a lightning rod of concern, with Treasury Secretary Steven Mnuchin, Senator Marco Rubio, and other government officials issuing warnings about applicants making false certifications; the Small Business Administration (“SBA”) providing a limited safe harbor for borrowers to return funds and announcing mandatory review of all PPP loans over $2 million; the DOJ conducting a criminal inquiry into potential fraud in connection with PPP loans and filing its first set of PPP-related criminal charges;[2] congressional committees threatening subpoenas; State Attorneys General initiating investigations into lending decisions; and journalists seeking to expose companies that they claim are too big or well-resourced to merit receiving aid. This has all taken place even before the special oversight mechanisms created by the CARES Act have come online, including a Special Inspector General for Pandemic Recovery, a special committee of Inspectors General devoted to COVID-related relief, and a Congressional Oversight Commission. And if the 2008 financial crisis is any guide, the distribution of COVID-19 relief funds can be expected to spur investigative activity for years to come.

This heightened level of scrutiny has brought new focus on the False Claims Act (“FCA”), which has served as a potent tool for the Department of Justice, Inspectors General, and private qui tam plaintiffs (whistleblowers) to pursue government fraud cases against companies and individuals in a broad range of circumstances involving federal funds. Although companies that routinely do business with the government are likely to be familiar with the FCA, many borrowers participating in the PPP and certain other aid programs may have less familiarity.

This memorandum reviews the key aspects of FCA liability and identifies the primary areas of risk under the CARES Act. It also discusses strategies and measures that companies can employ to manage their FCA risks, whether as a government borrower or contractor. Steps such as maintaining appropriate policies and procedures (including whistleblower policies), conducting targeted training, maintaining careful documentation, and consulting with counsel can avert FCA claims or provide important defenses in the event of an investigation or litigation.

Key Aspects of FCA Liability

The two most commonly utilized provisions of the FCA impose civil liability for making false claims or for making false statements in connection with a claim. The false claims provision creates liability for any individual or entity that knowingly presents, or causes to be presented, to the government a false or fraudulent claim for payment.[3] The false statements provision imposes liability for any individual or entity that knowingly makes or uses, or causes to be made or used, a false record or statement in connection with such a claim.[4] A “claim” is broadly defined as a request or demand for money, and can be made directly or through an intermediary.

An FCA action brought in relation to federal loan or grant applications under the CARES Act would likely be premised on an allegation that the defendant made a false statement or certification in the course of making its claim to the government or an intermediary lender. To establish a violation, the government or private plaintiff would need to establish that: (1) the defendant made a false statement or submitted a false claim (or caused a false statement or claim to be made); (2) the defendant did so “knowingly”; (3) the false certification was material; and (4) the government paid out money as a result.[5]

Several aspects of FCA liability bear emphasis:

- Knowledge/Scienter. The FCA requires proof that the defendant acted “knowingly,” defined as having “actual knowledge” of the falsity of the information at the time it was submitted, or having acted with “deliberate ignorance” or “reckless disregard” with respect to the truth or falsity of that information.[6] No specific intent to defraud the government is required.[7] The scienter requirement is not met where a defendant relies on a “good faith” but mistaken interpretation of a regulation.[8]

- Materiality. While courts may look to different factors to assess whether an alleged false statement was material, the materiality test is an objective one that examines whether the allegedly false statement had a tendency to “influence” payment, as opposed to whether the statement, in fact, influenced payment. Importantly, materiality does not require evidence that the government actually relied on the alleged false statement.[9]

- False Certifications. FCA actions based on false certifications can be brought on either express or implied certification theories. Express certification actions are those in which the defendant certifies compliance with a law, rule, contractual term, or regulation where compliance is required as part of the application process for payment.[10] Implied certification actions are those in which a defendant, by submitting a claim to the government, implicitly certifies compliance.[11]

- Individual Liability. In addition to corporate liability, the FCA imposes liability on individuals who knowingly make false statements or present false claims to the government on behalf of a business, or who cause such statements or claims to be made.[12] For example, in United States Entin, the government prevailed in an FCA action against three individuals—the president of the company, an attorney and officer of the company, and a consultant—who knowingly misrepresented the amount of the company’s unencumbered capital in the company’s application to the SBA.[13]

- “Causing” Liability. The government and qui tam plaintiffs have increasingly pursued businesses that did not directly make the claim at issue—such as parent companies or private equity sponsors—on the theory that they nevertheless “caused” the claim or statement to be made. In September 2019, for example, the DOJ settled FCA claims against a private equity firm, its portfolio company, and two portfolio company executives in connection with a kickback payment scheme to generate referrals of prescriptions through a Department of Defense healthcare program. The DOJ alleged that the private equity firm knew of and agreed to the plan to pay outside marketers and financed the kickback payments.[14]

- Government Knowledge Inference. In certain circumstances, an FCA defendant may raise a “government knowledge inference” defense, arguing that its conduct was not fraudulent because government officials were aware of the defendant’s conduct and took no steps to alter it (or to alter the government’s own conduct by stopping payment). Courts that have accepted this defense have generally found that the government “[knew] and approve[d] of the particulars of [the] claim for payment before that claim [was] presented.”[15] Some courts require that a defendant raising this defense provide evidence showing that, at the time, the defendant knew that the government knew of and approved of the defendant’s conduct.[16]

- Damages. An individual or entity that violates the FCA is liable for: (1) treble damages relative to the amount of the government’s “original loss;”[17] (2) a civil penalty for each violation, which is adjusted for inflation (for violations occurring after January 29, 2018, the range is $11,665 to $23,331); (3) in a qui tam action, the relator’s reasonable attorneys’ fees; and (4) costs of the civil action incurred by the government.[18] In the case of multiple defendants, FCA liability is joint and several. The government’s original loss is calculated as the total amount of funds obtained from the government in reliance on false claims, which amount is generally tripled (to calculate treble damages) before any compensatory payments are deducted.[19]

- Statute of Limitations. There is a six-year statute of limitations for qui tam[20] Additionally, there is a tolling provision pursuant to which the government may bring claims at any time within three years after the government learns, or reasonably should have learned, of the potential violation, but the government cannot bring claims more than ten years after the date on which the violation is committed.[21] The FCA also contains an express relation-back provision, providing that in actions in which the government elects to intervene, the government pleadings will relate back to the filing date of the complaint of the person who originally brought the action.[22]

Qui Tam Actions

FCA actions may be brought by the federal government or by private individuals, known as relators, on behalf of the government in qui tam actions, if the relator has information that the defendant knowingly submitted or caused the submission of false or fraudulent claims to the government.[23] Qui tam actions typically follow the same procedure:

- Relators file a complaint under seal and provide a copy and a written disclosure of “substantially all material evidence” to the DOJ.[24]

- The complaint remains under seal for at least 60 days, during which time the government makes a determination as to whether it will intervene in the action. The government may, for good cause, file for an extension.[25]

- The government may intervene and conduct the action itself, decline to intervene and allow the relator to conduct the action, or move to dismiss the qui tam action by arguing that maintenance of the action would interfere with the interests of the government.[26] Under relevant guidance, DOJ attorneys are encouraged to give consideration to dismissing FCA actions in order to curb meritless qui tam actions, control litigation brought on behalf of the United States, and preserve government resources.[27]

The FCA provides strong incentives for relators to bring qui tam actions: relators are awarded between 15% and 25% of the final judgment or settlement if the government intervenes in an action, and between 25% and 30% if the government does not, as well as reasonable attorneys’ fees and costs.[28]

There is a bar to qui tam actions if the same allegations were publicly disclosed, unless the person bringing the action is the original source of the information.[29] There is also an absolute bar if the government is already a party to a suit or hearing based on the same allegations, although the mere fact that the government is internally aware of the allegations is not a bar to a qui tam[30]

Potential Criminal Liability

- The FCA also provides for criminal penalties, under 18 U.S.C. § 287,[31] if the government can prove that the defendant acted with criminal intent.[32] Unlike the FCA’s civil provisions, Section 287 does not specifically define what it means for a defendant to act “knowingly,” and some courts require that the government establish that the defendant acted “willfully.”[33] Defendants convicted under 18 U.S.C. § 287 may face up to five years’ imprisonment and a fine calculated on the same scale as civil FCA claims.[34]

- In addition to the FCA, various other criminal statutes could be implicated by the submission of a false claim to the government, depending on the circumstances. These include statutes prohibiting making false statements to a government agency, making false statements in connection with a federal agency or bank loan, bank fraud, mail fraud, and wire fraud; there are also agency-specific fraud statutes.[35]

FCA Risks Under the CARES Act

The CARES Act provides a number of government loan, grant, and contracting opportunities that could potentially give rise to FCA liability:

- PPP Loans. As noted, there have been bipartisan calls for heightened scrutiny of PPP lending and efforts already underway to detect and address fraud and abuse, including criminal prosecutions. A PPP loan applicant must provide certain information about its business (e.g., the number of employees and payroll costs) and make a number of certifications, including that the applicant is eligible for a PPP loan and that “[c]urrent economic uncertainty makes th[e] loan request necessary to support the ongoing operations of the Applicant.”[36]

After the PPP had already launched, the SBA published new guidance about the meaning of this “economic uncertainty” certification and offered a limited safe harbor from review of this certification for applicants who fully returned PPP funds by a certain date (which date was subsequently extended to May 18, 2020).[37] In the new guidance, the SBA stated that it “will review all loans in excess of $2 million, in addition to other loans as appropriate, following the lender’s submission of the borrower’s loan forgiveness application.”[38] More recently, the SBA announced that PPP borrowers with loans under $2 million will be entitled to a limited safe harbor in which they are deemed to have made the economic uncertainty certification in good faith.[39] The SBA also announced that for those loans in excess of $2 million for which it determines that an adequate basis did not exist for the economic uncertainty certification, the SBA will seek repayment of the outstanding PPP loan balance and will inform the lender that the borrower is not eligible for loan forgiveness.[40] If the borrower repays the loan after receiving notification of the SBA’s determination, the SBA will not pursue administrative enforcement or referrals to other agencies based on its determination regarding the economic uncertainty certification.[41]

There has recently been increasing attention on certain types of companies—including certain lending companies, passive real estate businesses, and adult entertainment venues—that were declared ineligible for PPP loans by the SBA’s Interim Final Rule.[42] If companies in these categories knowingly certified their eligibility for PPP loans, they may face FCA risk. There have, however, been federal district court decisions that have held that certain of these exclusions violated the CARES Act.[43] Recipients of PPP loans will also have to submit additional information to apply for loan forgiveness, and any false statements made at that juncture could also give rise to FCA liability.

- Treasury Support to Airline Industry and National Security Companies. The CARES Act appropriated $46 billion for direct Treasury lending through loans and loan guarantees to airline industry and national security companies.[44] The statute also authorized Treasury to make $25 billion in grants for payroll assistance for passenger airlines.[45] To apply for these loans and grants, applicants must submit applications with required information, make various certifications, and agree to certain restrictions—all giving rise to potential FCA liability.

- Treasury Support to Federal Reserve Lending Facilities. The CARES Act appropriated $454 billion to Treasury to support Federal Reserve lending facilities and programs for eligible businesses, states, and municipalities.[46] Each of these facilities has specific eligibility requirements and restrictions. For example, the Federal Reserve recently made revisions to its Main Street Lending facilities, which now incorporate certain eligibility and affiliation requirements from the PPP program.[47] In United States ex rel. Kraus Wells Fargo & Co., the Second Circuit held that statements made in connection with a loan through an emergency Federal Reserve lending facility were actionable under the FCA. The qui tam action was brought by two former employees who alleged that Wells Fargo and Wachovia fraudulently misrepresented their financial conditions to obtain emergency loans from the Federal Reserve Bank of New York during the financial crisis. The court determined that, in these circumstances, the Federal Reserve Banks were functioning as “agents of the United States,” bringing the allegedly fraudulent loan applications within the FCA’s meaning of “claims.”[48]

- Government Contracting Opportunities. The CARES Act vests contracting authority in the Department of Health and Human Services (“HHS”), the Department of Veterans Affairs, the Department of State, and other government agencies to enter into contracts in support of various public health and safety measures.[49] These new contracting opportunities created for private entities also bring FCA risk. Further, companies that supply goods to contractors that sell those goods to the federal government also face FCA liability to the extent they submit false statements to a contractor that in turn submits false claims to the government.[50]

Enforcement and Oversight Agencies

The agencies and oversight bodies below—including new oversight entities created by the CARES Act—will investigate fraud and abuse involving CARES Act and other COVID-19-related funding:

- Department of Justice. The DOJ has affirmed that it remains “committed to pursuing” FCA violations during the COVID-19 response,[51] and will “prioritize the investigation and prosecution of Coronavirus-related fraud schemes.”[52] The DOJ has set up a national whistleblower hotline to report potential fraud, intended to monitor participants’ use of CARES Act funds.[53] Additionally, the DOJ has announced that it will coordinate enforcement efforts through specially appointed fraud coordinators at each U.S. Attorney’s Office to direct COVID-19-related investigations and prosecutions.[54] The DOJ’s Procurement Collusion Strike Force, which was established in November 2019 to focus on antitrust violations and related fraudulent schemes involving government funds, is also poised to investigate and prosecute COVID-19-related misconduct.[55]

The Fraud section of the DOJ’s Criminal Division announced on April 30, 2020 that it had contacted 15 to 20 of the largest PPP lenders to obtain information relating to PPP application fraud.[56] On May 5, 2020, the DOJ filed its first criminal charges against two individuals in Rhode Island who fraudulently obtained PPP loans,[57] and the following week, filed criminal charges against two more individuals—an engineer in Texas and a reality television personality in Georgia—who allegedly filed fraudulent PPP applications seeking millions of dollars in loans.[58]

- SBA Inspector General. The CARES Act provided $25 million in additional funding to the SBA Inspector General in light of the large sums made available under the PPP.[59] The SBA Inspector General has played a key role in a number of FCA actions that have involved defrauding SBA programs. Like other Inspectors General, the SBA Inspector General’s office is an investigative agency that issues subpoenas and builds cases, and then partners with DOJ attorneys to initiate FCA actions and/or criminal fraud prosecutions.

- Office of the Special Inspector General for Pandemic Recovery. The CARES Act also created an Office of the Special Inspector General for Pandemic Recovery (“SIGPR”), with a five-year term and a $25 million budget, who is responsible for conducting investigations and making reports related to loans made under the CARES Act.[60] President Trump nominated Brian Miller, who is currently a White House lawyer and previously served as the Inspector General for the General Services Administration.[61] His nomination is awaiting Senate confirmation. The SIGPR will conduct, supervise, and coordinate audits and investigations of the making, purchase, management, and sale of loans, loan guarantees, and other financial investments by Treasury under the CARES Act.[62]

- Pandemic Response Accountability Committee. The CARES Act created the Pandemic Response Accountability Committee (“PRAC”), which will be comprised of existing agency Inspectors General and has an $80 million budget, to “promote transparency and conduct and support oversight of covered funds and the Coronavirus response to (1) prevent and detect fraud, waste, abuse, and mismanagement; and (2) mitigate major risks that cut across program and agency boundaries.”[63] The PRAC has broad oversight and investigative powers, with the power to conduct independent investigations across the range of CARES Act programs, hold public hearings, and issue subpoenas for documents and to compel witness testimony.[64]

- Congressional Oversight Commission. The CARES Act established a five-member Congressional Oversight Commission that will remain in place through fiscal year 2025 to provide oversight over the activities of Treasury, the Federal Reserve, and other federal agencies administering the CARES Act.[65] Membership, selected by House and Senate leadership, includes Senator Pat Toomey (R-PA), Representatives Donna Shalala (D-FL) and French Hill (R-AR), and Bharat Ramamurti (D), a former aide to Senator Warren; the chairperson seat is currently vacant.[66] The Commission must submit monthly reports to Congress on a number of topics, including the impact of loans and loan guarantees on the economy.[67] The Commission has the power to conduct hearings and receive evidence, although it may not issue subpoenas to private companies to obtain documents and compel testimony.[68]

- Other Congressional Committees. On April 23, 2020, the House voted to establish an investigative subcommittee which will operate under the umbrella of the House Oversight Committee to monitor the Trump administration’s implementation of COVID-19 relief measures.[69] The House Select Subcommittee on the Coronavirus Crisis’s first action was to send letters to five public companies asking them to “immediately return” loans they had received from the PPP, and for those who opt not to do so, to produce documents and communications with the SBA, Treasury, and PPP lender relating to the loan, including all applications.[70] These letters were signed only by Democrats on the subcommittee; the move was sharply criticized by the Republicans on the subcommittee.[71] Separately, Senator Marco Rubio, who is the Chairman of the Senate Committee on Small Business and Entrepreneurship, has announced that his committee will also “conduct aggressive oversight of the [PPP], including whether companies made false certifications to the federal government to receive PPP loans.”[72]

- State Attorneys General. Offices of State Attorneys General are likely to conduct investigations into companies’ activities during and after the pandemic, including regarding price gouging, consumer protection violations, and various types of fraud. The New York and New Jersey Attorneys General have made particularly aggressive announcements in this regard. And when state funds are involved, State Attorneys General have become increasingly active in filing claims under state analogues to the FCA, and in many cases, federal and state-level FCA claims will proceed concurrently.

Considerations for Mitigating Risks

In light of the unprecedented magnitude of federal funds that will be dispersed as a result of COVID-19, as well as the existing and new oversight mechanisms for monitoring fraud and abuse, companies seeking to obtain government loans or grants or to enter into COVID-19-related contracting opportunities would be well advised to evaluate and assess the effectiveness of their compliance programs. Effective compliance programs are critical in detecting, deterring, and preventing government fraud—and where fraudulent conduct does occur, in minimizing potential liability. A compliance program should be scaled to the size of the company and its FCA risk profile: a small business that takes out a PPP loan will generally require a more limited set of procedures as compared to a large company with more significant government loans, grants, and/or contracting opportunities.

Earlier this year, Deputy Associate Attorney General Stephen Cox noted that the DOJ will take into account “the nature and effectiveness of a company’s compliance system in making the determination of whether the False Claims Act is the appropriate remedy.”[73] He also emphasized that a key element of any FCA claim is scienter, and a strong and effective compliance program could demonstrate a lack of scienter—providing a complete defense to FCA liability.[74] Additionally, Deputy Associate AG Cox reiterated the benefits of cooperating with FCA investigations, including—where a company provides “maximum cooperation”—the reduction of liability from treble damages to single damages, plus lost interest and costs of investigation, and in a qui tam case, the whistleblower’s share.[75]

To bolster their FCA compliance programs, companies should consider the following steps, appropriately tailored to the size of each company and its FCA risk profile:

- Tone from the Top. Management should consistently communicate the importance of complying with the law and company policies regarding government funds, and these communications should be documented.

- This message is especially important during the COVID-19 crisis, where stress runs high and ordinary work routines have been disrupted. These conditions may lead some personnel to pay less attention to compliance in favor of addressing pressing business and other needs. Targeted communications to those specifically involved in COVID-19 relief activities, including government loans, may be beneficial.

- The Board of Directors should monitor whether management has implemented and maintained appropriate policies and systems to manage the risks associated with government loans or contracts.

- Training. Institute periodic training regarding the FCA and related anti-fraud and anti-kickback laws, as well as the company’s related policies and procedures. Training should be appropriately targeted, with employees that have more direct responsibility for government funds and adhering to government requirements receiving more intense and specialized training.

- Whistleblower procedures. Ensure that systems are in place to receive whistleblower complaints and other concerns about potential compliance issues. Implement and advertise strong anti-retaliation policies towards whistleblowers and emphasize the obligation of all employees to report potential wrongdoing. If concerns are received, ensure that appropriate compliance or legal personnel conduct a well-documented investigation commensurate to the issues at hand.

- Statistics demonstrate that almost all whistleblowers initially report their allegations internally.[76] Accordingly, if initial reports of misconduct are taken seriously and properly addressed, it is possible that many whistleblower concerns can be adequately resolved without the need for litigation. To adequately respond to a valid compliance concern, a company may need to take serious steps, including disciplining or replacing individuals responsible for the misconduct.

- According to some studies, internal whistleblowing systems that have more active use (g., a higher volume of internal reporting) have been associated with fewer and lower amounts of government fines and material lawsuits.[77]

- Careful legal review. When applying for a benefit under the CARES Act or any other COVID-19 relief program, conduct a careful review of all relevant provisions and guidance to ensure a full understanding of the applicable requirements. Ensure that all statements made in applications for a government benefit are thoroughly checked and reviewed.

- Documentation. Where warranted, document your basis for making relevant certifications and for including particular information in submissions to the government. This documentation should include, for example, any relevant communications with the government, others in the industry, or counsel, which can be used as evidence for contesting scienter in an FCA investigation or action.

- Establish compliance procedures around particular loans or contracts. After funding has been obtained, implement specific compliance procedures and controls to (1) address any further certifications or documentation that must be provided to the government; and (2) track and document the use of the funding to ensure it is being used in compliance with all relevant requirements.

- Compliance monitoring. The legal or compliance function should undertake ongoing compliance monitoring activities to identify potential deficiencies in adhering to government loan or contracting terms. Particularly during this period of remote work and less direct interaction, frequent monitoring is essential.

- Evaluate D&O and other insurance policies. Companies may wish to review policy terms to determine the extent to which existing D&O or other policies would cover FCA-related claims and consider whether to obtain additional coverage.

We look forward to providing additional updates on the FCA and other risks associated with government relief efforts during the COVID-19 crisis.

* * *

[1] For a discussion of the CARES Act, see Paul, Weiss Client Memorandum, “Key Provisions of the ‘Phase Three’ COVID-19 Stimulus Package” (Mar. 27, 2020), available here.

[2] See Paul, Weiss Client Memorandum, “DOJ Announces Preliminary Inquiry into Potential Fraud in the Paycheck Protection Program” (May 5, 2020), available here.

[3] 31 U.S.C. § 3729 (a)(1)(A).

[4] 31 U.S.C. § 3729 (a)(1)(B). The FCA also imposes civil liability for conspiracy to violate the FCA, which is analyzed under traditional civil conspiracy principles. See U.S. ex rel. Westmoreland v. Amgen, Inc., 738 F. Supp. 2d 267, 280 (D. Mass. 2010) (holding that general civil conspiracy principles apply to FCA conspiracy claims).

[5] See U.S. ex rel. Hendow v. Univ. of Phoenix, 461 F.3d 1166, 1177–78 (9th Cir. 2006).

[6] See 31 U.S.C. § 3729 (b)(1)(A).

[7] See 31 U.S.C. § 3729 (b)(1)(B); see also U.S. ex rel. Rigsby v. State Farm Fire & Cas. Co., 794 F.3d 457, 478 (5th Cir. 2015).

[8] See U.S. ex rel. Oliver v. Parsons Co., 195 F.3d 457, 460 (9th Cir. 1999) (holding that a contractor relying on a good faith interpretation of a regulation was not subject to liability); U.S. v. Southland Mgmt. Corp., 326 F.3d 669, 684 (5th Cir. 2003) (en banc) (Jones, J., concurring) (“Where there are legitimate grounds for disagreement over the scope of a contractual or regulatory provision, and the claimant’s actions are in good faith, the claimant cannot be said to have knowingly presented a false claim.”).

[9] See U.S. ex rel. Feldman v. van Gorp, 697 F.3d 78, 95 (2d Cir. 2012).

[10] See Ebeid ex rel. U.S. v. Lungwitz, 616 F.3d 993, 998 (9th Cir. 2010).

[11] Id.

[12] See U.S. v. Advance Tool Co., 902 F. Supp. 1011, 1016 n.4 (W.D. Mo. 1995); U.S. v. Entin, 750 F. Supp. 512, 519–20 (S.D. Fla. 1990) (holding the president and sole shareholder of an SBA lender personally liable for false certifications made to the SBA); U.S. ex rel. Landis v. Tailwind Sports Corp., 51 F. Supp. 3d 9, 53–54 (D.D.C. 2014).

[13] 750 F. Supp. 512 (S.D. Fla. 1990).

[14] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, “Compounding Pharmacy, Two of Its Executives, and Private Equity Firm Agree to Pay $21.36 Million to Resolve False Claims Act Allegations” (Sept. 18, 2019), available here.

[15] See U.S. ex rel. Durcholz v. FKW Inc., 189 F.3d 542, 545 (7th Cir. 1999) (emphasis added) (collecting cases).

[16] See U.S. ex rel. Spay v. CVS Caremark Corp., 875 F.3d 746, 757–58 (3d Cir. 2017).

[17] See U.S. v. Bornstein, 423 U.S. 303, 314, 96 S. Ct. 523, 530, 46 L. Ed. 2d 514 (1976).

[18] See 31 U.S.C. § 3729(a)(1). Civil penalties are currently between $11,665 and $23,331. 28 CFR § 85.3(a)(9); 28 CFR § 85.5; 15 CFR § 6.3; see also 31 U.S.C. § 3730(d)(1); 31 U.S.C. § 3729(a)(3); 28 U.S.C. § 1920 (providing a list of costs that may be taxed in federal court, including compensation of experts and witness fees); City of Burlington v. Dague, 505 U.S. 557, 562 (1992).

[19] See Bornstein, 423 U.S. at 315.

[20] See 31 U.S.C. § 3731(b)(1).

[21] See 31 U.S.C. § 3731(b)(2).

[22] See 31 U.S.C. § 3731(c).

[23] See 31 U.S.C. § 3730(b).

[24] See 31 U.S.C. § 3730(b)(2).

[25] See 31 U.S.C. § 3730(b)(3).

[26] See 31 U.S.C. § 3730(c)(3), (4); 31 U.S.C. § 3731(c).

[27] See Memorandum from Michael D. Granston, Director, Commercial Litigation Branch, Fraud Section, U.S. Dep’t of Justice (Jan. 10, 2018), available here.

[28] See 31 U.S.C. § 3730(d)(1), (2). The relator’s share is reduced if the relator is found to have planned or initiated the underlying FCA violation, and the relator will be dismissed entirely from the case if the relator is convicted of criminal conduct arising from the violation. Id. § 3730(d)(3). This does not prevent the government from continuing with the action.

[29] See 31 U.S.C. § 3730(e)(4). The Act defines “publicly disclosed” to mean disclosed in any type of federal government hearing, Congressional hearings, federal reports, audits or investigations, or in the news media.

[30] See 31 U.S.C. § 3730(e)(3); U.S. ex rel. Oliver v. Philip Morris USA Inc., 763 F.3d 36, 42 (D.C. Cir. 2014).

[31] As in the civil False Claims Act, there is a criminal conspiracy statute codified at 18 U.S.C. § 286.

[32] See U.S. v. Maher, 582 F.2d 842, 848 (4th Cir. 1978).

[33] See id. at 847 (approving jury instruction that stated intent under § 287 could be proved either by “showing that the defendant was aware he was doing something wrong or that he acted with a specific intent to violate the law”); see also U.S. v. Milton, 602 F.2d 231, 234 (9th Cir. 1979) (holding that the jury did not need to receive an instruction on intent to defraud, as it is not an element of the offense); Kercher v. U.S., 409 F.2d 814, 817 (8th Cir. 1969) (“Clearly, on this record, the issue of the criminal intent, which § 287 obviously requires, is for the jury.”).

[34] See 18 U.S.C. § 287; 31 U.S.C. § 3729; 20 CFR § 429.211.

[35] See, e.g., 18 U.S.C. §§ 1001, 1014, 1343 and 1344; 15 U.S.C. § 645(a) (criminalizing fraudulent application for SBA loans).

[36] SBA Form 2483 (04/20).

[37] See SBA Paycheck Protection Program FAQs 31 & 47 (May 13, 2020).

[38] Id. at FAQ 39.

[39] Id. at FAQ 46.

[40] Id.

[41] Id. at 47.

[42] See 13 C.F.R. 120 (Apr. 2, 2010).

[43] See DV Diamond Club of Flint, LLC v. SBA, 2020 WL 2315880, at *8 (E.D. Mich. May 11, 2020).

[44] H.R. 748 § 4003(b), (d).

[45] Id. § 4112.

[46] Id. § 4003(b).

[47] See Paul, Weiss Client Memorandum, “UPDATE: Federal Reserve Issues Revised Term Sheets and Guidance for Main Street Lending Facilities, Announces New Main Street Priority Lending Facility” (May 1, 2020), available here.

[48] United States ex rel. Kraus v. Wells Fargo & Co., 943 F.3d 588 (2d Cir. 2019).

[49] See, e.g., H.R. 748 § 20004 (authorizing the Secretary of Veterans Affairs to enter into contracts with telecommunications companies to provide services for the purpose of “providing expanded mental health services to isolated veterans through telehealth or VA Video Connect.”); id. at § 21010 (authorizing the Department of State and the United States Agency for International Development to enter into contracts with individuals “for the provision of personal services . . . to prevent, prepare for, and respond to coronavirus.”). Under the Act, HHS has the authority to appoint specific individuals to “perform critical work relating to coronavirus” and to enter into contracts for blood donor awareness and geriatric healthcare, and to make modifications to existing federal health care contracts under the Public Health and Social Services Emergency Fund, among other things. See id. §§ 18108, 3226(b), 3403, 3610. HHS also has the authority to require laboratories that develop or perform coronavirus testing to submit reports in any form or frequency. Id. at § 18115.

[50] For example, in 2019, Sapa Profiles Inc. entered into a $34.6 million settlement to resolve its liability under the FCA for submitting false test results to its government contractor customer, which caused the contractor to invoice the federal government for aluminum extensions that did not comply with contract specifications. See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, Aluminum Extrusion Manufacturer Agrees to Pay over $46 Million for Defrauding Customers, Including the United States, in Connection with Test Result Falsification Scheme (Apr. 23, 2019), available here.

[51] Lydia Wheeler, Bloomberg News, “Coronavirus False Claims Task Force Urged at Justice Department” (Mar. 17, 2020), available here.

[52] Press Release, Office of Pub. Affairs, U.S. Dep’t. of Justice, “Attorney General William P. Barr Urges American Public to Report COVID-19 Fraud” (Mar. 20, 2020), available here; see also U.S. Dep’t. of Justice, Memorandum from Attorney General William P. Barr, “COVID-19 Department of Justice Priorities” (Mar. 16, 2020), available here.

[53] See U.S. Dep’t of Justice, Memorandum from the Office of the Deputy Attorney General, “Coordinated Nationwide Response to Detect, Deter, and Punish Crime Relating to the National Emergency Caused by COVID-19” (Mar. 19, 2020), available here.

[54] Id.

[55] See Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, “Justice Department Announces Procurement Collusion Strike Force: a Coordinated National Response to Combat Antitrust Crimes and Related Schemes in Government Procurement, Grant and Program Funding” (Nov. 5, 2019), available here.

[56] See Paul, Weiss Client Memorandum, “DOJ Announces Preliminary Inquiry into Potential Fraud in the Paycheck Protection Program” (May 5, 2020), available here.

[57] Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, “Two Charged in Rhode Island with Stimulus Fraud” (May 5, 2020), available here.

[58] Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, “Engineer Charged in Texas with COVID-19 Relief Fraud” (May 13, 2020), available here; Press Release, Office of Pub. Affairs, U.S. Dep’t of Justice, “Reality TV Personality Charged with Bank Fraud” (May 13, 2020), available here.

[59] H.R. 748 § 1107(a)(3).

[60] Id. at § 4018(b), (c), (d), (f).

[61] Saleha Mohsin & Laura Davidson, “Trump’s Choice for Watchdog Over Pandemic Funds Vows Vigilance”, Bloomberg News (May 4, 2020), available here.

[62] H.R. 748 § 4018(c).

[63] Id. §§ 15003, 15010.

[64] Id. §§ 15010(c)—(f).

[65] Id. §§ 4020(a), (b), (c), (f).

[66] Id. § (c); Kyle Cheney & Melanie Zanona, “Pelosi, McConnell Name Picks to Serve on Coronavirus Oversight Panel”, Politico: Congress (Apr. 17, 2020), available here.

[67] H.R. 748 § 4020(b).

[68] Id. § 4020(e).

[69] H.R. Res. 935, 116th Cong. (2020). For recommendations on addressing congressional investigations generally, see Paul, Weiss Client Memorandum, “Preparing for an Uptick in Congressional Investigation of Corporations” (Dec. 3, 2018), available here.

[70] See Press Release, House Committee on Oversight and Reform, “In First Official Action, House Coronavirus Panel Demands that Large Public Corporations Return Taxpayer Funds Intended for Small Businesses” (May 8, 2020), available here; see also, e.g., Letter from the Select Subcommittee on the Coronavirus Crisis to Tom Abood, President of EVO Transportation & Energy Servs., Inc. (May 8, 2020), available here.

[71] See, e.g., Press Release, Congressman Steve Scalise, “Scalise Slams Dems for Partisan Select Committee Action” (May 8, 2020), available here.

[72] See Press Release, Senator Marco Rubio, “Rubio: Small Business Committee Will Use Subpoena Power to Review Paycheck Protection Program Compliance” (Apr. 20, 2020), available here.

[73] Deputy Associate Attorney General Stephen Cox, “Keynote Remarks at the 2020 Advanced Forum on False Claims and Qui Tam Enforcement” (Jan. 27, 2020), available here.

[74] Id.

[75] Id.

[76] Ethics Resource Center, Inside the Mind of a Whistleblower: A Supplemental Report of the 2011 National Business Ethics Survey 12-13 (2012), available here.

[77] Stephen Stubben, et al., University of Utah, Evidence on the Use and Efficacy of Internal Whistleblowing Systems (Mar. 3, 2020), available here.